k_icon icon=”quote-left-2-solid” width=”32″ height=”32″] How long does it take to unblock a debit card The time it takes to unblock a debit card can vary depending on the bank and the specific circumstances. In some cases, it may be resolved within a few minutes or hours, while in others it may take several days. It is best to contact your bank directly to inquire about the specific timeline for unblocking your card.[/wpremark]

Can I still use my debit card if it is flagged If your debit card is flagged for suspicious activity, it may be temporarily blocked by your bank. During this time, you may not be able to use the card for transactions. However, once the issue is resolved, the card should be unblocked and you can resume using it as usual.

Can my debit card be blocked without my knowledge Yes, it is possible for your debit card to be blocked without your knowledge. This can happen if your bank detects suspicious activity or fraud on your account and decides to block the card for security reasons. In such cases, you may only become aware of the block when you attempt to use the card and it is declined.

How can I prevent my debit card from being flagged To prevent your debit card from being flagged, it is important to maintain regular and consistent spending habits. Avoid making unusually large or frequent purchases that deviate from your normal pattern of spending. Also, notify your bank if you plan to travel internationally to ensure that any transactions made outside of your usual location are not flagged as suspicious.

What should I do if my debit card is flagged If your debit card is flagged, you should contact your bank immediately to inquire about the reason for the flagging. They will be able to provide you with further instructions and guidance on how to resolve the issue. It may involve verifying your identity or providing additional information to confirm the legitimacy of the transactions.

Can I unblock my debit card myself In most cases, you cannot unblock your debit card yourself. The block is typically put in place by the bank for security reasons, and they will need to verify your identity and resolve any issues before unblocking the card. It is best to contact your bank directly and follow their instructions to have the card unblocked.

Can I still receive money if my debit card is blocked If your debit card is blocked, it may affect your ability to receive money, depending on the specific situation. For example, if someone tries to send you money directly to your blocked card, it may not go through. However, there may be alternative methods available for receiving funds, such as bank transfers or using a different payment platform.

What should I do if my card is flagged for fraud If your card is flagged for fraud, it is important to take immediate action. Contact your bank or credit card issuer to report the fraudulent activity and follow their instructions. They will guide you through the process of securing your account, cancelling any unauthorized transactions, and potentially issuing you a new card to prevent further fraud.

What happens when your card gets flagged

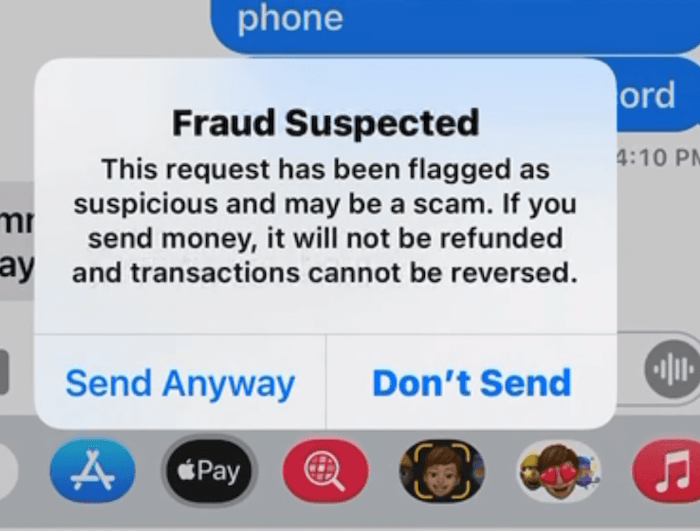

What Is Flagging In fraud, flagging is an automated or manual process performed by fraud prevention software and/or fraud analysts. Organizations are alerted to suspicious, potentially fraudulent transactions, which can then be flagged for further investigation and manual review.

Cached

Why is my debit card being declined when I have money

There are a number of issues that could result in a debit card decline. For starters, you could be mistaken about your balance, or you may have reached your daily limit for withdrawals. The bank may feel the transaction is suspicious, based on your purchase history. Technical issues may also be to blame.

Why would my card be flagged for suspicious activity

Unusual spending habits

Constant activity in a short period of time can raise a red flag to bank and credit card companies. The bank can see your purchases and knows your spending habits and if it's an amount out of the ordinary, you may get a call from your bank or credit card issuer questioning your purchase.

Why do debit cards get flagged

Normally debit cards can be blocked if there is fraud on the account so the fraudster can't do any more damage to your account. However, there can be times where your card gets blocked because the store you went to has had a high volume of fraudulent charges made at the specific location.

What amount of money gets flagged

Although many cash transactions are legitimate, the government can often trace illegal activities through payments reported on complete, accurate Forms 8300, Report of Cash Payments Over $10,000 Received in a Trade or BusinessPDF. Here are facts on who must file the form, what they must report and how to report it.

What amount gets flagged by the bank

$10,000

Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.

How do I know if my debit card is blocked

You can confirm if the card is blocked by calling customer care service or at the bank branch. You must raise an application for unblocking the ATM card online or offline through call/SMS/bank branch if your ATM card gets blocked.

Why did my card declined but still charged

When a payment fails a card security check some banks or card issuers may temporarily display the attempted payment as "pending" or "processing" in your online banking system. Rest assured that this charge is temporary and will usually be reversed within 24hours. We apologize should you experience this error.

How do you tell if your debit card has been compromised

Debit card fraud occurs when a thief accesses your card or PIN number and makes unauthorized transactions. The easiest way to spot debit card fraud is to sign up for online banking and monitor your account for suspicious activity.

What happens when an account is flagged

Examples of Flagged Account in a sentence

A Red Flagged Account (RFA) is one where a suspicion of fraudulent activity is thrown up by the presence of one or more Early Warning Signals (EWS). Accounts classified as fraud/Red Flagged Account will not be subjected to any restructuring.

What happens if my bank account is flagged

A bank account freeze means you can't take or transfer money out of the account. Bank accounts are typically frozen for suspected illegal activity, a creditor seeking payment, or by government request. A frozen account may also be a sign that you've been a victim of identity theft.

Is depositing $1000 cash suspicious

Banks must report cash deposits totaling $10,000 or more

If you're headed to the bank to deposit $50, $800, or even $1,000 in cash, you can go about your affairs as usual. But the deposit will be reported if you're depositing a large chunk of cash totaling over $10,000.

What is a suspicious amount of cash

Financial institutions are required to report cash deposits of $10,000 or more to the Financial Crimes Enforcement Network (FinCEN) in the United States, and also structuring to avoid the $10,000 threshold is also considered suspicious and reportable.

How much money can I cash without being flagged

Although many cash transactions are legitimate, the government can often trace illegal activities through payments reported on complete, accurate Forms 8300, Report of Cash Payments Over $10,000 Received in a Trade or BusinessPDF.

How do I know if my card is active or blocked

The simplest way to clear up any question about whether your credit card is still active is to call the issuer and ask. Call the number on the back of your card to inquire about the status of your account. If inactive, customer service can likely reactivate.

Can I check the status of my debit card

Track Debit Card Status Via Internet Banking

If your bank has not provided you with the tracking number, you can check debit card status on the net banking portal of your bank.

Can a declined transaction still go through

Declining a transaction will not prevent the transaction from going through. Declining the transaction will disable your debit card to prevent additional unauthorized transactions from processing.

What are the signs that your bank account is hacked

5 Ways You Can Tell If Your Bank Account Has Been HackedSmall unexplained payments.Unexpected notifications from your bank.A call claiming to be your bank demands information.Large transactions empty your bank account.You learn your account has been closed.

What happens when your debit card is compromised

If the transactions are verified as unauthorized, the money is usually refunded to you within three business days. After you report a compromised debit card, the bank may close your checking account and issue you a new debit card to use going forward.

How do you know if your name is flagged

There are signs that will indicate you have been flagged for additional screenings:You were not able to print a boarding pass from an airline ticketing kiosk or from the internet.You were denied or delayed boarding.A ticket agent “called someone” before handing you a boarding pass.

Will I get flagged for depositing too much money

Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.

How do you know if your account is being investigated

If your bank account is under investigation, the bank will typically notify you. You might receive an informal notification via email, but generally, you'll also get a formal notification by mail. This is especially true if it necessitates the bank freezing your account.

How much money can I deposit without being flagged

A cash deposit of more than $10,000 into your bank account requires special handling. The IRS requires banks and businesses to file Form 8300, the Currency Transaction Report, if they receive cash payments over $10,000. Depositing more than $10,000 will not result in immediate questioning from authorities, however.

What cash deposits get flagged

Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.

How do I know if my debit card is restricted

You can confirm if the card is blocked by calling customer care service or at the bank branch. You must raise an application for unblocking the ATM card online or offline through call/SMS/bank branch if your ATM card gets blocked.