Summary:

1. How do I remove an Equifax lock: At Equifax, you can use your myEquifax account to lift a security freeze for a date range you specify. You can also lift a security freeze by phone by calling our automated line at (800) 349-9960 or calling Customer Care at (888) 298-0045. Afterward, your Equifax credit report will be frozen again.

2. How do you unlock all 3 credit bureaus: If you make the request online or by phone, the three major credit bureaus are required to lift the freeze within an hour. The request can be done by mail, but note that this is a longer process. The credit bureaus, however, are required to remove the freeze within three business days of receiving notice.

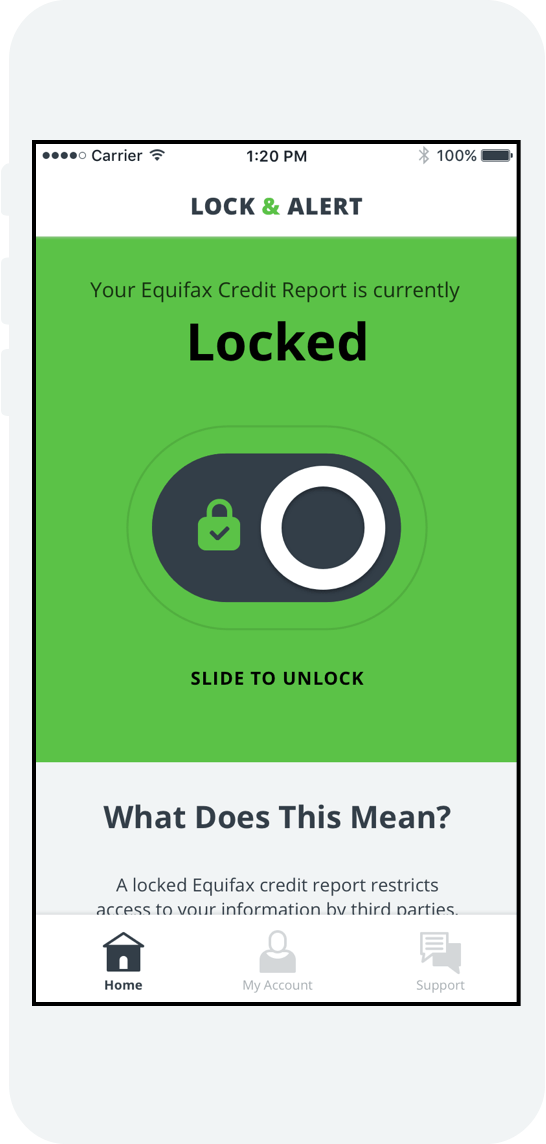

3. What happens when your credit report is locked: A security freeze prevents prospective creditors from accessing your credit file. Creditors typically won’t offer you credit if they can’t access your credit reporting file, so a security freeze, also called a credit freeze, prevents you or others from opening accounts in your name.

4. Why is my credit score locked: The main reason you would freeze or lock your report is if you’re concerned that your personal data has been compromised. Keep in mind that initiating a credit freeze means that you are unable to open a new credit card account or a loan.

5. How do I unlock my credit report after I have locked it: You have two options for unfreezing your credit files:

– Schedule a temporary thaw. This allows creditors to check your file for a set length of time, then restores the freeze when the scheduled window ends.

– Remove the freeze permanently. This leaves your files open until you request another credit freeze.

6. Why is there a lock or freeze on my Equifax: A security freeze is one step you can take to help prevent access to your Equifax credit report to open new credit accounts, with certain exceptions. Security freezes are federally regulated, and a security freeze must be temporarily lifted or permanently removed each time you apply for new credit.

7. How do I unfreeze all 3 credits: You can’t unfreeze at all three with a single action. You’ll have to unfreeze your credit with each credit bureau individually. How do I unfreeze my credit? You can unfreeze and freeze your credit reports online or by mail, or by calling each credit bureau.

Questions:

1. How can I remove the security freeze on my Equifax account? To remove the security freeze on your Equifax account, you can use your myEquifax account or contact Equifax Customer Care by phone.

How do I remove an Equifax lock

At Equifax, you can use your myEquifax account to lift a security freeze for a date range you specify. You can also lift a security freeze by phone by calling our automated line at (800) 349-9960 or calling Customer Care at (888) 298-0045. Afterward, your Equifax credit report will be frozen again.

Cached

How do you unlock all 3 credit bureaus

If you make the request online or by phone, the three major credit bureaus are required to lift the freeze within an hour . The request can be done by mail, but note that this is a longer process. The credit bureaus, however, are required to remove the freeze within three business days of receiving notice.

Cached

What happens when your credit report is locked

A security freeze prevents prospective creditors from accessing your credit file. Creditors typically won't offer you credit if they can't access your credit reporting file, so a security freeze, also called a credit freeze, prevents you or others from opening accounts in your name.

Why is my credit score locked

The main reason you would freeze or lock your report is if you're concerned that your personal data has been compromised. Keep in mind that initiating a credit freeze means that you are unable to open a new credit card account or a loan.

How do I unlock my credit report after I have locked it

You have two options for unfreezing your credit files:Schedule a temporary thaw. This allows creditors to check your file for a set length of time, then restores the freeze when the scheduled window ends.Remove the freeze permanently. This leaves your files open until you request another credit freeze.

Why is there a lock or freeze on my Equifax

A security freeze is one step you can take to help prevent access to your Equifax credit report to open new credit accounts, with certain exceptions. Security freezes are federally regulated, and a security freeze must be temporarily lifted or permanently removed each time you apply for new credit.

How do I unfreeze all 3 credits

You can't unfreeze at all three with a single action. You'll have to unfreeze your credit with each credit bureau individually. How do I unfreeze my credit You can unfreeze and freeze your credit reports online or by mail, or by calling each credit bureau.

Do all three credit bureaus need to be unfrozen

Each of the Major Credit Bureaus is Slightly Different

Here's a guide to unfreeze your credit with Equifax, Experian and TransUnion. The three major credit bureaus are all different. So, you have to unfreeze your credit with each bureau individually.

Does it cost money to unlock your credit

There's no longer a fee required to freeze or unfreeze your credit. You can easily and quickly freeze or unfreeze credit online. A credit freeze won't hurt your credit score.

How do I call Equifax to unfreeze my credit report

(888) 298-0045

You can also manage your freeze by phone: call us at (888) 298-0045. You'll be required to give certain information to verify your identity. You'll also have the option to receive a one-time PIN by text message or answer questions based on information in your Equifax credit report for identity verification.

How long does it take to unfreeze credit Equifax

Freezing and unfreezing your credit can be done as often as you like, but keep in mind that it can take up to an hour for each process to occur. If you freeze your credit and then realize that you need to unfreeze it, wait at least an hour to ensure that your credit is fully frozen.

How long does a credit lock last

How long does a credit lock last As with a credit freeze, your credit lock will remain until you ask the credit bureaus to remove it, either temporarily or permanently. For the best protection, keep your credit lock in place until you are ready to apply for a credit card or loan.

How do I know if my Equifax is locked

You can check the status of your security freeze through your myEquifax account as well. By phone. Call us at (888) 298-0045. You'll be required to give certain information to verify your identity.

How long does it take Equifax to unfreeze credit

Equifax allows you to unfreeze your credit temporarily or permanently, for a specific creditor or for a specified period (from one day to one year). If you choose to unfreeze or reinstate a freeze by phone, you'll be asked to verify your identity by answering security questions or receiving a one-time PIN by text.

How long does Equifax security freeze last

one-year

An initial (one-year) fraud alert can be placed if you believe you are or may become a victim of fraud or identity theft. The fraud alert lasts for one year. If you want to keep it active on your credit reports, you'll need to renew it after that time.

Can I unfreeze my credit online

You can unfreeze and freeze your credit reports online or by mail, or by calling each credit bureau. TransUnion requires a PIN, and Equifax offers the option to request a one-time PIN if you're calling to unfreeze.

How do I lift a freeze from all credit bureaus

In order to place or remove a credit freeze on your credit reports, you must contact each of the three major credit bureaus (Equifax, Experian and TransUnion) individually. It might be worth asking your potential creditor or employer which bureau it uses for credit checks.

Is it good to have your credit file locked

Locking or freezing your credit file may help prevent criminals from opening fraudulent accounts in your name. If you don't plan on applying for any new credit in the near future and your state doesn't allow credit freezing fees, a freeze may be the way to go.

How long does Equifax freeze last

An initial (one-year) fraud alert can be placed if you believe you are or may become a victim of fraud or identity theft. The fraud alert lasts for one year. If you want to keep it active on your credit reports, you'll need to renew it after that time.

How long does it take to unfreeze Equifax

Freezing and unfreezing your credit can be done as often as you like, but keep in mind that it can take up to an hour for each process to occur.

Do I need to call all 3 credit bureaus to unfreeze my credit

You have to unfreeze your credit at all three credit bureaus individually, unless you know which credit bureau a creditor is using for credit checks and choose to lift your freeze at just that one.

Can you unfreeze credit over the phone

You can unfreeze and freeze your credit reports online or by mail, or by calling each credit bureau. TransUnion requires a PIN, and Equifax offers the option to request a one-time PIN if you're calling to unfreeze.

What number do I call to unfreeze my credit

888-397-3742

Removing a security freeze takes up to three days following receipt of your mailed request. Phone: Additionally, you can request removal of an Experian security freeze by calling 888-EXPERIAN (888-397-3742).

Do I have unfreeze my credit with all three bureaus

You have to unfreeze your credit at all three credit bureaus individually, unless you know which credit bureau a creditor is using for credit checks and choose to lift your freeze at just that one.

How long does it take to lift a credit freeze Equifax

In terms of timing, a credit freeze must be removed no later than one hour after a credit bureau receives your request by phone or online. If you mail in a request to have a freeze lifted, credit bureaus have three business days after receiving it to lift the credit freeze.