e, it will likely show up on your credit report. You can request a free copy of your credit report from each of the three major credit bureaus – Experian, Equifax, and TransUnion – once every 12 months through AnnualCreditReport.com. Review the report carefully for any unfamiliar accounts or suspicious activity.

Additionally, you may receive notifications or alerts from financial institutions or credit monitoring services if they detect any unusual activity associated with your Social Security number. These alerts can include notifications of new accounts opened in your name, changes to your personal information, or requests for credit in your name.

Another way to check if your SSN is compromised is to monitor your bank and credit card statements regularly for any unauthorized transactions. If you notice any suspicious activity, contact your financial institution immediately.

It’s important to note that checking your credit report and monitoring your accounts alone may not be sufficient to determine if your SSN has been compromised. It’s advisable to also monitor your personal information such as address changes, unauthorized inquiries on your credit report, or notifications from the IRS regarding taxes filed using your SSN.

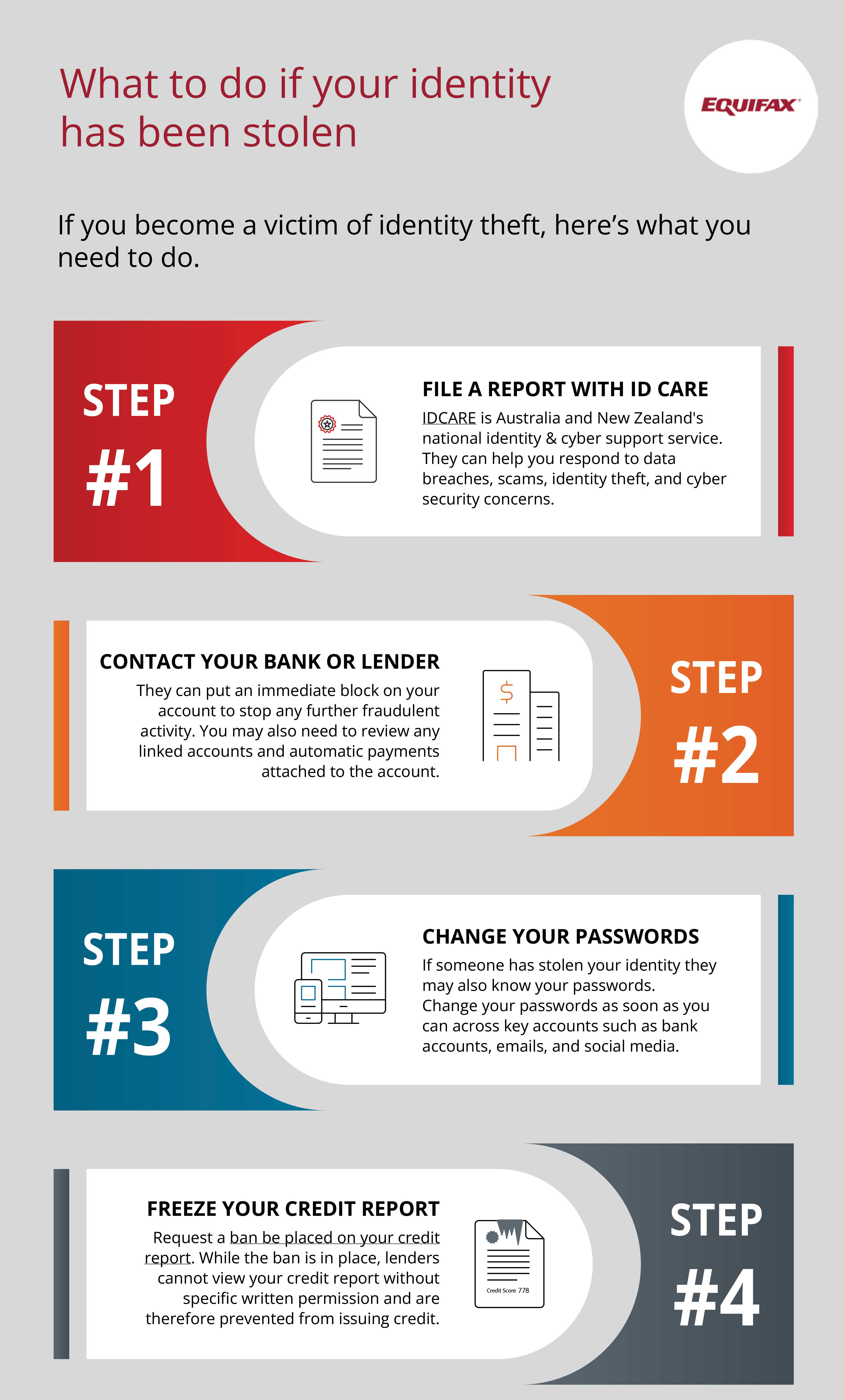

If you suspect that your SSN has been compromised, it’s crucial to take immediate action to protect yourself. Here are three steps you should consider:

1. Place a fraud alert or security freeze: Contact one of the three major credit bureaus (Experian, Equifax, or TransUnion) to place a fraud alert on your credit report. This alert notifies potential creditors to verify your identification before granting credit in your name. Alternatively, you can opt for a security freeze, which restricts access to your credit report, making it difficult for potential identity thieves to open new accounts in your name.

2. Report the incident to the authorities: Contact your local police department and file a report detailing the identity theft. Obtain a copy of the police report as it may be required when dealing with creditors, banks, or other institutions.

3. Notify the appropriate organizations: Contact your bank, credit card issuers, and any other financial institutions where you have accounts to inform them of the situation. They can assist you in monitoring your accounts for fraudulent activity or guide you on the necessary steps to resolve any issues.

Remember, these steps are just a starting point, and it’s important to be vigilant and proactive in protecting your personal information. Regularly monitoring your credit reports, reviewing your financial statements, and maintaining strong security practices can significantly reduce the risk of identity theft and minimize the potential consequences.

How do I notify Equifax of identity theft

You can also call Equifax at (800) 525-6285 or send a request by mail to place a fraud alert or active duty alert. Download this form for instructions and mailing address.

Cached

How do you find out if your identity has been stolen

Warning signs of ID theftBills for items you did not buy.Debt collection calls for accounts you did not open.Information on your credit report for accounts you did not open.Denials for loan applications.Mail stops coming to – or is missing from – your mailbox.

CachedSimilar

How do I check to see if someone is using my Social Security number for free

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

What is Equifax identity alert

Identity monitoring means you will be notified if Equifax discovers your personal information is being illegally traded online. You can also place a ban on your Credit Report to help prevent fraudulent accounts being opened in your name.

How can I find out if someone opened an account in my name

The best way to find out if someone has opened an account in your name is to pull your own credit reports to check. Note that you'll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

What are 3 steps you should take if you believe your identity has been compromised

Contact your police department, report the crime and obtain a police report. Decide whether you want to place a security freeze on your credit report.

How do you check if my SSN is being used

To see if someone's using your SSN, check your credit report. You can check it online through AnnualCreditReport.com, the only authorized website for free credit reports. Or you can call their phone number at 1-877-322-8228 to request your free copy.

How do I know if my SSN is compromised

Check Your Credit Report.

If someone has used your SSN to apply for a credit card or a loan or open other accounts in your name, your credit report is the first place the activity can appear. Look for accounts you don't recognize or credit applications you never submitted.

How does Equifax verify identity

Equifax Identity Proofing is an Internet-based service that authenticates an applicant's identity by presenting multiple-choice questions to the applicant that should only be known by that actual person.

How do I find out if someone is applying for credit in my name

The best way to find out if someone has opened an account in your name is to pull your own credit reports to check. Note that you'll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

Can someone open an account in your name without you knowing

This person may be the actual fraudster or someone the criminal has manipulated into acting as a front for the fraud. The accounts are then used to either launder money or commit future fraud. Criminals use stolen credentials and personal data to open accounts in the names of individuals without their knowledge.

Can you check if your identity has been compromised

Check your credit reports to find evidence of fraud. You can get free credit reports from annualcreditreport.com or directly from the credit bureaus. Examine the credit reports closely for inaccurate, incomplete, or suspicious information. Place a fraud alert on your credit reports.

What is the most common method used to steal your identity

Physical Theft: examples of this would be dumpster diving, mail theft, skimming, change of address, reshipping, government records, identity consolidation. Technology-Based: examples of this are phishing, pharming, DNS Cache Poisoning, wardriving, spyware, malware and viruses.

Can I check my SSN status online

On the My Home page scroll down to the Your Benefit Applications section and select View Details under the More Info heading. View your application status in the Current Status section. Check the status of your Social Security application online today!

How do I check my SSN for theft

You may reach the FTC's identity theft hotline toll free at 1-877-IDTHEFT (1-877-438-4338) or visit their website at www.ftc.gov/idtheft.

How long does it take for Equifax to verify

If you file a dispute regarding information on your Equifax credit report, you can generally expect to receive the results of the investigation within 30 days. If the information on your credit report is found to be inaccurate or incomplete, your credit report will be updated, generally within about 30 days.

Can someone steal your identity if they know your credit score

Can Someone Steal Your Identity with Your Credit Report Your credit report contains a lot of personal information, so it's a goldmine for identity thieves. With a copy of your report in hand, a potential fraudster might be able to see: Full name.

Can someone take out a loan in my name without me knowing

If anyone, including a spouse, family member, or intimate partner, uses your personal information to open up an account in your name without your permission, this could be considered identify theft.

How to find out if someone is opening accounts in your name

The best way to find out if someone has opened an account in your name is to pull your own credit reports to check. Note that you'll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

How can I tell if someone opened a checking account in my name

How to find out if bank accounts are fraudulently opened in your name. If scammers open bank accounts in your name, you may be able to find out about it by taking a look at your checking account reports. These consumer reports include information about people's banking and check-writing history.

What are the first signs of identity theft

8 Warning Signs of Identity TheftUnrecognized bank or credit card transactions.Unfamiliar inquiries on your credit report.Unexpected bills or statements.Unexpected lack of bills or statements.Surprise credit score drop.Denial of loan or credit applications.Calls from debt collectors.

What are 3 steps to take after identity has been stolen

If you suspect you may be a victim of identity theft, complete these tasks as soon as possible and document everything you do.Call your bank and other companies where fraud occurred.Contact a credit agency to place a fraud alert.Create an Identity Theft Affidavit.File a report with your local police department.

How can I see if my SSN is being used

To see if someone's using your SSN, check your credit report. You can check it online through AnnualCreditReport.com, the only authorized website for free credit reports. Or you can call their phone number at 1-877-322-8228 to request your free copy.

How can I see what my SSN was used for

Check Your Social Security Statement.

The statement also shows if withdrawals have been taken against your earnings, indicating that someone is using your SSN to claim your benefits (unless those withdrawals are yours).

How do you check if my SSN has been used

To see if someone's using your SSN, check your credit report. You can check it online through AnnualCreditReport.com, the only authorized website for free credit reports. Or you can call their phone number at 1-877-322-8228 to request your free copy.