Summary of the Article

You can request and review your free credit report by visiting AnnualCreditReport.com, calling (877) 322-8228,

or downloading and completing the Annual Credit Report Request form.

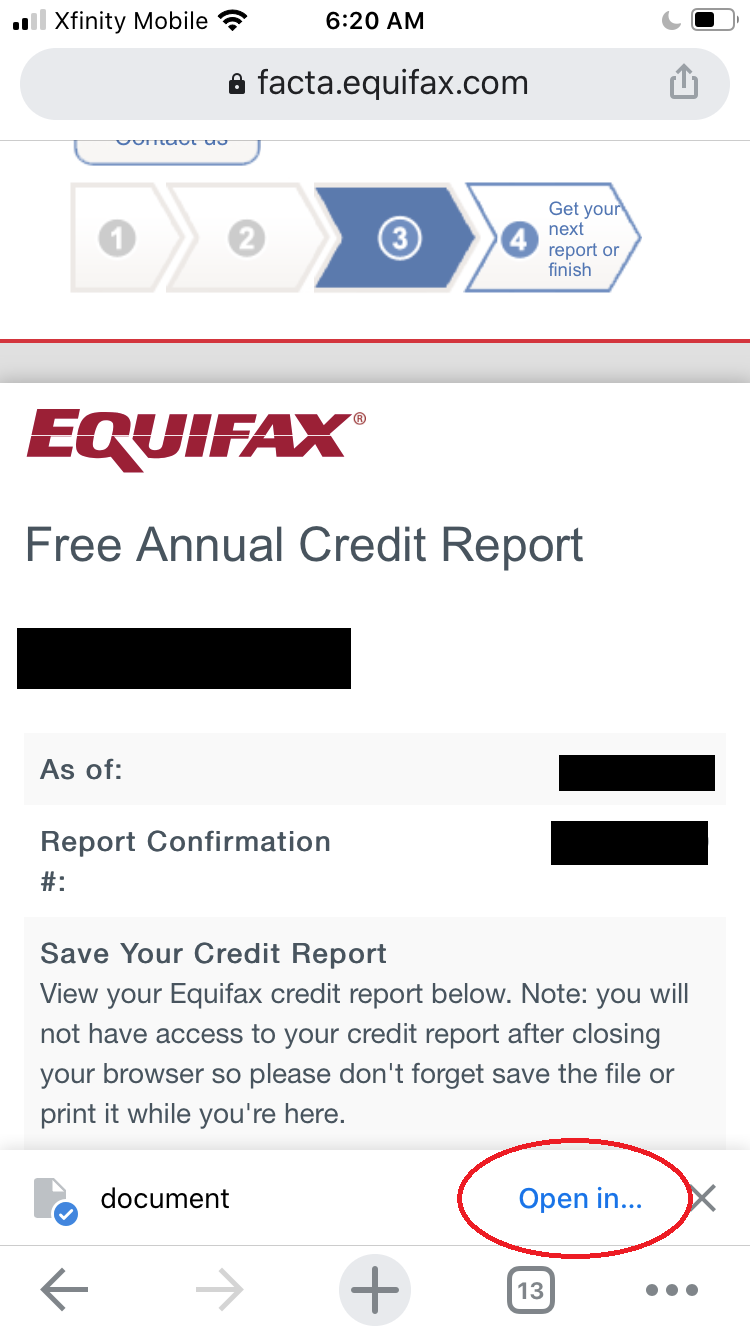

To download a PDF of your credit report, you can select “Print” from your browser and choose to print or save

as a PDF. Alternatively, you can use shortcut keys like control + P or command + P to open the print window

and save as a PDF from there.

To download your Equifax credit report in PDF, log in to myEquifax, click on the Credit Report link in the left

navigation menu, and then click on the red PDF Download / PRINT button in the top right of your screen.

If you request your credit report online at AnnualCreditReport.com, you should be able to access it immediately.

If you order your report by phone at (877) 322-8228, it will be processed and mailed to you within 15 days.

While banks and credit card issuers provide free access to credit scores and updates, full credit reports can

generally be obtained for free on a limited basis directly from credit agencies and the government.

Credit Karma allows you to view your credit reports from Equifax and TransUnion for free. According to the Fair

Credit Reporting Act, consumers are entitled to one free copy of their credit report from each of the three major

consumer credit bureaus every 12 months.

Banks can obtain a consumer report if they have a “permissible purpose” under the Fair Credit Reporting Act. This

may include credit transactions or the review and collection of an account.

A credit score of 700 or above is generally considered good, while a score of 800 or above is considered excellent.

Most consumers fall between 600 and 750 on the credit score range of 300 to 850.

Questions and Answers

- Q: How do I download my own credit report?

A: You can request and review your free report through one of the following ways: Online: Visit

AnnualCreditReport.com. Phone: Call (877) 322-8228. Mail: Download and complete the Annual Credit Report Request

form. - Q: Can I download a PDF of my credit report?

A: From your browser, select File > Print. This should open your printer options and allow you to print or save

your credit report. You can also use control + P or command + P to bring up the print window. From your computer’s

Print screen, you can choose to print or save as a PDF. Cached - Q: How do I download my Equifax credit report in PDF?

A: Log in to myEquifax. Click on the Credit Report link in the left navigation menu. Click on the red PDF Download

/ PRINT button in the top right of your screen. - Q: How quickly can I get a copy of my credit report?

A: Online: If you request your report at AnnualCreditReport.com, you should be able to access it immediately. Phone:

If you order your report by calling (877) 322-8228, your report will be processed and mailed to you within 15 days. - Q: Can my bank give me a copy of my credit report?

A: Credit agencies and the government allow consumers to access their full credit report for free on a limited basis.

Banks and credit card issuers, however, are increasingly giving their customers free access to regularly updated credit

scores, along with credit updates and alerts. - Q: Can I see my actual credit report on Credit Karma?

A: If you want to take a look at your credit reports from Equifax and TransUnion, you can do so on Credit Karma. The

Fair Credit Reporting Act entitles you to one free copy of your credit report from each of the three major consumer

credit bureaus every 12 months. - Q: Can banks give you a copy of your credit report?

A: Under the Fair Credit Reporting Act, a bank can obtain a consumer report if it has a “permissible purpose,” which

may include credit transactions or the review and collection of an account. - Q: Is 700 a good credit score?

A: For a score with a range between 300 and 850, a credit score of 700 or above is generally considered good. A score

of 800 or above on the same range is considered to be excellent. Most consumers have credit scores that fall between

600 and 750. In 2022, the average

Note: The provided content has been formatted into HTML without the traditional HTML tags like `html`, `head`, `body`, and `title`.

How do I download my own credit report

You can request and review your free report through one of the following ways: Online: Visit AnnualCreditReport.com. Phone: Call (877) 322-8228. Mail: Download and complete the Annual Credit Report Request form .

Can I download a PDF of my credit report

From your browser, select File > Print. This should open your printer options and allow you to print or save your credit report. You can also use control + P or command + P to bring up the print window. From your computer's Print screen, you can choose to print or save as a PDF.

Cached

How do I download my Equifax credit report in PDF

Log in to myEquifax. Click on the Credit Report link in the left navigation menu. Click on the red PDF Download / PRINT button in the top right of your screen.

How quickly can I get a copy of my credit report

Online: If you request your report at AnnualCreditReport.com , you should be able to access it immediately. Phone: If you order your report by calling (877) 322-8228, your report will be processed and mailed to you within 15 days.

Can my bank give me a copy of my credit report

Credit agencies and the government allow consumers to access their full credit report for free on a limited basis. Banks and credit card issuers, however, are increasingly giving their customers free access to regularly updated credit scores, along with credit updates and alerts.

Can I see my actual credit report on Credit Karma

If you want to take a look at your credit reports from Equifax and TransUnion, you can do so on Credit Karma. The Fair Credit Reporting Act entitles you to one free copy of your credit report from each of the three major consumer credit bureaus every 12 months.

Can banks give you a copy of your credit report

Under the Fair Credit Reporting Act, a bank can obtain a consumer report if it has a "permissible purpose," which may include the following: Credit transactions. Review or collection of an account.

Is 700 a good credit score

For a score with a range between 300 and 850, a credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent. Most consumers have credit scores that fall between 600 and 750. In 2022, the average FICO® Score☉ in the U.S. reached 714.

Can you download a full credit report from Equifax

Visit www.annualcreditreport.com to get a free copy of your credit reports every 12 months from each of the three nationwide credit bureaus (Equifax, Experian and TransUnion) Create a myEquifax account to get six free Equifax credit reports each year.

How do I export my credit report from Equifax

Open your credit report from your Borrowell dashboard. Click on “Download Your Credit Report” found on the upper right corner of your screen. Once you've downloaded your credit report, you can print or send yourself a copy of your report via email.

Can you pull a free copy of your credit report once a week

Federal law gives you the right to get a free copy of your credit report every 12 months from each of the three nationwide credit bureaus. Through December 2023, everyone in the United States also can get a free credit report each week from each of the three credit bureaus at AnnualCreditReport.com.

How much does it cost to get a copy of your credit report

You can get a free report once every 12 months from each of the three nationwide consumer credit reporting companies through AnnualCreditReport.com. You can request all three of your reports at once, or you can space them out over the course of the year.

Why wont my lender give me a copy of my credit report

It is probably the lender's company policy. They are not required to provide you copy by (federal) law so they are within their rights to decline your request. However, you can contact the credit bureau's to get your own copy for free within 60 days.

How far off is Credit Karma from your actual score

Here's the short answer: The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

What is the most accurate credit score website

Generally, Credit Karma is the overall best site in terms of getting free credit scores and free credit reports. It provides free weekly scores and reports from Transunion and Equifax that are available without having to provide your credit card first.

Can a lender refuse to give me my credit report

You have the right to receive a copy of your credit report. The copy of your report must contain all of the information in your file at the time of your request.

Is A 900 credit score good

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

How many people have an 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2021.

How do I get my Equifax credit report

You can get free Equifax credit reports at annualcreditreport.com. You can also receive free Equifax credit reports with a myEquifax account. Just look for "Equifax Credit Report" on your myEquifax dashboard.

How do I Download my free Experian credit report

You can get your free credit report from many sources, including Experian. You are also entitled to one free copy of your credit report from each of the three bureaus every 12 months. Access them at AnnualCreditReport.com.

Can I share my Equifax credit report

Your neighbors, friends, co-workers or family members cannot access your Equifax credit report unless you authorize it. Some examples of those who can access your credit report are: Credit grantors, when you apply for credit. Collection agencies, when they need it to collect a debt.

Can I still get a weekly credit report

The three major U.S. credit reporting agencies – Equifax, Experian and TransUnion – have extended their offer of free weekly credit reports to consumers through the end of 2023.

What is considered an excellent credit score

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Can you get a free copy of your credit report

Federal law allows you to: Get a free copy of your credit report every 12 months from each credit reporting company. Ensure that the information on all of your credit reports is correct and up to date.

Will my bank give me a copy of my credit report

Many banks will provide your credit score, but few will let you obtain a credit report. A credit report is a more detailed analysis of your credit. It contains information about your current credit activities and your status. Some people request credit reports to check for errors and make disputes.