nk account There is no limit to the number of times a creditor can freeze your bank account. If you owe a debt and the creditor obtains a court judgment, they can continue to freeze your account until the debt is paid off.

Cached[/wpremark]

Can a creditor garnish a joint bank account Yes, a creditor can garnish a joint bank account. If you have a joint account with someone who owes a debt, the creditor can take money from that account to satisfy the debt, even if you are not the one who owes the debt.

Cached

Can a creditor garnish my bank account without a judgment In some situations, a creditor may be able to garnish your bank account without a judgment. For example, if you owe certain debts to the government, such as unpaid taxes or child support, federal law allows for garnishment without a court judgment.

Cached

Can a creditor garnish a business bank account Yes, if you owe a debt as a business owner, a creditor may be able to garnish your business bank account. However, the rules for garnishing a business account may differ from those for personal accounts, so it’s important to consult with a legal professional for guidance.

Cached

Can a creditor garnish a savings account Yes, a creditor can garnish a savings account if you owe a debt. They can legally take money from your savings account to satisfy the debt, just like they can with a checking account.

Cached

Can a creditor garnish your bank account without a court order In most cases, a creditor needs to obtain a court order in order to garnish your bank account. However, there are exceptions for certain debts, such as unpaid taxes or child support, where federal or state laws allow for garnishment without a court order.

Cached

Can a creditor garnish unemployment benefits Unemployment benefits are generally exempt from garnishment. However, it’s important to note that if you deposit your unemployment benefits into a bank account and co-mingle those funds with other funds, they may no longer be protected from garnishment.

Cached

Can a creditor garnish a prepaid debit card Yes, a creditor may be able to garnish funds on a prepaid debit card if you owe a debt. Prepaid debit cards are not typically protected from garnishment like certain federal benefits, so if you owe a debt, the creditor may seek to garnish the funds on the card.

Cached

Can a creditor garnish a trust bank account Depending on the terms of the trust and the nature of the debt, a creditor may be able to garnish funds in a trust bank account. It’s important to consult with a legal professional to understand the specific laws and regulations regarding trust accounts and garnishment in your jurisdiction.

Cached

Can a creditor garnish a retirement account In most cases, retirement accounts are protected from garnishment by federal law. However, there are exceptions, such as if you owe back taxes to the IRS or if the retirement account was improperly funded. It’s important to consult with a legal professional for guidance if you have concerns about garnishment of your retirement account.

Cached

Can a creditor garnish a foreign bank account It is possible for a creditor to garnish funds in a foreign bank account, depending on the laws and regulations of the country where the account is held. If you have a foreign bank account and owe a debt, it’s important to consult with a legal professional familiar with international debt collection laws to understand your rights and options.

Cached

Can a creditor garnish a business account for personal debt In some cases, if you have personal debt and you operate a business, a creditor may be able to garnish your business bank account to satisfy the personal debt. The specific rules and regulations regarding garnishment of business accounts for personal debt can vary, so it’s important to consult with a legal professional for guidance.

Cached

Can a creditor garnish a joint account if one person owes a debt Yes, if one person on a joint account owes a debt, a creditor may be able to garnish the funds in that account. It’s important to note that the other account holder who does not owe the debt may need to take steps to protect their share of the funds. Consulting with a legal professional is advisable in this situation.

Cached

Can a creditor garnish a trust account for personal debt It is possible for a creditor to garnish funds in a trust account if you owe a personal debt. However, there may be legal protections in place depending on the type of trust and the laws of your jurisdiction. It’s important to consult with a legal professional for advice specific to your situation.

Cached

[h2]Summary:[/h2]

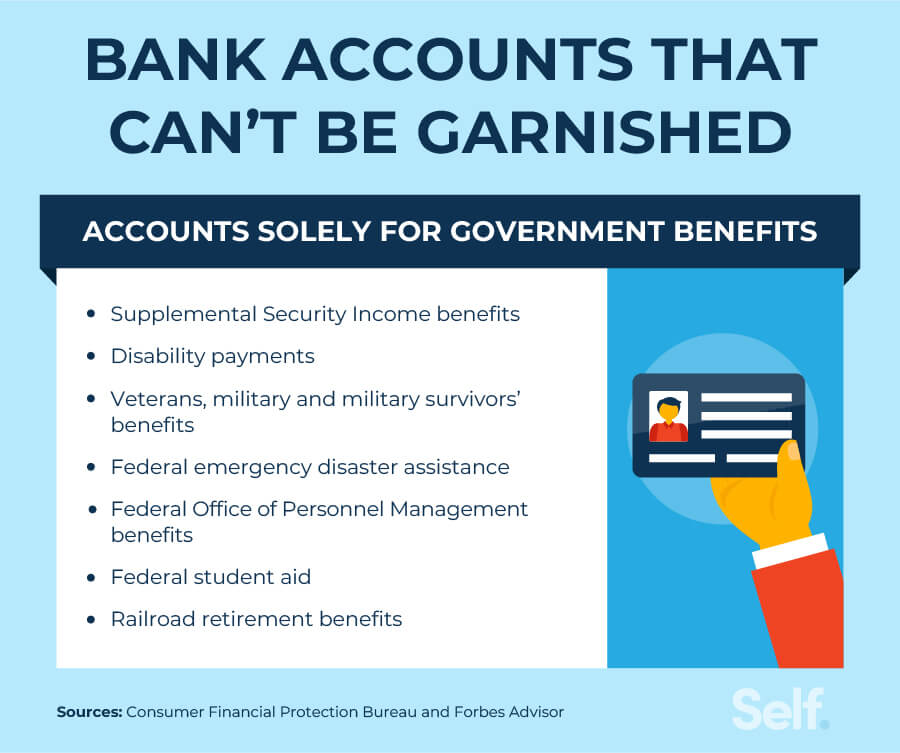

[first][strong]Bank accounts solely for government benefits[/strong]: Federal law ensures that creditors cannot touch certain federal benefits, such as Social Security funds and veterans’ benefits. If you’re receiving these benefits, they would not be subject to garnishment.[/first]

[second][strong]If a debt collector has a court judgment[/strong], then it may be able to garnish your bank account or wages. Certain debts owed to the government may also result in garnishment, even without a judgment.[/second]

[third][strong]A judgment creditor does not have to give you specific notice[/strong] before freezing your bank account. However, a creditor or debt collector is required to notify you (1) that it has filed a lawsuit against you; and (2) that it has obtained a judgment against you.[/third]

[fourth][strong]Creditors may be able to garnish a bank account[/strong] (also referred to as levying the funds in a bank account) that you own jointly with someone else who is not your spouse. A creditor can take money from your joint savings or checking account even if you don’t owe the debt.[/fourth]

[fifth][strong]Bank garnishment is legal in all 50 states[/strong]. However, four states prohibit wage garnishment for consumer debts. According to Debt.org, those states are Texas, South Carolina, Pennsylvania, and North Carolina.[/fifth]

[sixth][strong]If you are struggling with debt and debt collectors[/strong], Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase “please cease and desist all calls and contact with me immediately” to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.[/sixth]

[seventh][strong]A judgment creditor cannot see your online account balances[/strong]. But a creditor can ascertain account balances using post-judgment discovery. The judgment creditor can subpoena a bank for bank statements or other records which reveal a typical balance in the account.[/seventh]

[eighth][strong]There is no limit to the number of times a creditor can freeze your bank account[/strong]. If you owe a debt and the creditor obtains a court judgment, they can continue to freeze your account until the debt is paid off.[/eighth]

[ninth][strong]Yes, a creditor can garnish a joint bank account[/strong]. If you have a joint account with someone who owes a debt, the creditor can take money from that account to satisfy the debt, even if you are not the one who owes the debt.[/ninth]

[tenth][strong]In some situations, a creditor may be able to garnish your bank account without a judgment[/strong]. For example, if you owe certain debts to the government, such as unpaid taxes or child support, federal law allows for garnishment without a court judgment.[/tenth]

[h2]Questions:[/h2]

[first][strong]1. What type of bank accounts cannot be garnished?[/strong]

Bank accounts solely for government benefits cannot be garnished.[/first]

[second][strong]2. Can a creditor take all money from my bank account?[/strong]

If a debt collector has a court judgment, then it may be able to garnish your bank account or wages.[/second]

[third][strong]3. Can a creditor freeze my bank account without notifying me?[/strong]

No. A judgment creditor does not have to give you specific notice before freezing your bank account. However, a creditor or debt collector is required to notify you (1) that it has filed a lawsuit against you; and (2) that it has obtained a judgment against you.[/third]

[fourth][strong]4. Can a creditor take money from a joint bank account?[/strong]

Creditors may be able to garnish a bank account (also referred to as levying the funds in a bank account) that you own jointly with someone else who is not your spouse. A creditor can take money from your joint savings or checking account even if you don’t owe the debt.[/fourth]

[fifth][strong]5. What states completely prohibit creditor garnishments of bank accounts?[/strong]

Bank garnishment is legal in all 50 states. However, four states prohibit wage garnishment for consumer debts. Those states are Texas, South Carolina, Pennsylvania, and North Carolina.[/fifth]

[sixth][strong]6. What is the 11-word phrase to stop debt collectors?[/strong]

The 11-word phrase is “please cease and desist all calls and contact with me immediately.”[/sixth]

[seventh][strong]7. Do creditors watch your bank account?[/strong]

A judgment creditor cannot see your online account balances. But a creditor can ascertain account balances using post-judgment discovery.[/seventh]

[eighth][strong]8. How many times can a creditor freeze your bank account?[/strong]

There is no limit to the number of times a creditor can freeze your bank account.[/eighth]

[ninth][strong]9. Can a creditor garnish a joint bank account?[/strong]

Yes, a creditor can garnish a joint bank account if one person owes a debt.[/ninth]

[tenth][strong]10. Can a creditor garnish your bank account

What type of bank accounts Cannot be garnished

Bank accounts solely for government benefits

Federal law ensures that creditors cannot touch certain federal benefits, such as Social Security funds and veterans' benefits. If you're receiving these benefits, they would not be subject to garnishment.

Cached

Can a creditor take all money from my bank account

If a debt collector has a court judgment, then it may be able to garnish your bank account or wages. Certain debts owed to the government may also result in garnishment, even without a judgment.

Cached

Can a creditor freeze my bank account without notifying me

No. A judgment creditor does not have to give you specific notice before freezing your bank account. However, a creditor or debt collector is required to notify you (1) that it has filed a lawsuit against you; and (2) that it has obtained a judgment against you.

Cached

Can a creditor take money from a joint bank account

Creditors may be able to garnish a bank account (also referred to as levying the funds in a bank account) that you own jointly with someone else who is not your spouse. A creditor can take money from your joint savings or checking account even if you don't owe the debt.

What states completely prohibit creditor garnishments of bank accounts

Bank garnishment is legal in all 50 states. However, four states prohibit wage garnishment for consumer debts. According to Debt.org, those states are Texas, South Carolina, Pennsylvania, and North Carolina.

What is the 11 word phrase to stop debt collectors

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase “please cease and desist all calls and contact with me immediately” to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

Do creditors watch your bank account

Can debt collectors see your bank account balance A judgment creditor cannot see your online account balances. But a creditor can ascertain account balances using post-judgment discovery. The judgment creditor can subpoena a bank for bank statements or other records which reveal a typical balance in the account.

How many times can a creditor freeze your bank account

A creditor can levy your bank account multiple times until the judgement is paid in full. In other words, you aren't safe from future levies just because a creditor already levied your account.

How can a creditor wipe your bank account without notice

A creditor does not need to tell you if your bank account is frozen after securing a judgment against you for unpaid debt. However, a creditor must notify you when it files a lawsuit against you and when it has received a judgment against you.

How much money is protected in a joint bank account

The best way to work out the protection that applies is to know that the FSCS considers that half the money in the account belongs to each person.

What is the most a creditor can garnish

Limitations on the Amount of Earnings that may be Garnished (General)

| Weekly | Biweekly | Monthly |

|---|---|---|

| $290.00 or more: MAXIMUM 25% | $580.00 or more: MAXIMUM 25% | $1,256.66 or more: MAXIMUM 25% |

What bank accounts Cannot be frozen

Certain types of income cannot be garnished or frozen in a bank account. Foremost among these are federal and state benefits, such as Social Security payments. Not only is a creditor forbidden from taking this money through garnishment, but, after it has been deposited in an account, a creditor cannot freeze it.

What is the 777 rule with debt collectors

One of the most rigorous rules in their favor is the 7-in-7 rule. This rule states that a creditor must not contact the person who owes them money more than seven times within a 7-day period. Also, they must not contact the individual within seven days after engaging in a phone conversation about a particular debt.

What is a drop dead letter

You have the right to send what's referred to as a “drop dead letter. '' It's a cease-and-desist motion that will prevent the collector from contacting you again about the debt. Be aware that you still owe the money, and you can be sued for the debt.

What type of bank accounts are protected from creditors

In many states, some IRS-designated trust accounts may be exempt from creditor garnishment. This includes individual retirement accounts (IRAs), pension accounts and annuity accounts. Assets (including bank accounts) held in what's known as an irrevocable living trust cannot be accessed by creditors.

Can you open a new bank account if your account is frozen

But in the meantime, if your account is frozen or might be, we recommend that you open a new bank account at a new bank where you don't owe any money. Notify your employer to deposit your paycheck into this new account. Move any money from your old account to your new account.

Does freezing bank account stop payments

As noted above, a frozen account likely means you won't have access to your money until the situation is resolved. You can't take out cash, and scheduled payments won't go through.

How do you hide your money from debt collectors

Seven Ways to Protect Your Assets from Litigation and CreditorsPurchase Insurance. Insurance is crucial as a first line of protection against speculative claims that could endanger your assets.Transfer Assets.Re-Title Assets.Make Retirement Plan Contributions.Create an LLC or FLP.Set Up a DAPT.Create an Offshore Trust.

Does FDIC cover $500000 on a joint account

Each co-owner of a joint account is insured up to $250,000 for the combined amount of his or her interests in all joint accounts at the same IDI.

What to do if you have more than 250k in the bank

Open an account at a different bank.Add a joint owner.Get an account that's in a different ownership category.Join a credit union.Use IntraFi Network Deposits.Open a cash management account.Put your money in a MaxSafe account.Opt for an account with both FDIC and DIF insurance.

How do creditors find your bank accounts

Creditors and debt collectors can find your bank accounts through your previous payment records, credit applications, skip tracers, and information subpoenas. Most of the time, the creditor must obtain a court order before garnishing your bank accounts, but this isn't the case for some government entities.

Does garnish affect credit score

A garnishment judgment will stay on your credit reports for up to seven years, affecting your credit score.

Can my wife’s bank account be garnished for my debt

The relevant information to focus on here is that California is a community property state, which means that legally married couples jointly own everything – including debt. As a result, it is possible for a creditor to garnish a spouse's bank account if their spouse owes a debt.

What happens if debt collector Cannot validate debt

What Happens Now If a debt collector can't verify your debt, then they must stop contacting you about it. And they have to let credit bureaus know so they can remove the debt from your credit report.

How do you change bank accounts to avoid garnishment

Opening a Bank Account That No Creditor Can Touch. There are four ways to open a bank account that no creditor can touch: (1) use an exempt bank account, (2) establish a bank account in a state that prohibits garnishments, (3) open an offshore bank account, or (4) maintain a wage or government benefits account.