=”chat_message_1_my” icon_show=”0″ background_color=”#e0f3ff” padding_right=”30″ padding_left=”30″ border_radius=”30″] How can I modify a credit report Unfortunately, you cannot directly modify the information on your credit report. The information on your credit report is provided by lenders, creditors, and other sources that have reported your credit activity to the credit bureaus. However, if you believe there is inaccurate or incomplete information on your credit report, you can dispute it with the credit bureaus to have it corrected or removed.[/wpremark]

How often should I check my credit report It is recommended to check your credit report at least once a year. This will help you identify any errors or suspicious activity and take appropriate actions to protect your credit. Additionally, if you are planning to apply for a loan or credit card, it is a good idea to check your credit report beforehand to ensure its accuracy and improve your chances of approval.

Can I get my credit report instantly Yes, if you request your credit report online at AnnualCreditReport.com, you should be able to access it immediately. However, if you request it by phone or mail, it might take some time to process and deliver your report to you.

How can I protect my credit report from identity theft To protect your credit report from identity theft, you can take the following steps:

1. Regularly monitor your credit report for any suspicious activity or errors.

2. Set up fraud alerts or credit freezes with the credit bureaus.

3. Keep your personal information secure and avoid sharing it with unknown sources.

4. Use strong and unique passwords for your online accounts.

5. Be cautious of phishing scams and do not click on suspicious links or provide personal information.

6. Review your bank and credit card statements regularly for any unauthorized charges.

7. Consider using identity theft protection services for added security.

8. If you suspect any fraudulent activity, report it to the credit bureaus and the authorities immediately.

Can I get my credit report if I have no credit history Yes, even if you have no credit history, you can still request and obtain your credit report. Your credit report will show that you have no credit history, but it is important to review it for accuracy and to start building credit if necessary.

Will checking my credit report affect my credit score No, checking your credit report will not impact your credit score. When you check your own credit report, it is considered a “soft inquiry” and has no impact on your creditworthiness. However, if a lender or creditor checks your credit report as part of a credit application, it may result in a “hard inquiry” which can temporarily lower your credit score by a few points.

What should I do if I find errors on my credit report If you find any errors on your credit report, you should take the following steps:

1. Contact the credit bureau(s) to report the error in writing.

2. Provide any supporting documentation to prove the error.

3. Request that the error be investigated and corrected.

4. Keep records of all communication related to the dispute.

5. Follow up with the credit bureau(s) to ensure the error is resolved.

6. Monitor your credit report regularly to ensure the error does not reappear.

7. If the error is not resolved, you may consider filing a complaint with the Consumer Financial Protection Bureau or seeking legal advice.

How far back does my credit history go Your credit history can go back as far as the first time you established credit. This can include your credit cards, loans, and other credit accounts. The length of your credit history plays a role in determining your credit score, so it is beneficial to have a longer credit history with a positive payment history.

Can I dispute items on my credit report online Yes, you can dispute items on your credit report online through the credit bureau’s website. Each credit bureau has a dispute process that allows you to initiate a dispute and provide supporting documentation online. However, it is recommended to also send a written dispute via certified mail to ensure proper documentation and tracking of your dispute.

Can I get a free credit report for my business No, the free annual credit report is only available for individuals, not businesses. However, if you want to check the credit report for your business, you can request it from commercial credit reporting agencies such as Dun & Bradstreet or Experian’s business credit division. Keep in mind that these reports may come with a fee.

Summary of the Article: How to Get and Manage Your Credit Report

1. How do I get a PDF version of my credit report?

You can request and review your free report through one of the following ways:

- Online: Visit AnnualCreditReport.com.

- Phone: Call (877) 322-8228.

- Mail: Download and complete the Annual Credit Report Request form.

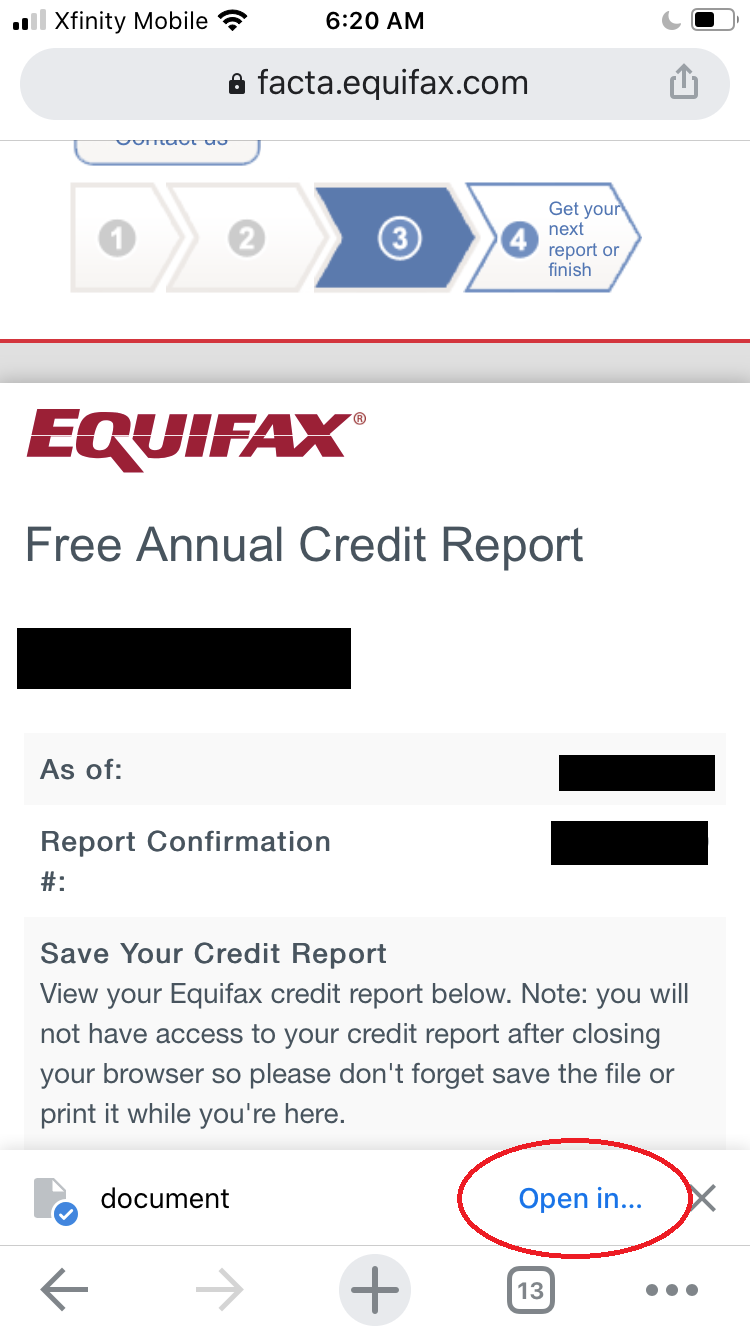

2. Can you download a full credit report from Equifax?

Yes, you can visit www.annualcreditreport.com to get a free copy of your credit reports every 12 months from each of the three nationwide credit bureaus (Equifax, Experian, and TransUnion). You can also create a myEquifax account to get six free Equifax credit reports each year.

3. How do I open my Equifax credit report PDF password?

To open your Equifax credit report PDF, you need to retrieve the unique password generated by our system. The password will be sent to your mobile app, and you can log in to the Equifax app to access your credit report.

4. How do I get my Equifax credit report?

You can get free Equifax credit reports at annualcreditreport.com. Alternatively, you can also receive free Equifax credit reports by creating a myEquifax account. Look for “Equifax Credit Report” on your myEquifax dashboard.

5. How do I get a digital credit report?

You can request your credit reports online by visiting AnnualCreditReport.com, calling 1-877-322-8228 (TTY: 1-800-821-7232), or filling out the Annual Credit Report request form and mailing it to the Annual Credit Report Request Service in Atlanta, GA.

6. Where can I find the edition of a PDF?

To find the edition of a PDF using PDF Complete application:

- Open the PDF Complete application from the Start menu.

- Select “Help” from the top menu bar and choose “About PDF Complete…”

- The edition and version of PDF Complete will be listed in the window that follows.

7. How long does it take to download a credit report?

If you request your credit report online at AnnualCreditReport.com, you should be able to access it immediately. However, if you order your report by phone, it will be processed and mailed to you within 15 days.

8. How accurate is Equifax on Credit Karma?

The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two major consumer credit bureaus. Therefore, the information should accurately reflect your credit information as reported by those bureaus.

9. How can I modify a credit report?

Unfortunately, you cannot directly modify the information on your credit report. However, if you believe there is inaccurate or incomplete information, you can dispute it with the credit bureaus and provide supporting documentation to have it corrected or removed.

10. How often should I check my credit report?

It is recommended to check your credit report at least once a year to identify errors or suspicious activity. Checking your report before applying for credit can help ensure its accuracy and improve your chances of approval.

11. Can I get my credit report instantly?

Yes, if you request your credit report online at AnnualCreditReport.com, you should be able to access it immediately. However, other methods such as phone or mail might take longer to process and deliver your report.

12. How can I protect my credit report from identity theft?

To protect your credit report from identity theft, follow these steps:

- Regularly monitor your credit report for any suspicious activity or errors.

- Set up fraud alerts or credit freezes with the credit bureaus.

- Keep your personal information secure and avoid sharing it with unknown sources.

- Use strong and unique passwords for your online accounts.

- Be cautious of phishing scams and do not click on suspicious links or provide personal information.

- Review your bank and credit card statements regularly for any unauthorized charges.

- Consider using identity theft protection services for added security.

- If you suspect any fraudulent activity, report it to the credit bureaus and authorities immediately.

13. Can I get my credit report if I have no credit history?

Yes, even if you have no credit history, you can still request and obtain your credit report. Reviewing your report for accuracy and starting to build credit if necessary is important in this case.

14. Will checking my credit report affect my credit score?

No, checking your own credit report is considered a “soft inquiry” and does not impact your credit score. However, when a lender or creditor checks your report as part of a credit application, it may result in a “hard inquiry” which can temporarily lower your credit score.

15. What should I do if I find errors on my credit report?

If you find errors on your credit report, take the following steps:

- Contact the credit bureau(s) to report the error in writing.

- Provide any supporting documentation to prove the error.

- Request an investigation and correction of the error.

- Keep records of all communication related to the dispute.

- Follow up with the credit bureau(s) to ensure resolution.

- Monitor your credit report regularly to prevent reoccurrence.

- If the error persists, consider filing a complaint with the Consumer Financial Protection Bureau or seeking legal advice.

Please note that the information provided in this summary and answers are based on my personal experience and understanding. It is important to refer to authoritative sources and consult professionals for specific and up-to-date information regarding credit reports and related matters.

How do I get a PDF version of my credit report

You can request and review your free report through one of the following ways: Online: Visit AnnualCreditReport.com. Phone: Call (877) 322-8228. Mail: Download and complete the Annual Credit Report Request form .

Can you Download a full credit report from Equifax

Visit www.annualcreditreport.com to get a free copy of your credit reports every 12 months from each of the three nationwide credit bureaus (Equifax, Experian and TransUnion) Create a myEquifax account to get six free Equifax credit reports each year.

Cached

How do I open my Equifax credit report PDF password

Password: Our system will generate a unique password for your report, which will be sent to your mobile App. Login to Equifax app to retrieve the password to your Credit Report.

How do I get my Equifax credit report

You can get free Equifax credit reports at annualcreditreport.com. You can also receive free Equifax credit reports with a myEquifax account. Just look for "Equifax Credit Report" on your myEquifax dashboard.

Cached

How do I get a digital credit report

You may request your reports:Online by visiting AnnualCreditReport.com.By calling 1-877-322-8228 (TTY: 1-800-821-7232)By filling out the Annual Credit Report request form and mailing it to: Annual Credit Report Request Service. PO Box 105281. Atlanta, GA 30348-5281.

Where can I find the edition of a PDF

Open your PDF Complete application from the Start menu.Select Help from the top menu bar, and choose About PDF Complete….Your PDF Complete edition and version is listed in the window that follows.

How long does it take to Download a credit report

Online: If you request your report at AnnualCreditReport.com , you should be able to access it immediately. Phone: If you order your report by calling (877) 322-8228, your report will be processed and mailed to you within 15 days.

How accurate is Equifax on Credit Karma

Here's the short answer: The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

What is the password to open credit PDF

The default password to open your credit report pdf containing your CIBIL score is your date of birth in DDMMYYYY format.

How to open protected PDF file

How to unlock a PDF to remove password security:Open the PDF in Acrobat.Use the “Unlock” tool: Choose “Tools” > “Protect” > “Encrypt” > “Remove Security.”Remove Security: The options vary depending on the type of password security attached to the document.

Why can’t I see my Equifax report

There are a couple of reasons why some accounts may not be listed on your Equifax credit report: Not all lenders and creditors report to all three nationwide credit bureaus. Some report to only two, one or none at all. You can check with your lenders and creditors to find out which bureaus they report to.

How can I get my credit report the same day

Online: If you request your report at AnnualCreditReport.com , you should be able to access it immediately. Phone: If you order your report by calling (877) 322-8228, your report will be processed and mailed to you within 15 days.

How do I download a PDF from digital editions

How to Convert Adobe Digital Editions to PDF – Two ConvertersMake sure you have downloaded Calibre, and then choose "Add books" to import your files.In the top toolbar, find "Convert books".A new window appears.Once the conversion is done, you will receive a PDF file with the original information from your ebooks.

How do I extract a PDF from Adobe Digital Editions

Navigate to Acrobat online services Convert to PDF page. Drag and drop the file you want to convert or select the File button to navigate to your file. Your PDF will be ready within moments. Download or share your new PDF file.

How long does it take to get an Equifax report

Once you have requested a copy of your free Equifax credit report or a My Credit Alert subscription you will receive your credit report within one business day, provided we are able to verify your identity.

Which credit score matters more TransUnion or Equifax

No credit score from any one of the credit bureaus is more valuable or more accurate than another. It's possible that a lender may gravitate toward one score over another, but that doesn't necessarily mean that score is better.

Is Equifax your actual score

The Equifax credit score is an educational credit score developed by Equifax. Equifax credit scores are provided to consumers for their own use to help them estimate their general credit position. Equifax credit scores are not used by lenders and creditors to assess consumers' creditworthiness.

How do I access a secured PDF

From the Document Properties dialog box, click the Security tab. If you have trouble opening a PDF, or you're restricted from using certain features, contact the author of the PDF. A password-protected PDF either requires a password to open or a password to change or remove restricted operations.

What is unlocking PDF

Unlocking your document is quick and simple with this tool: Open the PDF in Adobe Acrobat. Use the “Unlock” tool by choosing Tools > Protect > Encrypt > Remove Security. Remove the password: If the document has a Document Open password, just click “OK” to remove it.

How do I view a PDF with password protection

How to open password protected PDF with Adobe:Launch the password-protected PDF file using Adobe Acrobat Pro, and then enter the password used to lock it.Select "File" > "Properties".Underneath the "Security" tab, select "Security Method," and a drop-down menu with several options will pop up.

How do I open a PDF that is not protected view

Enable or disable Protected ViewChoose Preferences.From the Categories on the left, select Security (Enhanced).Select the Enable Enhanced Security option.Choose one of the following options: Off. Disables Protected View, if you have enabled it. Protected View is off by default. Files From Potentially Unsafe Locations.

What happened to Equifax credit report

In September of 2017, Equifax announced a data breach that exposed the personal information of 147 million people. The company has agreed to a global settlement with the Federal Trade Commission, the Consumer Financial Protection Bureau, and 50 U.S. states and territories.

Why doesn t Credit Karma show Equifax

Financial institutions report to different bureaus at different times. At Credit Karma, your reports can be checked for updates as often as daily for TransUnion and weekly for Equifax, with a limited number of members getting daily Equifax score checks at this time.

How quickly can I get a copy of my credit report

Online: If you request your report at AnnualCreditReport.com , you should be able to access it immediately. Phone: If you order your report by calling (877) 322-8228, your report will be processed and mailed to you within 15 days.

What’s the easiest way to get a copy of your credit report

How to get a copy of your credit reportOnline by visiting AnnualCreditReport.com.By calling 1-877-322-8228 (TTY: 1-800-821-7232)By filling out the Annual Credit Report request form and mailing it to: Annual Credit Report Request Service. PO Box 105281. Atlanta, GA 30348-5281.