now about the scam. The bank will investigate the situation and determine if you are eligible for a refund. However, it is important to note that each case is different and the outcome may vary. It is always best to report the scam as soon as possible to increase your chances of getting a refund. Additionally, make sure to provide all the necessary documentation and information to support your claim.

Can I get my money back if I transfer it to the wrong account number If you have accidentally transferred money to the wrong account number, it can be challenging to get a refund. However, you should contact your bank immediately and explain the situation. They may be able to assist you in contacting the recipient’s bank and requesting a reversal of the transaction. Keep in mind that the success of this process depends on various factors, such as the recipient’s cooperation and the time elapsed since the transaction took place. It is essential to act quickly to have the best chance of recovering your funds.

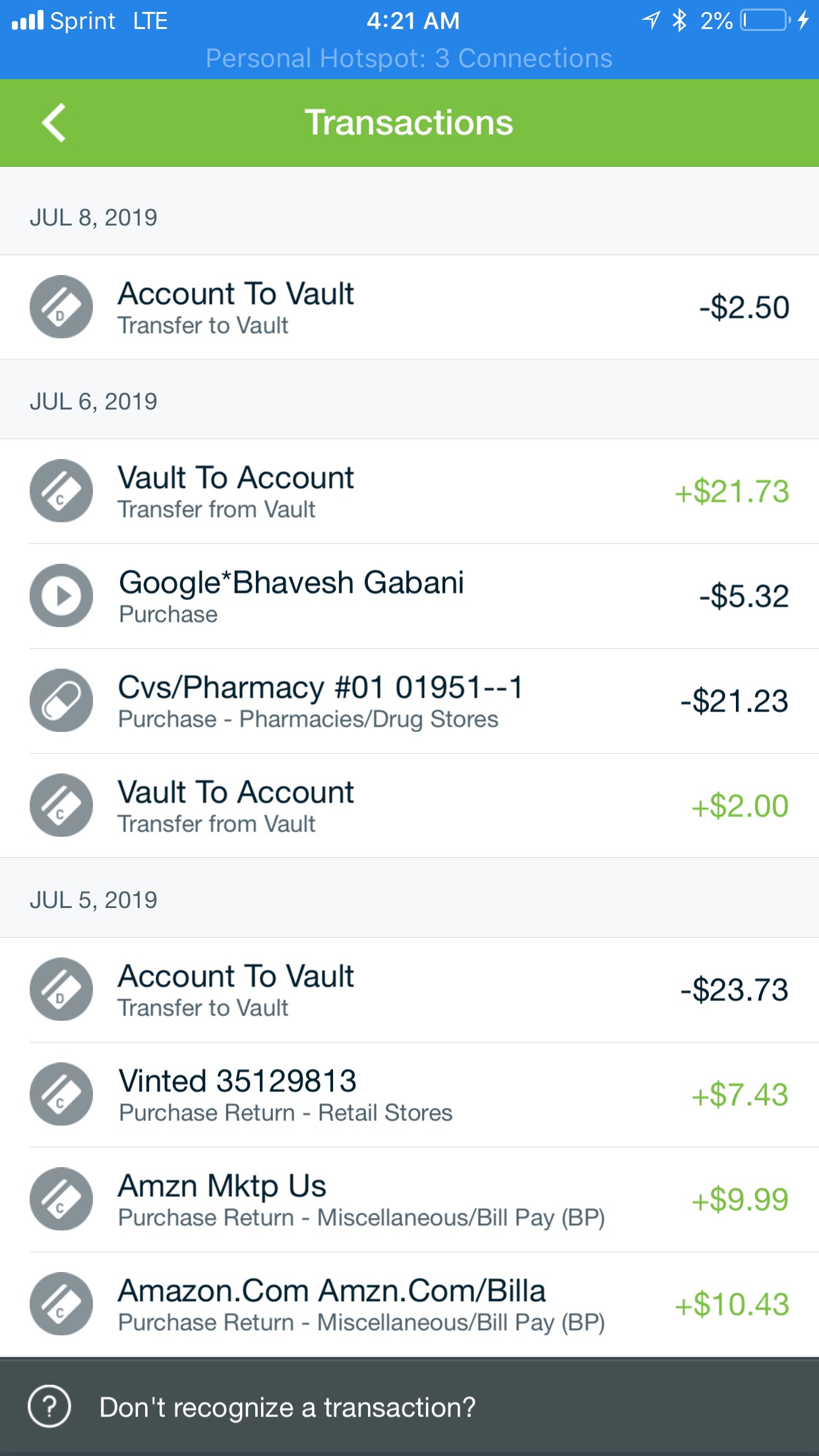

How long does it take to get a refund from a bank investigation The duration of a bank investigation can vary depending on the complexity of the case. In some instances, it may take a few weeks, while in others, it could take several months. During this time, the bank will gather evidence, review transaction details, and assess the validity of the claim. It is important to be patient and cooperate with the bank throughout the investigation process. Can I get a refund if I paid by debit card Yes, you may be eligible for a refund if you made the payment using a debit card. The exact process may vary depending on your bank’s policies, but you should contact them as soon as possible to report the unauthorized transaction. Provide them with all the relevant details and documentation to support your claim. Banks typically have specific timeframes within which you need to report the issue to qualify for a refund. It is crucial to act swiftly and follow the instructions provided by your bank. How can I protect myself from unauthorized transactions There are several steps you can take to protect yourself from unauthorized transactions:1. Regularly review your bank statements and transaction history to identify any suspicious activity.

2. Keep your personal and financial information secure. Avoid sharing sensitive details through insecure channels or with unknown individuals.

3. Use strong and unique passwords for your online banking accounts and avoid using the same password for multiple platforms.

4. Enable two-factor authentication for an added layer of security.

5. Be cautious when providing your card details online and only use reputable and secure websites.

6. Monitor your credit reports regularly to detect any fraudulent accounts opened in your name.

7. Consider using virtual cards for online purchases, as they provide an extra layer of security.

8. Install up-to-date antivirus software on your devices to protect against malware and phishing attempts.

9. Be wary of unsolicited calls, emails, or messages asking for your personal or financial information.

10. If you suspect any unauthorized activity, report it to your bank immediately.

1. Double-check the bank’s policies and guidelines to ensure that your claim falls within their refund eligibility criteria.

2. Gather all relevant documentation, such as receipts, transaction records, and any communication with the bank regarding the dispute.

3. Contact the bank’s customer service department and escalate the issue. Clearly explain your case and provide all necessary evidence to support your claim.

4. If the issue remains unresolved, you can file a complaint with the bank’s regulatory authority or ombudsman. They will review the case impartially and help mediate between you and the bank.

5. Consult a legal professional or seek advice from a consumer rights organization if necessary.

Keep in mind that each bank has its own policies and procedures for handling disputed charges. It is essential to familiarize yourself with these policies and follow the appropriate channels to seek resolution.

Can I get my money back if I accidentally paid a scammer If you have accidentally paid a scammer, it can be challenging to recover the funds. However, you should immediately contact your bank to report the situation and provide them with all the relevant details. They may be able to assist you in blocking further transactions and potentially recovering the money. Additionally, you should also report the scam to the appropriate authorities, such as the police or your local fraud prevention agency. Cooperation with law enforcement agencies can increase the chances of apprehending the scammers and potentially retrieving the funds. What legal actions can I take against a scammer If you have been a victim of a scam, there are several legal actions you can take:1. Report the scam to your local law enforcement agency. They will investigate the matter and take appropriate action.

2. Gather all evidence related to the scam, such as emails, messages, receipts, and bank statements. This evidence will be crucial in supporting your case.

3. Consider consulting a lawyer specializing in fraud cases. They can provide legal advice and guide you through the process of taking legal action against the scammer.

4. File a complaint with the relevant consumer protection agencies or regulatory bodies.

5. Inform your bank and other financial institutions involved in the scam. They may have additional measures in place to assist victims and prevent further fraudulent transactions.

6. Share your experience with others to raise awareness and help prevent others from falling victim to the same scam.

Taking legal action against scammers can be a complex process, and the outcome may vary depending on various factors. It is essential to seek legal advice and follow the appropriate legal procedures in your jurisdiction.

Can I get my money back after unauthorized transaction

As per the RBI refund rules, if the fraud is reported within 3 days, no liability lies with the victim. If it is reported within 3-7 days, the bank refunds the transaction amount or the maximum liability amount (see table below), whichever is lower. If reported after 7 days, depends on the bank's policy.

Can a bank refuse to refund Unauthorised transaction

Your bank can only refuse to refund an unauthorised payment if: it can prove you authorised the payment. it can prove you acted fraudulently. it can prove you deliberately, or with 'gross negligence', failed to protect the details of your card, PIN or password in a way that allowed the payment.

How do I get a refund for unauthorized purchases

Contact your bank as soon as possible.

The longer you wait to report unauthorized purchases, the more liable you are for the costs. You limit your liability if you contact the bank within two business days.

Cached

Will banks refund stolen money

Your bank should refund any money stolen from you as a result of fraud and identity theft. They should do this as soon as possible – ideally by the end of the next working day after you report the problem.

Do banks actually investigate unauthorized transactions

Most banks make sure their customers don't have to pay a penny. After the bank receives the proper documents, they have 10 business days to investigate the claim and decide if it's fraudulent. Depending on the severity of the fraud, the bank may notify authorities–or even the FBI, though this rarely happens.

How long does it take to dispute an unauthorized transaction

The credit card issuer must acknowledge your dispute within 30 days, and you won't be responsible for paying the charge or interest that would accrue on the charge during the investigation.

Can I force a refund through my bank

The chargeback process lets you ask your bank to refund a payment on your debit card when a purchase has gone wrong. You should contact the seller first, as you cannot start a chargeback claim unless you have done this. Then, if you can't resolve the issue, get in touch with your bank.

Will the bank refund me if I get scammed

Contact your bank immediately to let them know what's happened and ask if you can get a refund. Most banks should reimburse you if you've transferred money to someone because of a scam.

How does the bank investigate an unauthorized payment

The customer makes a complaint regarding a transaction.An investigator examines the claim.The bank gathers evidence about the customer's claim.The investigator examines the transaction based on the customer's claim.The investigator makes a decision.

Do banks usually refund scammed money

Contact your bank immediately to let them know what's happened and ask if you can get a refund. Most banks should reimburse you if you've transferred money to someone because of a scam.

Can bank reverse a transaction if scammed

If you've bought something from a scammer

Your card provider can ask the seller's bank to refund the money. This is known as the 'chargeback scheme'. If you paid by debit card, you can use chargeback however much you paid.

Who pays for unauthorized transactions

You, the consumer, typically aren't liable for credit card fraud, but someone pays the tab. So who foots the bill when a thief uses your credit card or its number to illegally buy stuff The short answer is it's typically the merchant where you bought something or the bank that issued the credit card.

How long do banks investigate unauthorized transactions

Typically bank fraud investigations take up to 45 days.

Who pays when you dispute a charge

Who pays when you dispute a charge Your issuing bank will cover the cost initially by providing you with a provisional credit for the original transaction amount. After filing the dispute, though, they will immediately recover those funds (plus fees) from the merchant's account.

Do banks refund money if scammed

Contact your bank immediately to let them know what's happened and ask if you can get a refund. Most banks should reimburse you if you've transferred money to someone because of a scam.

How do banks investigate unauthorized transactions

Banks hire personnel, such as internal credit fraud investigators, who use electronic transaction trails and account-based rules to determine the origin of fraudulent transactions.

What do I tell my bank if I got scammed

If you gave the fraudster your bank account number or routing number, contact your bank or credit union immediately. You may need to close the account and open a new one. Social security number. Go ahead with a fraud alert or credit freeze and report your information stolen at the FTC's identitytheft.gov website.

Can you contact your bank if you have been scammed

If you've sent money or shared your banking details with a scammer, contact your financial institution immediately. They may be able to stop a transaction, or close your account if the scammer has your account details.

Do banks refund scammed money

Contact your bank immediately to let them know what's happened and ask if you can get a refund. Most banks should reimburse you if you've transferred money to someone because of a scam.

How long can a bank hold funds for suspicious activity

How Long Can a Bank Freeze an Account For There is no set timeline that banks have before they have to unfreeze an account. Generally, for simpler situations or misunderstandings the freeze can last for 7-10 days.

What to do if there is an unauthorized charge on debit card

A: Contact your bank immediately if you suspect unauthorized transactions on your debit card. If the transaction was made using a debit card or other electronic fund transfers, you may have additional protections under federal law.

Can I ask my bank to reverse a payment

The chargeback process lets you ask your bank to refund a payment on your debit card when a purchase has gone wrong. You should contact the seller first, as you cannot start a chargeback claim unless you have done this. Then, if you can't resolve the issue, get in touch with your bank.

What are the chances of getting money back after being scammed

Advocate, Supreme Court of India, Dr Pavan Duggal, said that victims losing money to bank frauds can get 90% of their money back in just 10 days. Most banks have an insurance policy against unauthorized transactions. Bank customers have to report an unauthorized transaction within three days to get up to full refund.

What happens if I dispute a charge and get a refund

A chargeback takes place when you contact your credit card issuer and dispute a charge. In this case, the money you paid is refunded back to you temporarily, at which point your card issuer will conduct an investigation to determine who is liable for the transaction.

Can I dispute a charge and get a refund

If you're not satisfied with the merchant's response, you may be able to dispute the charge with your credit card company and have the charge reversed. This is sometimes called a chargeback. Contact your credit card company to see whether you can dispute a charge.