nt on Friday night. However, keep in mind that some banks may have specific cut-off times for processing deposits, so it’s possible that your direct deposit may not be available until the next business day if it’s initiated late in the evening.

Can I get my direct deposit a day early?

Some banks offer early direct deposit as a convenience for their customers. If your employer supports early direct deposit, you may be able to get your funds deposited into your account a day early. However, this is not guaranteed and varies depending on your bank and employer.

What happens if payday falls on a Saturday?

If your payday falls on a Saturday, your direct deposit will usually be available on the Friday before. This is because banks are not open on weekends and do not process payments on those days. Therefore, your employer will typically initiate the direct deposit a day earlier to ensure that you receive your funds on time.

What happens if payday falls on a Sunday?

If your payday falls on a Sunday, your direct deposit will typically be available on the following Monday. Again, this is because banks do not process payments on weekends, so your employer will initiate the deposit on the next business day to ensure timely access to your funds.

Can I spend my direct deposit before payday?

While your direct deposit may be available to you on the day before your official payday, it’s important to note that your employer could still reverse the deposit if any issues arise. Therefore, it’s generally advised to wait until your actual payday to spend the funds to avoid any potential complications.

Can I have multiple direct deposits?

Yes, you can have multiple direct deposits. This is especially useful if you have different sources of income or if you want to allocate funds to different accounts. You can set up multiple direct deposits with your employer or through your bank’s online banking platform.

Can I change my direct deposit information?

Yes, you can change your direct deposit information. If you need to update your bank account or routing number, you’ll typically need to fill out a new direct deposit form provided by your employer. It’s important to notify your employer as soon as possible to ensure a smooth transition of your direct deposit payments.

Can I split my direct deposit into different accounts?

Some employers and banks allow you to split your direct deposit into different accounts. This can be helpful if you want to allocate a certain amount to your checking account and the rest to your savings account, for example. Check with your employer or banking institution to see if this option is available to you.

Can I get a paper check instead of direct deposit?

In most cases, employers prefer to use direct deposit as it is a more efficient and cost-effective method of payment. However, if you have a valid reason for not being able to receive direct deposit, you may be able to request a paper check. It’s best to discuss this with your employer to see if alternative arrangements can be made.

Can I track my direct deposit?

Most banks allow you to track your direct deposit by checking your account balance or transaction history online. If you’re uncertain about the timing or status of a direct deposit, it’s always a good idea to contact your bank for more information. They can provide you with the most accurate and up-to-date information regarding your deposit.

What should I do if my direct deposit is late?

If your direct deposit is late, the first step is to check with your employer to confirm that the payment has been initiated. It’s possible that there may have been an error or delay in processing. If your employer confirms that the deposit has been made, but you still haven’t received it, you should contact your bank for assistance. They can help look into the issue and provide guidance on next steps.

What happens if my direct deposit is rejected?

If your direct deposit is rejected, it’s important to contact your employer as soon as possible to address the issue. There could be various reasons why a direct deposit may be rejected, such as incorrect account information or insufficient funds. Your employer will be able to assist you in resolving the problem and ensuring that you receive your payment in a timely manner.

Is direct deposit safer than receiving a paper check?

In general, direct deposit is considered to be safer than receiving a paper check. With direct deposit, there is no risk of the check being lost, stolen, or damaged in the mail. Additionally, the funds are electronically transferred into your account, reducing the risk of theft or fraud. However, it’s always important to practice good account security and monitor your transactions regularly to ensure the safety of your funds.

Do I need a bank account for direct deposit?

Yes, in most cases, you will need a bank account to receive direct deposit payments. Direct deposit requires the use of electronic fund transfers, which can only be processed through a bank or financial institution. If you do not currently have a bank account, you may want to consider opening one to take advantage of the convenience and security that direct deposit offers.

How long does direct deposit take if I get paid on Friday

Your funds will be available to you on the first banking day following the last calendar day of the month. If the last calendar day of the month is on Friday, a weekend, or a holiday, your funds will be available on the next banking day.

Does direct deposit get paid on Friday

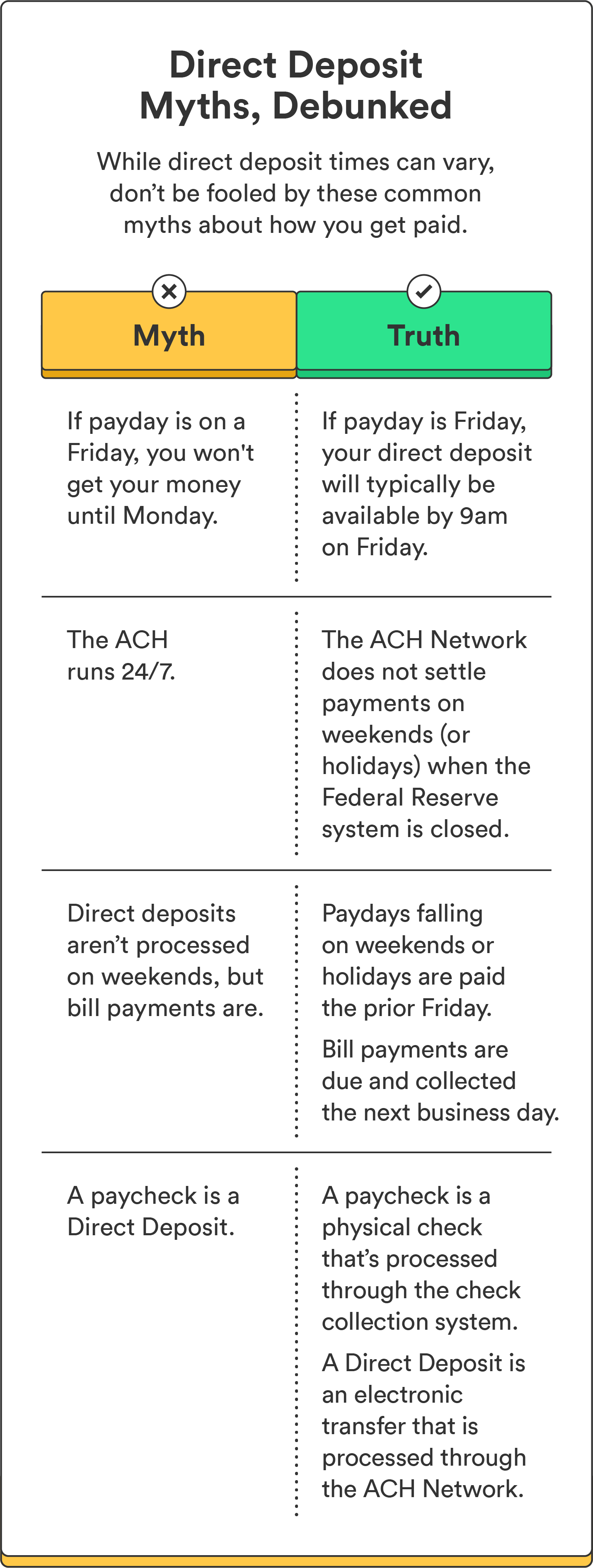

Does direct deposit go through on weekends The ACH Network does not settle payments on weekends (or holidays) when the Federal Reserve system is closed.

Cached

Do banks process on Friday night

Most transactions post at the end of each business day but posting order and times can vary. Business days for banks are generally Monday – Friday from 9am to 5pm, excluding federal holidays. Transactions received outside of these hours, including on weekends, are usually posted on the next business day.

How long does it take for a direct deposit to go through

On average, direct deposit usually takes one to three business days to clear. The process is fast, but the actual time frame for the funds to hit your account depends on when the issuer initiates the payment. Several other factors can also cause delays.

What time does Friday deposit hit

What Time Does Cash App Direct Deposit Hit on Friday Similarly, if you're expecting a deposit on Friday, you should expect to see it between 2:00 AM and 4:00 AM in your time zone. However, if there are any processing issues, it may take longer for the money to appear in your account.

What time of day do direct deposits usually hit

What time of day does direct deposit hit Usually, you'll have access to your direct deposit at the opening of business on your payday — by 9 a.m. In many cases, direct deposits hit accounts even earlier, often between midnight and 6 a.m. on payday morning.

How does getting paid Friday work

Biweekly is one of the most common payroll schedules and is when you get paid twice monthly on the same day of the week, usually on alternating Fridays. For example, if you get paid on Friday, you'll receive another paycheck two Fridays later on a biweekly schedule.

Can direct deposit hit Friday night

If your employer uses a payroll software that ensures your money is available on payday, you should see your direct deposit hit your bank account on that Friday.

Why didn’t my direct deposit go through at midnight

This is because some financial institutions update their accounts a few hours after midnight. However, most banks complete the direct deposit before 6 am, allowing many consumers to wake up the next day with the funds sitting in their accounts.

What time of day do direct deposits post

What time of day does direct deposit hit Usually, you'll have access to your direct deposit at the opening of business on your payday — by 9 a.m. In many cases, direct deposits hit accounts even earlier, often between midnight and 6 a.m. on payday morning.

What banks pay 2 days early

Financial institutions with early direct deposit

| Financial institution (Click on the name to see our review) | Direct deposit details |

|---|---|

| OneUnited Bank | Up to 2 days early. |

| PayPal | Up to 2 days early. |

| PenFed Credit Union | Up to 2 days early. |

| Regions Bank | Up to 2 days early. |

Does direct deposit come Thursday or Friday

Employers and the government process payroll or government benefits on Tuesday or Wednesday to have paper checks available by Friday. For paychecks that are processed by direct deposit through ACH, employers give notice of the direct deposit on Wednesday or Thursday along with a payment date of Friday.

Will I get paid Friday if payday is on a Saturday

When it's a Saturday or Sunday. If you normally pay employees on a twice-per-month pay schedule, and that payday falls on a Saturday, then you should typically pay your employees on the Friday before your normal payday. If the normal pay date falls on Sunday, you should typically pay on the following Monday.

Can you get paid on Friday

A pay date is the date on which companies pay employees for their work. Friday is the most common payday. It can take a few days to process payroll. Therefore, the last day of the pay period is typically not when employees get paid for their work from that pay period.

Does direct deposit always hit at 12am

Usually, you'll have access to your direct deposit at the opening of business on your payday — by 9 a.m. In many cases, direct deposits hit accounts even earlier, often between midnight and 6 a.m. on payday morning. But there are factors that can affect how long it takes your direct deposit to become available.

Does direct deposit come in at 12 am

Funds are transferred electronically and are deposited into the recipient's account at midnight on the payment date. Since the funds clear automatically through the ACH, they are available immediately, so there's no need for the bank to put a hold on them.

Does direct deposit hit Thursday or Friday

If your employer uses a payroll software that ensures your money is available on payday, you should see your direct deposit hit your bank account on that Friday.

How does direct deposit work if I get paid 2 days early

How early direct deposit works. Early direct deposit is generally a free and automatic feature at a bank. Automatic, in this case, means there's no sign-up required if you're eligible. And early means one to two days ahead of payday, so if you normally get a paycheck on Friday, it would arrive on Wednesday.

Do you always get paid 2 days early with direct deposit

Depending on your payroll company, direct deposits are sent via ACH to your bank account up to two days early along with a designated posting date. Most institutions hold these funds until the paycheck posting date while actually earning interest on those funds.

Why did I get paid Thursday instead of Friday

The pay date is the day that employees receive their checks or direct deposits. Some direct deposits are processed early, so an employee with direct deposit might receive the money on a Thursday instead of Friday – when paper checks are delivered.

When payday falls on a weekend direct deposit

The ACH only processes direct deposit transfers Monday – Friday. This excludes weekends and holidays. Employees' direct deposits are delayed a day when payday falls on a bank holiday. Again, when there's a bank holiday any time between when you run payroll and the pay date, there's a direct deposit processing delay.

Why didn’t I get my direct deposit at midnight

This is because some financial institutions update their accounts a few hours after midnight. However, most banks complete the direct deposit before 6 am, allowing many consumers to wake up the next day with the funds sitting in their accounts.

Why didn t my direct deposit hit at 12am

This is because some financial institutions update their accounts a few hours after midnight. However, most banks complete the direct deposit before 6 am, allowing many consumers to wake up the next day with the funds sitting in their accounts.

Why did I get paid on Thursday instead of Friday

The pay date is the day that employees receive their checks or direct deposits. Some direct deposits are processed early, so an employee with direct deposit might receive the money on a Thursday instead of Friday – when paper checks are delivered.

Can direct deposit hit later in the day

Banks are required to make direct-deposit funds available for withdrawal not later than the business day after the banking day on which the bank received the electronic payment. For instance, funds direct deposited on a regular, non-holiday Monday would be available by Tuesday.