Summary of the Article:

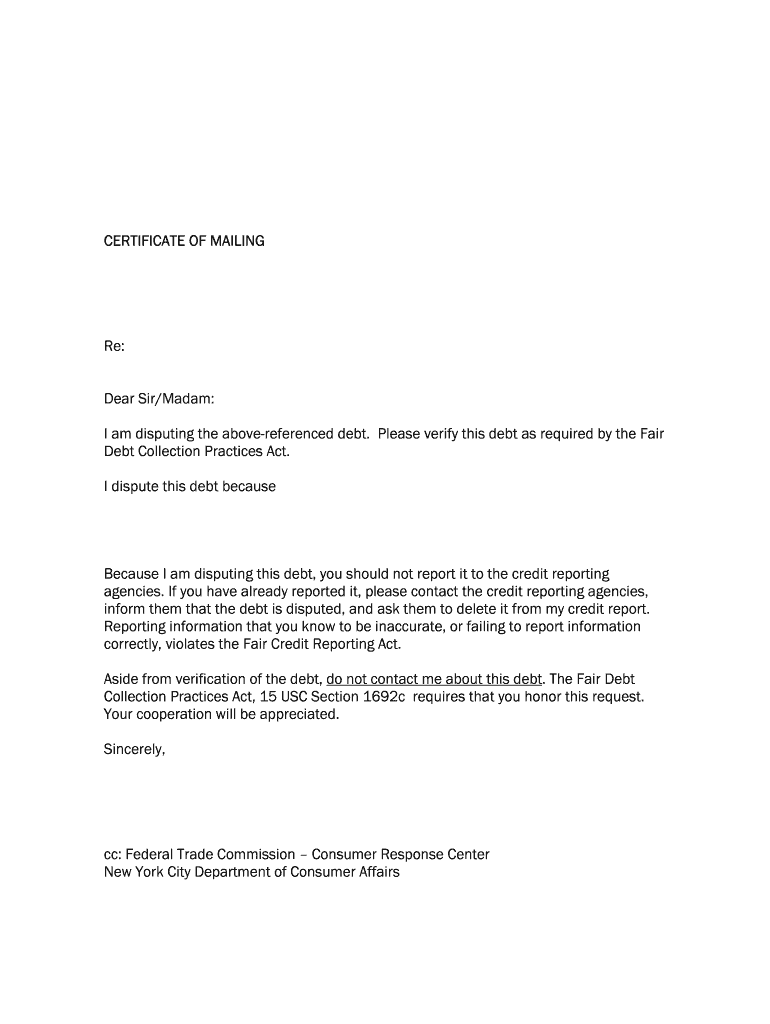

1. How to fill out a dispute letter: Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask the business to take action. Enclose a copy of your report with the disputed items circled.

2. What is a 604 dispute letter: A 604 dispute letter asks credit bureaus to remove errors from your report under section 604 of the FCRA. It can help protect your credit and improve your score.

3. Difference between a 609 and 604 dispute letter: A 609 letter verifies information and uncovers hidden details. Section 604 explains when credit bureaus can release your credit information.

4. How to write a letter to remove hard inquiries: Write a letter to request the removal of unauthorized credit inquiries on your credit report. Specify the credit bureau and the number of inquiries you didn’t authorize.

5. Is it better to write or type dispute letters: Write clearly or type your complaint. If your handwriting is legible, you can handwrite it; otherwise, type it.

6. How to dispute and remove negative items on your credit report: Get a free copy of your credit report, file a dispute with the credit reporting agency, file a dispute with the creditor, review the claim results, or hire a credit repair service.

7. How to remove closed accounts from your credit report: Dispute any inaccuracies, write a formal goodwill letter requesting removal, or wait for the accounts to be removed over time.

8. Do 609 letters really work: There’s no evidence to suggest a 609 letter is more or less effective than the usual process.

Questions:

1. How do you fill out a dispute letter?

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

2. What is a 604 dispute letter?

A 604 dispute letter asks credit bureaus to remove errors from your report that fall under section 604 of the Fair Credit Reporting Act (FCRA). While it might take some time, it’s a viable option to protect your credit and improve your score.

3. What is the difference between a 609 and 604 dispute letter?

A 609 letter can help you verify information and identify errors on your credit report. It can also uncover “hidden” details that don’t show up in your free credit report. Section 604 explains the circumstances in which the credit bureaus can release your credit information to various entities.

4. How do I write a letter to remove hard inquiries?

To whom this may concern, I am writing to request the removal of unauthorized credit inquiries on my (name of the credit bureau—Equifax, Experian and/or TransUnion) credit report. My latest credit report shows (number of hard inquiries you are disputing) credit inquiries that I did not authorize.

5. Is it better to write or type dispute letters?

Write clearly or type your complaint. If your handwriting is legible, feel free to handwrite your complaint. If it’s not, type it.

6. How do I dispute and remove negative items on my credit report?

To remove negative items from your credit report yourself, follow these steps: (1) Get a free copy of your credit report. (2) File a dispute with the credit reporting agency. (3) File a dispute directly with the creditor. (4) Review the claim results. (5) Hire a credit repair service if needed.

7. How do I remove closed accounts from my credit report?

Closed accounts can be removed from your credit report in three main ways: (1) Dispute any inaccuracies. (2) Write a formal goodwill letter requesting removal. (3) Simply wait for the closed accounts to be removed over time.

8. Do 609 letters really work?

There’s no evidence to suggest a 609 letter is more or less effective than the usual process.

How do you fill out a dispute letter

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

Cached

What is a 604 dispute letter

What is a 604 dispute letter A 604 dispute letter asks credit bureaus to remove errors from your report that fall under section 604 of the Fair Credit Reporting Act (FCRA). While it might take some time, it's a viable option to protect your credit and improve your score.

Cached

What is the difference between a 609 and 604 dispute letter

A 609 letter can help you verify information and identify errors on your credit report. It can also uncover “hidden” details that don't show up in your free credit report. Section 604 explains the circumstances in which the credit bureaus can release your credit information to various entities.

Cached

How do I write a letter to remove hard inquiries

To whom this may concern, I am writing to request the removal of unauthorized credit inquiries on my (name of the credit bureau—Equifax, Experian and/or TransUnion) credit report. My latest credit report shows (number of hard inquiries you are disputing) credit inquiries that I did not authorize.

Is it better to write or type dispute letters

Write clearly or type your complaint. If your handwriting is legible, feel free to handwrite your complaint. If it's not, type it.

How do I dispute and remove negative items on my credit report

How to remove negative items from your credit report yourselfGet a free copy of your credit report.File a dispute with the credit reporting agency.File a dispute directly with the creditor.Review the claim results.Hire a credit repair service.

How do I remove closed accounts from my credit report

Closed accounts can be removed from your credit report in three main ways: (1) dispute any inaccuracies, (2) write a formal goodwill letter requesting removal or (3) simply wait for the closed accounts to be removed over time.

Do 609 letters really work

There's no evidence to suggest a 609 letter is more or less effective than the usual process of disputing an error on your credit report—it's just another method of gathering information and seeking verification of the accuracy of the report. If disputes are successful, the credit bureaus may remove the negative item.

What do you say to get hard inquiries removed

What to do: Contact the creditor responsible for the hard inquiry. You should be able to find their contact details on their official website or social media page. Explain that you believe there is an error on your credit report and request that they remove the inquiry.

What can I say to remove hard inquiries from my credit report

If you find an unauthorized or inaccurate hard inquiry, you can file a dispute letter and request that the bureau remove it from your report. The consumer credit bureaus must investigate dispute requests unless they determine your dispute is frivolous.

What is the most effective way to dispute a credit report

Dispute the information with the credit reporting companyContact information for you including complete name, address, and telephone number.Report confirmation number, if available.Clearly identify each mistake, such as an account number for any account you may be disputing.Explain why you are disputing the information.

What should a credit dispute letter say

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

How to remove all negative items from your credit report for free

Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years. Lenders use your credit reports to scrutinize your past debt payment behavior and make informed decisions about whether to extend you credit and under what terms.

Why you should never dispute negative items on your credit report online

If you dispute your credit reports online, you make it difficult to enforce the law, and it slows you down. Eventually, if you are correct, it will require filing a claim to make the credit bureaus correct the problem, especially if it was not fixed the first time.

How to get a letter to creditor to remove closed account from credit report

In a goodwill letter, you write to a creditor and ask to have a negative mark removed from your credit report. Your letter should explain that you have a good reason for missing a payment, such as an unexpected illness or temporary loss of employment.

How long does it take to remove closed accounts from credit report

Wait for the accounts to fall off

How long do closed accounts stay on your credit report Negative information typically falls off your credit report 7 years after the original date of delinquency, whereas closed accounts in good standing usually fall off your account after 10 years.

What should a 609 letter include

If you're looking to get information from a credit bureau, make sure that your 609 letter has the right information, including your account number, what you're asking for, proof of your identity, and any other documents that might help them process your request.

What is the 11 word credit loophole

In case you are wondering what the 11 word phrase to stop debt collectors is supposed to be its “Please cease and desist all calls and contact with me immediately.”

How many points will my credit score increase when a hard inquiry is removed

In most cases, hard inquiries have very little if any impact on your credit scores—and they have no effect after one year from the date the inquiry was made. So when a hard inquiry is removed from your credit reports, your scores may not improve much—or see any movement at all.

What is the easiest way to remove hard inquiries

If you find an inquiry on your credit report that you don't recognize, contact the creditor or the credit bureau to request its removal. You'll need to provide proof that the inquiry was unauthorized or fraudulent.

How do I file a credit dispute and win

You'll likely need to fill out a dispute form and provide supporting documentation that helps prove an error was made. If your dispute is accepted, follow up to make sure the credit bureau and the business that supplied the incorrect information update their records accordingly.

Is it easy to win a credit card dispute

This can't always be helped. You might not always get a fair outcome when you dispute a chargeback, but you can increase your chances of winning by providing the right documents. Per our experience, if you do everything right, you can expect a 65% to 75% success rate.

What reason should I put for disputing credit

Accounts that aren't yours. Inaccurate credit limit/loan amount or account balance. Inaccurate creditor. Inaccurate account status, for example, an account status reported as past due when the account is actually current.

What is the 11 word phrase in credit secrets

In case you are wondering what the 11 word phrase to stop debt collectors is supposed to be its “Please cease and desist all calls and contact with me immediately.”

How much will my credit score increase if negative item is removed

There's no concrete answer to this question because every credit report is unique, and it will depend on how much the collection is currently affecting your credit score. If it has reduced your credit score by 100 points, removing it will likely boost your score by 100 points.