dispute a charge after the deadline If you try to dispute a charge after the deadline, your credit card issuer may not be obligated to investigate or resolve the dispute. It is important to act quickly if you notice any unauthorized or incorrect charges on your credit card statement. If you miss the deadline, you may still be able to resolve the issue directly with the merchant or through other means, but you may not have the same protections and options as when disputing through your credit card issuer.

Can I dispute a charge for a service I was not satisfied with?

Yes, you can dispute a charge for a service that you were not satisfied with. If you believe that the service was not as described or did not meet your expectations, you can contact your credit card issuer and explain the situation. However, it is important to note that simply being dissatisfied with a service does not guarantee that you will be successful in disputing the charge. Your credit card issuer will assess the validity of your claim based on the evidence provided.

Can I dispute a charge if I no longer have the receipt?

Yes, you can dispute a charge even if you no longer have the receipt. While having a receipt can provide additional evidence to support your dispute, it is not always necessary. You can still provide other forms of evidence, such as emails, contracts, or photos, to support your claim. It is always recommended to gather as much relevant documentation as possible to strengthen your case when disputing a charge.

What should I do if the merchant refuses to resolve the dispute?

If the merchant refuses to resolve the dispute or does not respond to your attempts to resolve the issue, you can escalate the dispute by contacting your credit card issuer. They will guide you through the dispute resolution process and may initiate a chargeback on your behalf if necessary. It is important to keep all communication and documentation related to the dispute, as this will be helpful in presenting your case to the credit card issuer.

What information should I provide when disputing a charge?

When disputing a charge, it is important to provide as much relevant information as possible to support your claim. This may include details about the transaction, such as the date, amount, and description of the charge. Additionally, providing any evidence you have, such as receipts, emails, or photographs, can strengthen your case. It is also important to clearly state the reason for the dispute and explain why you believe the charge is incorrect or unauthorized. The more information and evidence you can provide, the stronger your case will be.

Can I dispute a charge if I authorized it but the amount was incorrect?

Yes, you can dispute a charge if you authorized it but the amount was incorrect. If you believe that the amount charged to your credit card does not match what you agreed to, you can contact your credit card issuer and explain the discrepancy. It is important to provide any relevant documentation, such as receipts or agreements, to support your claim. Your credit card issuer will then investigate the dispute and work to resolve the issue.

Can I dispute a charge made on a debit card?

Yes, you can dispute a charge made on a debit card. While the dispute process may be slightly different for debit cards compared to credit cards, you still have the right to dispute unauthorized or incorrect charges. Contact your bank or financial institution to initiate the dispute and provide them with the necessary information and evidence. It is important to act quickly, as there may be time limits for disputing charges on debit cards.

What should I do if my dispute is not resolved in my favor?

If your dispute is not resolved in your favor, you still have options. You can try reaching out to your credit card issuer again and provide any additional evidence or arguments to support your case. If necessary, you can also consider filing a complaint with the appropriate regulatory or consumer protection agency. Additionally, if the disputed charge is significant, you may want to consult with a legal professional to explore further legal actions or options that may be available to you.

Will disputing a charge affect my credit score?

Disputing a charge should not directly impact your credit score. The act of disputing a charge is separate from the factors that determine your credit score, such as payment history or credit utilization. However, if the disputed charge is related to a larger issue, such as ongoing financial difficulties, it may indirectly affect your credit score. It is always recommended to monitor your credit report regularly and address any inaccuracies or issues promptly to maintain a healthy credit profile.

What protections do I have when disputing a charge?

When disputing a charge, you have certain protections under the Fair Credit Billing Act (FCBA). This law allows you to dispute charges for goods or services that you did not authorize or that were not delivered as agreed. It also provides guidelines for resolving billing errors and unauthorized charges. Your credit card issuer is required to investigate your dispute and provide you with a response within a specific timeframe. If the dispute is resolved in your favor, you are entitled to a refund or credit for the disputed amount.

Can I dispute a charge if I used a virtual credit card number?

Yes, you can dispute a charge if you used a virtual credit card number. Virtual credit card numbers offer an extra layer of security and privacy for online transactions. If you encounter an unauthorized or incorrect charge on your virtual credit card, you can still follow the standard dispute process provided by your credit card issuer. Make sure to provide all the necessary information and evidence to support your claim, including details about the virtual credit card number used for the transaction.

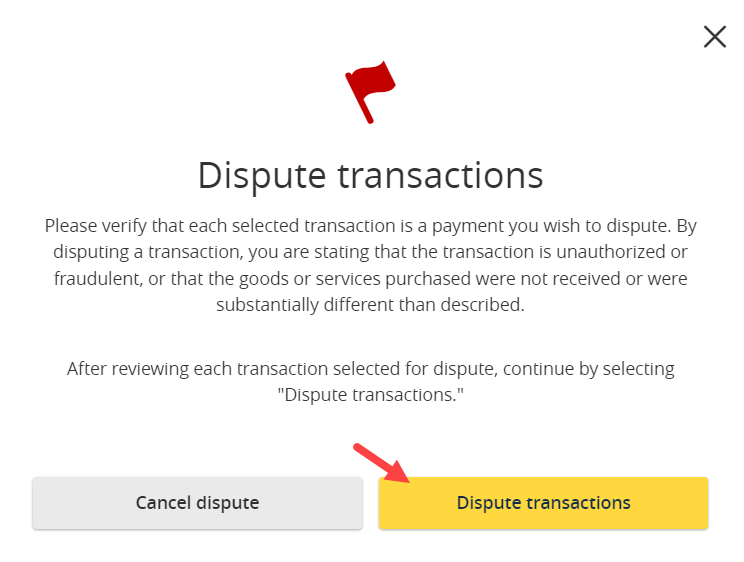

What is the best way to dispute a transaction

Contact your credit card issuer

Remember, you should wait one to three days until your charges post. You can only dispute charges that have already been posted. If you prefer not to submit a dispute online, you may do so in writing, or by calling customer service and disputing the charge over the phone.

What is a good reason to dispute a transaction

There are several reasons you may want to dispute a credit card charge, including fraudulent purchases, billing errors or bad service/service not rendered. Fraudulent charges on your bill can be disputed by calling your credit card issuer or filing a dispute online.

How do I dispute a charge on my card

How to Dispute a Credit Card ChargeCall the customer service number on the back of your credit card or on your statement.Email customer service.Dispute through the financial institution's app.Dispute the transaction in writing (the address should be on your statement)

Cached

Can I dispute a transaction I already paid

If you already paid the charge that you're disputing, you can still dispute it. But you probably won't get the money back until the credit card company has decided that you were right. If the card company finds you are correct, the charge must be removed from your bill.

Cached

Who pays when you dispute a charge

Who pays when you dispute a charge Your issuing bank will cover the cost initially by providing you with a provisional credit for the original transaction amount. After filing the dispute, though, they will immediately recover those funds (plus fees) from the merchant's account.

What happens to the merchant when you dispute a charge

Once the payment dispute is officially filed, it officially progresses to a chargeback. The funds are moved from the merchant's account to the consumer's. The merchant has no say in this; in fact, the seller may not even know about the dispute until the money is debited from their account.

How long do I have to dispute a charge

60 days

You generally have at least 60 days to dispute credit card charges when there's a billing error or fraudulent transaction, and 120 days if you have a complaint about the quality of goods or services.

What happens when you try to dispute a charge

Your credit card company will likely remove the charge from your statement during the dispute process. You won't need to pay it until a decision is reached regarding the dispute, and if you win, you won't need to pay it at all.

Will the merchant know if I dispute a charge

The merchant is simultaneously notified that they've received a dispute from the cardholders, and that the acquiring bank has debited funds from the merchant account to reimburse the cardholder for the transaction and to cover the fees for investigating the chargeback.

Can a merchant deny a dispute

A merchant cannot outright refuse a chargeback, but they can dispute it in a process called representment, where they present their case against the legitimacy of the chargeback to the issuing bank.

How long does it usually take to dispute a charge

Under the law, creditors must acknowledge your complaint in writing within 30 days of receiving it. Then expect to receive a written resolution within two billing cycles, and no later than 90 days, from the original date your creditor received the dispute.

Can a dispute charge be denied

Receiving a dispute denial

After conducting an investigation, your card issuer may deny your dispute. For example, if the issuer may not find evidence that the transaction you disputed was unauthorized.