nce there isn’t a highly specific, targeted audience. Another disadvantage is the lack of buyer protection on Facebook Marketplace. This means that if a buyer scams you or doesn’t pay for the item they purchased from you, there isn’t much recourse for you as a seller. Additionally, Facebook Marketplace does not offer a digital store option, so you can’t create a dedicated storefront for your products. This can make it difficult to establish a brand or attract repeat customers. Finally, one of the drawbacks of selling on Facebook Marketplace is the lack of storage space. Unlike other ecommerce platforms, Facebook Marketplace does not provide a space for sellers to store their inventory. This means sellers must find alternative storage solutions, which can be inconvenient and costly.

A key factor to consider when selling on Facebook Marketplace is the safety of transactions. While Facebook Marketplace is generally safe, there is still the potential for scammers to take advantage of unsuspecting buyers and sellers. It is important to be cautious and pay attention to signs of fraudulent activity. For example, if a buyer offers to pay significantly more than the asking price or requests unusual payment methods, it may be a red flag. It is also recommended to meet in a safe public place when completing transactions in person.

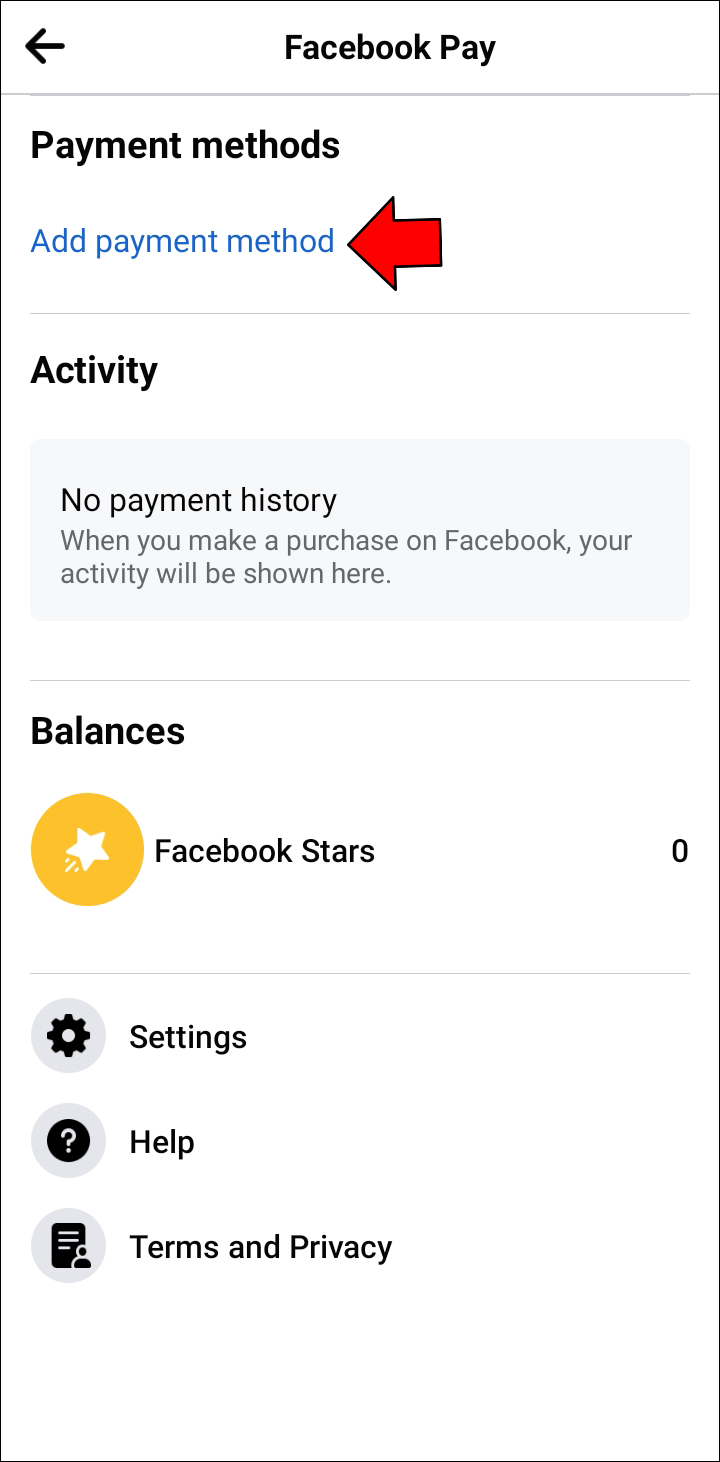

When it comes to getting paid on Facebook Marketplace, there are several options available. One of the safest ways to get paid is by using secure person-to-person payment sites such as PayPal. This allows both the buyer and seller to have protection and ensures that the transaction is secure. Another option is to use Facebook Pay, which allows users to add their debit card or PayPal information to facilitate payments. This provides a convenient and secure way to accept payment directly within the Facebook platform.

For tax purposes, it is important to be aware that online marketplaces like Facebook Marketplace may report transactions to the IRS using Form 1099-K. This form shows the total dollar amount of online transactions for the year. If you meet certain gross sales and transaction thresholds, you may receive a Form 1099-K from Facebook or other online marketplaces. It is important to report your sales and pay taxes on your profit or gain from selling on Facebook Marketplace.

When it comes to the earning potential on Facebook Marketplace, there is no specific threshold before you have to pay taxes. However, if you are a Facebook or eBay seller, you may receive a Form 1099-K if you meet certain gross sales and transaction thresholds. According to the IRS, if you have gross merchandise sales of at least $20,000, you will receive a Form 1099-K. It is important to consult with a tax professional to understand your specific tax obligations based on your earnings.

In conclusion, selling on Facebook Marketplace can be a viable option for individuals looking to sell everyday items or unique products. It is important to be aware of the fees involved, exercise caution when completing transactions, and understand your tax obligations. By taking these factors into consideration, you can maximize your experience and potential earnings on Facebook Marketplace.

How much money does Facebook Marketplace take from you

FAQs About Facebook Marketplace

Facebook will not charge you a listing fee for selling items on Facebook Marketplace. However, there are selling fees involved. The selling fee is 5% per shipment or a flat fee of $. 40 for shipments of $8 or less.

Cached

Is selling on Facebook Marketplace worth it

It's great to sell exciting, trendy stuff, but reliable ecommerce best-sellers tend to fly under the radar. Facebook Marketplace is a great place to sell everyday household items like furniture, cleaning supplies, books, and glassware. There will always be demand for these kinds of products.

Is getting paid on Facebook Marketplace safe

Facebook Marketplace is about as safe as any other online buying and selling site. It all relies on the user's knowledge and experience. If you pay attention to all the signs, you probably won't get snagged in a scammer's trap.

Cached

Does Facebook Marketplace report to IRS

Payment service entities (PSEs)—including online marketplaces like Etsy, Facebook Marketplace and StubHub—report online transactions to the IRS using Form 1099-K. A 1099-K form shows the total dollar amount of your online transactions for the year.

What are the disadvantages of Facebook Marketplace

Cons of Facebook MarketplaceUnsafe Meetups. People you sell your products to might request meet-ups at random places.No Digital Store. This feature allows buyers to sell random items on Facebook Marketplace.No Buyer Protection.Getting Recognized Is Difficult.No Storage Space.

What are the cons of selling on Facebook Marketplace

Cons of using only Facebook Marketplace

You may not find a large buyer pool for your product. Because there are so many buyers and product categories, your item may get lost in the shuffle. It may take longer to sell your items since there isn't a highly specific, targeted audience.

What is the safest way to get paid when selling on Facebook Marketplace

Don't transfer money directly into a seller's bank account. Instead, offer to use a secure person-to-person payment site, such as PayPal or sending and receiving money in Messenger.

How do I accept payment on Facebook

Add or remove a payment method in MessengerOpen your Messenger app.Tap your profile picture in the top left.Scroll down and tap Facebook Pay.Tap Add new debit card or PayPal.Tap Add Debit Card or Add PayPal.Enter your payment method information, then tap Save.

How much money can you make on Marketplace before paying taxes

If you're a Facebook or eBay seller, you will receive Form 1099-K if you meet certain gross sales and transaction thresholds. According to the IRS, you will receive a Form 1099-K if you have the following: Gross merchandise sales of at least $20,000.

Do I have to pay taxes on stuff I sell on Facebook

If you sell goods online for a profit, you need to report your sales to the IRS and pay taxes on your profit or gain.

Why not to use Facebook Marketplace

Cons of using only Facebook Marketplace

You may not find a large buyer pool for your product. Because there are so many buyers and product categories, your item may get lost in the shuffle. It may take longer to sell your items since there isn't a highly specific, targeted audience.

Should I sell on Craigslist or Facebook Marketplace

Choose the Right Platform

Not every platform is well-suited to every type of product. If you're selling larger items — such as furniture — you may have better luck selling on Craigslist. Smaller items such as clothing, jewelry and collectibles, on the other hand, tend to fare better on Facebook Marketplace and eBay.

How to avoid being scammed on Facebook Marketplace as a seller

Don't Use Unusual Payment Methods

Only use Facebook Checkout, PayPal, or cash when it comes to Facebook Market. For PayPal, make sure you never select friends and family payments. This will completely negate your ability to get a refund and be protected by PayPal. The seller may claim they want to avoid fees.

What should I accept for payment on Facebook Marketplace

As for payment, carrying cash, especially a lot of cash, is risky. Facebook Marketplace recommends a secure person-to-person payment method such as PayPal.

How can my customers Pay me on Facebook

To use Facebook Pay, customers check out, indicate they want to use Facebook Pay, and enter their PIN to complete the transaction. Users can also opt for biometric identification methods in place of PINs. Either way, with Facebook Pay, customers don't have to enter their payment card number for every transaction.

Is it safe to accept PayPal for Facebook Marketplace

As for payment, carrying cash, especially a lot of cash, is risky. Facebook Marketplace recommends a secure person-to-person payment method such as PayPal.

Do I have to report income from Facebook Marketplace

Your earned money from selling on Marketplace could be subject to taxes. Even if you don't claim the income when you file your annual taxes, we will submit a Form 1099 and report your income to the IRS.

Does IRS track Facebook Marketplace sales

Payment service entities (PSEs)—including online marketplaces like Etsy, Facebook Marketplace and StubHub—report online transactions to the IRS using Form 1099-K. A 1099-K form shows the total dollar amount of your online transactions for the year.

Is selling personal items considered income

The gain on the sale of a personal item is taxable. You must report the transaction (gain on sale) on Form 8949, Sales and Other Dispositions of Capital AssetsPDF, and Form 1040, U.S. Individual Income Tax Return, Schedule D, Capital Gains and LossesPDF.

What is the best payment method for Facebook Marketplace

As for payment, carrying cash, especially a lot of cash, is risky. Facebook Marketplace recommends a secure person-to-person payment method such as PayPal.

What should you not do when selling on Facebook Marketplace

Don't share your financial information (example: PayPal login and password, bank account info) or unnecessary personal information with buyers or sellers. Don't respond to messages or emails that ask you to provide verification codes or account information, such as your email address and password.

What is the safest way to receive money when selling on Facebook Marketplace

Don't transfer money directly into a seller's bank account. Instead, offer to use a secure person-to-person payment site, such as PayPal or sending and receiving money in Messenger.

How to tell if a buyer is scamming you on Facebook Marketplace

Facebook Marketplace scam red flagsLow prices for what should be high-ticket items.Refusing to meet up in person for exchanges.Moving conversations outside of Facebook Messenger.Asking for payment in the form of a gift card.Requesting deposits on items before receiving them.

What is the safest way to take payment on Marketplace

As for payment, carrying cash, especially a lot of cash, is risky. Facebook Marketplace recommends a secure person-to-person payment method such as PayPal.

What is the safest way to receive money from a buyer

What is the safest way to accept payment Besides cash, a certified check is the safest way you can receive a payment to your business.