Summary of the Article

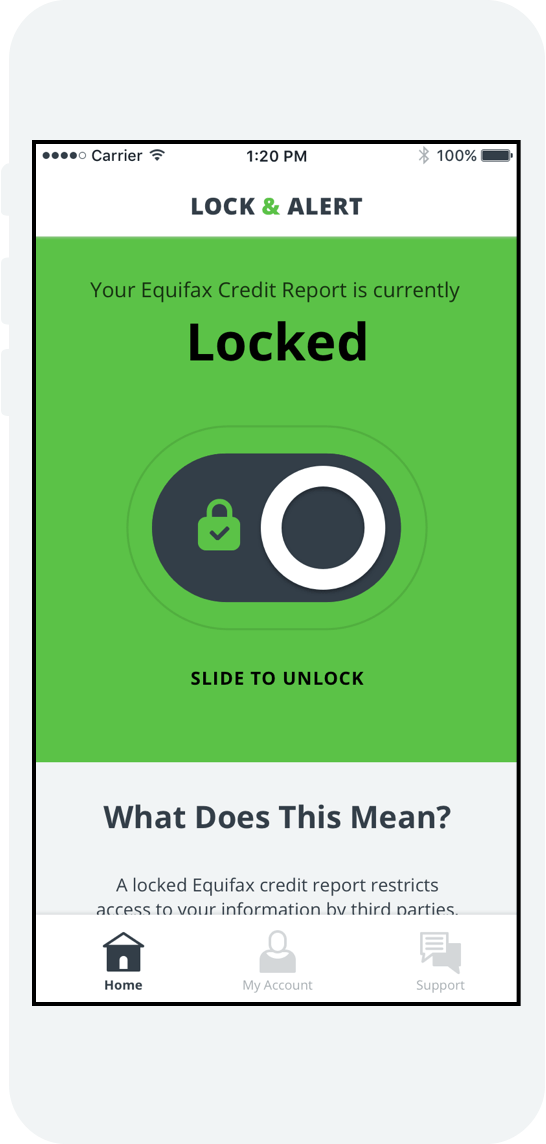

1. How do I take the lock off my Equifax account?

If you have a security freeze on your Equifax credit report, you can use Lock & Alert to remove the freeze and lock your Equifax credit report. You can manage a security freeze by creating a myEquifax account or call them at (888) 298-0045.

2. How do I cancel my credit lock?

The quickest and easiest way to unfreeze your credit report is to contact the credit bureau (or bureaus) you used to freeze your credit either online or by phone. You also have the option to contact them by mail.

3. Why is there a lock or freeze on my Equifax?

A security freeze is one step you can take to help prevent access to your Equifax credit report for opening new credit accounts, with certain exceptions. Security freezes are federally regulated, and a security freeze must be temporarily lifted or permanently removed each time you apply for new credit.

4. How do I unfreeze my Equifax without my PIN?

By phone: Call them at (888) 298-0045. You’ll have the option to verify your identity by providing certain personal information and receiving a one-time PIN by text message (data charges may apply) or answering questions based on information in your Equifax credit report.

5. How long does it take Equifax to unfreeze credit?

Freezing and unfreezing your credit can be done as often as you like, but keep in mind that it can take up to an hour for each process to occur. If you freeze your credit and then realize that you need to unfreeze it, wait at least an hour to ensure that your credit is fully frozen.

6. Why does it say my credit is locked?

A security freeze prevents prospective creditors from accessing your credit file. Creditors typically won’t offer you credit if they can’t access your credit reporting file, so a security freeze, also called a credit freeze, prevents you or others from opening accounts in your name.

7. Can I unfreeze my credit online?

You can unfreeze and freeze your credit reports online or by mail, or by calling each credit bureau. TransUnion requires a PIN, and Equifax offers the option to request a one-time PIN if you’re calling to unfreeze.

8. How long does a credit lock last?

As with a credit freeze, your credit lock will remain until you ask them to remove it. It does not have a specific expiration date.

Questions and Answers

- How do I take the lock off my Equifax account?

You can take the lock off your Equifax account by using the Lock & Alert feature in your myEquifax account or by calling them at (888) 298-0045. - How do I cancel my credit lock?

To cancel your credit lock, you need to contact the credit bureau (or bureaus) you used to freeze your credit. You can do this online, by phone, or by mail. - Why is there a lock or freeze on my Equifax?

A lock or freeze is placed on your Equifax account to prevent unauthorized access and the opening of new credit accounts in your name. - How do I unfreeze my Equifax without my PIN?

If you don’t have your PIN, you can unfreeze your Equifax account by calling them at (888) 298-0045. You will need to verify your identity through other means, such as providing personal information or answering questions based on your Equifax credit report. - How long does it take Equifax to unfreeze credit?

It can take up to an hour for Equifax to unfreeze your credit. It’s important to wait at least an hour after unfreezing your credit to ensure that the freeze is fully lifted. - Why does it say my credit is locked?

If your credit is locked, it means that a security freeze or credit lock has been placed on your credit file. This prevents creditors from accessing your credit report and opening new accounts in your name. - Can I unfreeze my credit online?

Yes, you can unfreeze your credit online by logging into your myEquifax account or by visiting the Equifax website. - How long does a credit lock last?

A credit lock remains in place until you request its removal. It does not have a specific expiration date like a credit freeze. - Can I temporarily lift my credit freeze?

Yes, you can temporarily lift your credit freeze when you need to apply for new credit. This can be done online or by calling Equifax at (888) 298-0045. - What are the exceptions to a security freeze?

While a security freeze generally prevents access to your credit report, certain entities, such as existing creditors or debt collectors, will still have access to your information. - How can I protect my credit while it is frozen?

While your credit is frozen, it is still important to monitor your existing accounts for any suspicious activity. You can also sign up for credit monitoring services or place fraud alerts with the credit bureaus. - Can I unfreeze my credit for a specific period?

No, once you unfreeze your credit, it remains unfrozen until you request a freeze again. There is no provision for unfreezing your credit for a specific time period. - How do I remove a credit freeze permanently?

To remove a credit freeze permanently, you need to contact Equifax and request the freeze to be lifted. This can be done online or by calling (888) 298-0045. - What happens if I forget my PIN?

If you forget your PIN, you can contact Equifax at (888) 298-0045 to reset it. They will guide you through the process of verifying your identity and setting a new PIN. - Can I freeze my credit with other credit bureaus?

Yes, you can freeze your credit with all three major credit bureaus: Equifax, Experian, and TransUnion. It is recommended to freeze your credit with all bureaus for maximum protection.

How do I take the lock off my Equifax account

If you have a security freeze on your Equifax credit report, you can use Lock & Alert to remove the freeze and lock your Equifax credit report. You can manage a security freeze by creating a myEquifax account, or call us at (888) 298-0045.

Cached

How do I cancel my credit lock

The quickest and easiest way to unfreeze your credit report is to contact the credit bureau (or bureaus) you used to freeze your credit either online or by phone. But you also have the option to contact them by mail.

Cached

Why is there a lock or freeze on my Equifax

A security freeze is one step you can take to help prevent access to your Equifax credit report to open new credit accounts, with certain exceptions. Security freezes are federally regulated, and a security freeze must be temporarily lifted or permanently removed each time you apply for new credit.

How do I unfreeze my Equifax without my PIN

By phone: Call us at (888) 298-0045. You'll have the option to verify your identity by providing certain personal information, and receiving a one-time PIN by text message (data charges may apply) or answering questions based on information in your Equifax credit report.

How long does it take Equifax to unfreeze credit

Freezing and unfreezing your credit can be done as often as you like, but keep in mind that it can take up to an hour for each process to occur. If you freeze your credit and then realize that you need to unfreeze it, wait at least an hour to ensure that your credit is fully frozen.

Why does it say my credit is locked

A security freeze prevents prospective creditors from accessing your credit file. Creditors typically won't offer you credit if they can't access your credit reporting file, so a security freeze, also called a credit freeze, prevents you or others from opening accounts in your name.

Can I unfreeze my credit online

You can unfreeze and freeze your credit reports online or by mail, or by calling each credit bureau. TransUnion requires a PIN, and Equifax offers the option to request a one-time PIN if you're calling to unfreeze.

How long does a credit lock last

How long does a credit lock last As with a credit freeze, your credit lock will remain until you ask the credit bureaus to remove it, either temporarily or permanently. For the best protection, keep your credit lock in place until you are ready to apply for a credit card or loan.

How long does it take to unfreeze credit Equifax

Freezing and unfreezing your credit can be done as often as you like, but keep in mind that it can take up to an hour for each process to occur. If you freeze your credit and then realize that you need to unfreeze it, wait at least an hour to ensure that your credit is fully frozen.

How long does Equifax security freeze last

one-year

An initial (one-year) fraud alert can be placed if you believe you are or may become a victim of fraud or identity theft. The fraud alert lasts for one year. If you want to keep it active on your credit reports, you'll need to renew it after that time.

How do you unfreeze all 3 credit bureaus

You can unfreeze your credit report at each of the three bureaus—Experian, TransUnion and Equifax—online through your accounts, over the phone or by mailing the correct documentation.

Does it cost money to unlock your credit

There's no longer a fee required to freeze or unfreeze your credit. You can easily and quickly freeze or unfreeze credit online. A credit freeze won't hurt your credit score.

Can I unfreeze my credit at any time

You can unfreeze your credit at any time, and there's no fee to do so. You can “thaw” your credit temporarily, or you can permanently unfreeze your credit once your accounts are secure. You have to get in touch with each credit bureau (Experian, TransUnion and Equifax) to unfreeze your credit with them.

How long does Equifax freeze last

An initial (one-year) fraud alert can be placed if you believe you are or may become a victim of fraud or identity theft. The fraud alert lasts for one year. If you want to keep it active on your credit reports, you'll need to renew it after that time.

How often can I unfreeze my credit

It's free to freeze and unfreeze your credit report as often as you like. Ultimately, freezing your credit adds an extra layer of security to your identity and accounts.

Do I need to unfreeze all three credit bureaus

You have to unfreeze your credit at all three credit bureaus individually, unless you know which credit bureau a creditor is using for credit checks and choose to lift your freeze at just that one.

How do I unlock all 3 credit reports

You can unfreeze your credit report at each of the three bureaus—Experian, TransUnion and Equifax—online through your accounts, over the phone or by mailing the correct documentation.

Do I have to unfreeze all three credit bureaus to apply for credit card

If you're looking to apply for a loan or credit card, you will need to unfreeze your credit report. You'll have to unfreeze your credit report individually with each credit bureau. However, if you know which bureau a creditor is using, you can just unfreeze that one.

Does locking your credit hurt your credit score

A credit freeze won't have any impact on your credit score, nor will it impact your current credit accounts. While a credit freeze won't affect your credit score in any way, it will impact your ability to qualify for a loan or credit card unless you thaw your credit file before submitting your application.

Do I need to call all 3 credit bureaus to unfreeze my credit

You have to unfreeze your credit at all three credit bureaus individually, unless you know which credit bureau a creditor is using for credit checks and choose to lift your freeze at just that one.

Can you unfreeze your credit anytime

You must contact all three credit bureaus to freeze your credit. However, credit freezes are free, you can lift them at any time, and they don't affect your credit score.

How long does it take to unfreeze Equifax

Freezing and unfreezing your credit can be done as often as you like, but keep in mind that it can take up to an hour for each process to occur.

How do I unfreeze all 3 credits

You can't unfreeze at all three with a single action. You'll have to unfreeze your credit with each credit bureau individually. How do I unfreeze my credit You can unfreeze and freeze your credit reports online or by mail, or by calling each credit bureau.

What is a major downside of locking your credit

A freeze can give you a false sense of security — you may still be susceptible to credit fraud or other fraud involving your Social Security number. A credit freeze won't affect your current accounts, but if a thief steals the information on an existing account, your credit may be used without your permission.

How long should I keep my credit locked

How long does a credit lock last As with a credit freeze, your credit lock will remain until you ask the credit bureaus to remove it, either temporarily or permanently. For the best protection, keep your credit lock in place until you are ready to apply for a credit card or loan.