maximum of a date range you specify. The process of unfreezing your credit can take up to an hour to fully complete.

To remove an Equifax lock, you can use your myEquifax account. Simply log in and navigate to the security freeze section. From there, you can select the option to lift the freeze for a specific date range. If you prefer, you can also lift the freeze by phone by calling the automated line at (800) 349-9960 or contacting Customer Care at (888) 298-0045.

If you have placed a lock on your credit report and wish to remove it, you can do so by contacting the credit bureau responsible for the lock. This can be done either online or by phone. Each credit bureau has its own process for removing locks, so be sure to follow the specific instructions provided by the bureau.

Unfreezing your credit report can take up to an hour to complete. It is important to wait at least an hour after initiating the unfreeze process to ensure that your credit is fully unlocked. This time frame allows for any necessary updates to your credit report to occur.

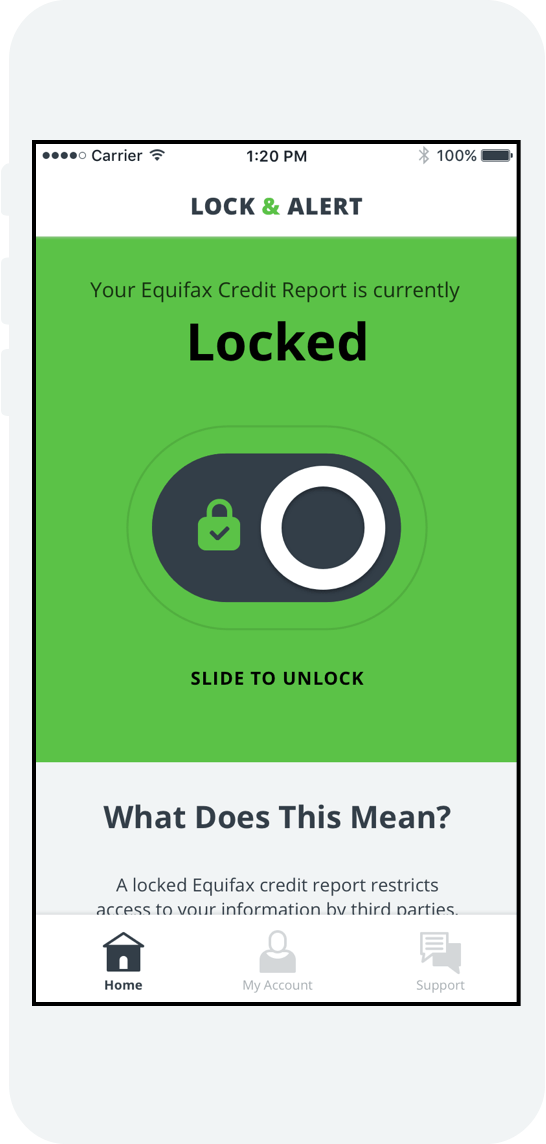

The presence of a lock or freeze on your Equifax credit report is a security measure designed to help prevent unauthorized access to your credit information. By freezing your credit, you make it difficult for others to open new credit accounts using your identity. This is a federally regulated process, and it is necessary to temporarily lift or permanently remove the freeze each time you apply for new credit.

Equifax security freezes typically last for one year. If you believe you are a victim of fraud or identity theft, you can place an initial (one-year) fraud alert on your credit report. This alert will remain active for one year, and you will need to renew it after that time if you wish to continue having it on your credit reports.

When unfreezing your credit, it is important to remember that you need to unfreeze it at all three credit bureaus individually. This means contacting each bureau separately and following their specific unfreeze process. If you know which credit bureau a creditor is using for credit checks, you have the option to lift the freeze at just that one bureau.

A credit lock, similar to a credit freeze, will remain in place until you request its removal from the credit bureaus. You can choose to temporarily or permanently remove the lock. For optimal protection, it is recommended to keep your credit lock in place until you are ready to apply for a credit card or loan.

The time it takes Equifax to unfreeze your credit can vary depending on the method you choose. You can unfreeze your credit temporarily or permanently online, and the process typically takes up to an hour. However, if you prefer to unfreeze your credit by phone, the exact time frame may differ based on the call volume and any additional verification required.

With this information, you should now have a better understanding of how to remove an Equifax lock, the duration of a security freeze, and the steps involved in unfreezing your credit with Equifax. Remember to follow the specific instructions provided by Equifax or the credit bureaus when unfreezing your credit to ensure a smooth process.

How do I remove an Equifax lock

At Equifax, you can use your myEquifax account to lift a security freeze for a date range you specify. You can also lift a security freeze by phone by calling our automated line at (800) 349-9960 or calling Customer Care at (888) 298-0045. Afterward, your Equifax credit report will be frozen again.

Cached

How do I remove a lock from my credit report

The quickest and easiest way to unfreeze your credit report is to contact the credit bureau (or bureaus) you used to freeze your credit either online or by phone. But you also have the option to contact them by mail.

Cached

How long does it take to unlock Equifax

Freezing and unfreezing your credit can be done as often as you like, but keep in mind that it can take up to an hour for each process to occur. If you freeze your credit and then realize that you need to unfreeze it, wait at least an hour to ensure that your credit is fully frozen.

Cached

Why is there a lock or freeze on my Equifax

A security freeze is one step you can take to help prevent access to your Equifax credit report to open new credit accounts, with certain exceptions. Security freezes are federally regulated, and a security freeze must be temporarily lifted or permanently removed each time you apply for new credit.

How long does Equifax security freeze last

one-year

An initial (one-year) fraud alert can be placed if you believe you are or may become a victim of fraud or identity theft. The fraud alert lasts for one year. If you want to keep it active on your credit reports, you'll need to renew it after that time.

Do I need to unfreeze all three bureaus

You have to unfreeze your credit at all three credit bureaus individually, unless you know which credit bureau a creditor is using for credit checks and choose to lift your freeze at just that one.

How long does a credit lock last

How long does a credit lock last As with a credit freeze, your credit lock will remain until you ask the credit bureaus to remove it, either temporarily or permanently. For the best protection, keep your credit lock in place until you are ready to apply for a credit card or loan.

How long does it take Equifax to unfreeze

Equifax allows you to unfreeze your credit temporarily or permanently, for a specific creditor or for a specified period (from one day to one year). If you choose to unfreeze or reinstate a freeze by phone, you'll be asked to verify your identity by answering security questions or receiving a one-time PIN by text.

How long does Equifax freeze last

An initial (one-year) fraud alert can be placed if you believe you are or may become a victim of fraud or identity theft. The fraud alert lasts for one year. If you want to keep it active on your credit reports, you'll need to renew it after that time.

How do you unfreeze all 3 credit bureaus

You can unfreeze your credit report at each of the three bureaus—Experian, TransUnion and Equifax—online through your accounts, over the phone or by mailing the correct documentation.

How often can I unfreeze my credit

It's free to freeze and unfreeze your credit report as often as you like. Ultimately, freezing your credit adds an extra layer of security to your identity and accounts.

How do I unfreeze all 3 credits

You can't unfreeze at all three with a single action. You'll have to unfreeze your credit with each credit bureau individually. How do I unfreeze my credit You can unfreeze and freeze your credit reports online or by mail, or by calling each credit bureau.

How do I unlock all 3 credit reports

You can unfreeze your credit report at each of the three bureaus—Experian, TransUnion and Equifax—online through your accounts, over the phone or by mailing the correct documentation.

Does locking your credit hurt your credit score

A credit freeze won't have any impact on your credit score, nor will it impact your current credit accounts. While a credit freeze won't affect your credit score in any way, it will impact your ability to qualify for a loan or credit card unless you thaw your credit file before submitting your application.

Can I unfreeze my credit online

You can unfreeze and freeze your credit reports online or by mail, or by calling each credit bureau. TransUnion requires a PIN, and Equifax offers the option to request a one-time PIN if you're calling to unfreeze.

Can you unfreeze your credit anytime

You must contact all three credit bureaus to freeze your credit. However, credit freezes are free, you can lift them at any time, and they don't affect your credit score.

Can I unfreeze my credit at any time

You can unfreeze your credit at any time, and there's no fee to do so. You can “thaw” your credit temporarily, or you can permanently unfreeze your credit once your accounts are secure. You have to get in touch with each credit bureau (Experian, TransUnion and Equifax) to unfreeze your credit with them.

Do I have to unfreeze all three credit bureaus to apply for credit card

If you're looking to apply for a loan or credit card, you will need to unfreeze your credit report. You'll have to unfreeze your credit report individually with each credit bureau. However, if you know which bureau a creditor is using, you can just unfreeze that one.

Do I need to call all 3 credit bureaus to unfreeze my credit

You have to unfreeze your credit at all three credit bureaus individually, unless you know which credit bureau a creditor is using for credit checks and choose to lift your freeze at just that one.

What is a major downside of locking your credit

A freeze can give you a false sense of security — you may still be susceptible to credit fraud or other fraud involving your Social Security number. A credit freeze won't affect your current accounts, but if a thief steals the information on an existing account, your credit may be used without your permission.

How quickly can you unfreeze your credit

In most cases, if you request to remove the freeze (also known as "thawing" your credit report) online or by telephone, your Experian credit file can be unfrozen within a matter of minutes—although you should allow up to an hour. You can also request to lift your freeze by mail.

Does locking your credit drop your score

A credit freeze won't have any impact on your credit score, nor will it impact your current credit accounts. While a credit freeze won't affect your credit score in any way, it will impact your ability to qualify for a loan or credit card unless you thaw your credit file before submitting your application.

Is it easy to unfreeze your credit

In most cases, if you make the request online or by phone, the credit bureaus can lift a freeze in near real time. The Federal Trade Commission allows the bureaus up to one hour to complete an online or phone request, while requests by mail must be granted within three days after receipt.

Does it cost to unfreeze your credit

It's now free to freeze and unfreeze your credit reports with the three major credit reporting bureaus. A credit freeze doesn't prevent people who already have access to your credit history from viewing your credit file. In lieu of a credit freeze, you can also place a fraud alert on your credit file.