How to Prevent Identity Theft if Someone has Your Social Security Number

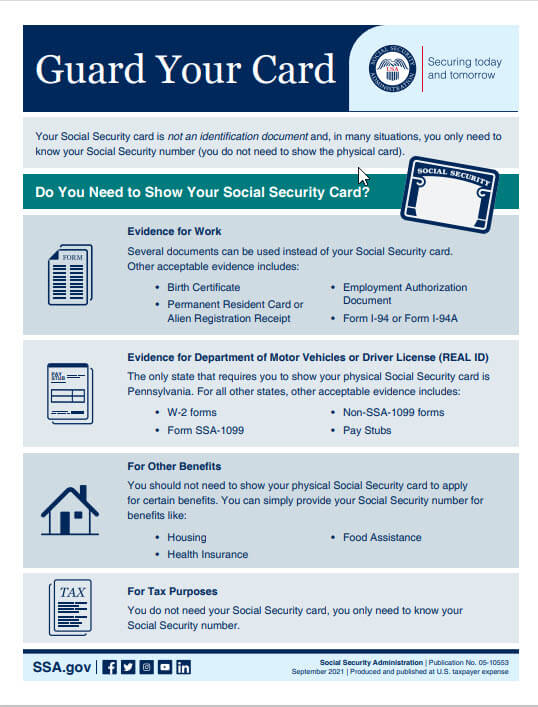

1. Do not routinely carry your SSN. Avoid carrying your Social Security number with you unless absolutely necessary.

2. Never say your SSN aloud in public. Be cautious when discussing or providing your Social Security number, especially in public places.

3. Beware of phishing scams. Stay vigilant and be cautious of emails, internet links, and phone calls that may be attempting to trick you into revealing personal information.

How Much Does it Cost to Lock Your Social Security Number?

To lock your Social Security number, you can write to the three major credit bureaus (Experian, TransUnion, and Equifax). There may be a nominal fee of approximately $10 to process the request.

How Can I Check to See if Someone is Using my Social Security Number?

If you suspect that someone is using your Social Security number for unauthorized purposes, you can contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit their website for further assistance.

How Do I Keep my Social Security Number Secure?

1. Offer an alternative form of ID. Whenever possible, provide an alternative form of identification instead of your Social Security number.

2. Ask why they want it and how it will be handled. Before providing your Social Security number, inquire about why it is needed and how it will be protected.

3. Leave your card at home. Avoid carrying your Social Security card with you on a daily basis.

4. Shred mail and documents with personal details. Dispose of any documents that contain personal information, such as bank statements, utility bills, or medical records, by shredding them.

5. Don’t use your SSN as a password. Avoid using your Social Security number as a password for online accounts or any other purpose.

6. Don’t send your SSN via an electronic device. Avoid transmitting your Social Security number through email or other electronic means, as it may be intercepted by unauthorized individuals.

7. Don’t give it out to strangers. Be cautious when sharing your Social Security number and only provide it to trusted individuals or organizations.

Can I Lock My Social Security Number Online?

Self Lock is a unique feature that allows you to protect your identity in E-Verify and Self Check by placing a “lock” on your Social Security number. This prevents anyone else from using your SSN for an E-Verify case.

Can I Check to See if My Social Security Number has been Compromised?

If you suspect that your Social Security number has been used fraudulently, you can check your credit report for any suspicious activity. Your credit report is usually the first place where fraudulent activity related to your SSN can appear.

Can Someone Open a Credit Card in My Name Without My Social Security Number?

In order to open a credit card in your name, an identity thief would typically need access to personal details such as your name, birthdate, and Social Security number. However, it is important to note that doing so is a federal crime. If caught, the thief may face jail time.

How Bad is it if Your Social Security Number is Stolen?

If someone obtains your Social Security number, they can potentially use it to gain access to other personal information about you. This can lead to various forms of identity theft and financial fraud, causing significant harm and inconvenience.

How to prevent identity theft if someone has your Social Security number

There are several things you should do to prevent identity theft:Do not routinely carry your SSN.Never say your SSN aloud in public.Beware of phishing scams (emails, internet links, and phone calls) trying to trick you into revealing personal information.

Cached

How much does it cost to lock your Social Security number

In addition, Adam Funk suggests writing to the three major credit bureaus — Experian, TransUnion, and Equifax — to lock your Social Security number. There may be a nominal fee of about $10 to process the request.

How can I check to see if someone is using my Social Security number

Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

How do I keep my SSN secure

How to Protect Your SSNOffer an Alternative Form of ID.Ask Why They Want It and How It Will Be Handled.Leave Your Card at Home.Shred Mail and Documents With Personal Details.Don't Use Your SSN as a Password.Don't Send Your SSN via an Electronic Device.Don't Give It out to Strangers.

Cached

Can I lock my SSN online

Self Lock is the unique feature that lets you protect your identity in E-Verify and Self Check by placing a "lock" in E-Verify on your Social Security number (SSN). This helps prevent anyone else from using your SSN for an E-Verify case.

Can I check to see if my SSN has been compromised

Check Your Credit Report.

If someone has used your SSN to apply for a credit card or a loan or open other accounts in your name, your credit report is the first place the activity can appear.

Can someone open a credit card in my name without my Social Security number

An identity thief would have to obtain personal details such as your name, birthdate and Social Security number in order to open a credit card in your name. However, it is a federal crime to do this, and it can result in jail time when the thief is caught for their behavior.

How bad is it if your Social Security number is stolen

A dishonest person who has your Social Security number can use it to get other personal information about you. Identity thieves can use your number and your good credit to apply for more credit in your name. Then, when they use the credit cards and don't pay the bills, it damages your credit.

How do I check to see if someone is using my social security number to file taxes

Know the Signs of Identity TheftYou get a letter from the IRS inquiring about a suspicious tax return that you did not file.You can't e-file your tax return because of a duplicate Social Security number.You get a tax transcript in the mail that you did not request.

How can I find out if someone is using my identity

Warning signs of ID theftBills for items you did not buy.Debt collection calls for accounts you did not open.Information on your credit report for accounts you did not open.Denials for loan applications.Mail stops coming to – or is missing from – your mailbox.

Does LifeLock protect Social Security number

Yes, LifeLock protects your Social Security number and other sensitive data. To do so, it monitors your social media accounts, the websites you visit, your financial accounts, and other places that have your personal information for indications that your identity may have been stolen.

Can you change your SSN due to identity theft

If you decide to apply for a new number, you'll need to prove your identity, age, and U.S. citizenship or immigration status. For more information, ask for Your Social Security Number and Card (Publication Number 05-10002). You'll also need to provide evidence that you're having ongoing problems because of the misuse.

How do I find out if a credit card has been opened in my name

The best way to find out if someone has opened an account in your name is to pull your own credit reports to check. Note that you'll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

How do I stop someone from filing my taxes in my name

Get your personal identification number (PIN) early.

If you know you'll be filing electronically, go to the IRS.gov website and get your electronic filing personal identification number (PIN) number. Once you have your PIN, no one else can file under your name without it.

What are the first signs of identity theft

8 Warning Signs of Identity TheftUnrecognized bank or credit card transactions.Unfamiliar inquiries on your credit report.Unexpected bills or statements.Unexpected lack of bills or statements.Surprise credit score drop.Denial of loan or credit applications.Calls from debt collectors.

Can you check if your identity has been compromised

Check your credit reports to find evidence of fraud. You can get free credit reports from annualcreditreport.com or directly from the credit bureaus. Examine the credit reports closely for inaccurate, incomplete, or suspicious information. Place a fraud alert on your credit reports.

What is the downside of LifeLock

Downsides. Only one credit bureau is monitored with the first three plans. You have to pony up and pay for the most expensive plan to monitor all three credit bureaus. Since not all companies report to all three bureaus, there could be fraud that you're not made aware of.

How much does LifeLock cost per month

LifeLock's Subscription Options

| Pricing | LifeLock Standard | LifeLock Ultimate Plus |

|---|---|---|

| Monthly price | $8.99 | $23.99 |

| Can it be bundled with Norton 360 | No | Yes |

| Monthly price with Norton 360 | n/a | $29.99 |

| Yearly price with Norton 360 | n/a | $299.88 |

Apr 12, 2023

Are you allowed to change your SSN

To request a different Social Security number, contact your local Social Security office for an in-person appointment.

How do I find out if someone opened a bank account in my name

How to find out if bank accounts are fraudulently opened in your name. If scammers open bank accounts in your name, you may be able to find out about it by taking a look at your checking account reports. These consumer reports include information about people's banking and check-writing history.

How can I find out if someone is using my name

What you can do to detect identity theftTrack what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address.Review your bills.Check your bank account statement.Get and review your credit reports.

What to do if someone already filed taxes in your name

Take Action if You Are a VictimRespond immediately to any IRS notice: Call the number provided.If your e-filed return is rejected because of a duplicate filing under your Social Security number, or if the IRS instructs you to do so, complete IRS Form 14039, Identity Theft AffidavitPDF.

What are three 3 warning signs of identity theft

8 Warning Signs of Identity TheftUnrecognized bank or credit card transactions.Unfamiliar inquiries on your credit report.Unexpected bills or statements.Unexpected lack of bills or statements.Surprise credit score drop.Denial of loan or credit applications.Calls from debt collectors.

What are 3 steps to take after identity has been stolen

If you suspect you may be a victim of identity theft, complete these tasks as soon as possible and document everything you do.Call your bank and other companies where fraud occurred.Contact a credit agency to place a fraud alert.Create an Identity Theft Affidavit.File a report with your local police department.

What are 3 steps you should take if you believe your identity has been compromised

Contact your police department, report the crime and obtain a police report. Decide whether you want to place a security freeze on your credit report.