ask that it be removed or corrected. You may also want to enclose any supporting documents. However, it’s important to note that emailing disputes to credit bureaus may not be the most secure method, so it’s recommended to use more secure methods such as mailing or online submission.[/wpremark]

How long does it take to remove a dispute from Experian The credit bureau has 30 days to investigate and respond to your dispute. If the information is found to be inaccurate or incomplete, it will be removed or corrected. If the dispute is not resolved within 30 days, it will be removed from your report.

How can I fix my credit score fast While there is no quick fix for improving your credit score, there are steps you can take to start improving it. These include paying your bills on time, keeping credit card balances low, paying off debt, and avoiding new credit applications. It’s important to note that improving your credit score takes time and patience.

How can I check my credit score for free You can check your credit score for free through Experian or other credit monitoring services. Many banks and credit card companies also offer free credit score monitoring as a benefit to their customers. Additionally, you are entitled to a free credit report from each of the three major credit bureaus (Experian, TransUnion, and Equifax) once a year, which does not include your credit score but provides detailed information about your credit history.

How do I request a credit freeze with Experian To request a credit freeze with Experian, you can visit their website and follow the instructions provided. You will need to provide your personal information and pay a fee, as well as provide proof of your identity. Once the credit freeze is in place, Experian will not release your credit report to potential creditors or lenders without your permission.

How do I remove my credit freeze with Experian To remove your credit freeze with Experian, you can visit their website or contact them directly. You will need to provide your personal information and follow the instructions provided to lift the freeze. It’s important to note that removing a credit freeze may involve a waiting period and may require proof of your identity.

Can I dispute information online with Experian Yes, you can dispute information online with Experian. They provide an online dispute form that you can fill out and submit. You will need to provide your personal information and details about the information you are disputing. It’s important to provide as much information and documentation as possible to support your dispute.

Can I check my child’s credit report with Experian Yes, you can check your child’s credit report with Experian. However, it’s important to note that children under the age of 18 typically do not have a credit report unless they have been authorized users on an account or have been victims of identity theft. If you suspect your child may have a credit report, you can contact Experian and follow their procedures for checking a child’s credit report.

How do I contact Experian by mail

you can mail it to Experian's National Consumer Assistance Center at P.O. Box 4500, Allen, TX 75013, or upload your document at experian.com/upload to submit it online.

How do I contact Experian directly

By Phone: Contact Experian's National Consumer Assistance Center at 1 888 EXPERIAN (1 888 397 3742).

Cached

How do I file a complaint with Experian

To submit a dispute, contact us by internet or by mail. You may also submit documents in support of your dispute. Documents may be uploaded for online disputes at Experian.com/upload or submitted by mail. When submitting documents, please only submit copies of documents and not originals.

Where do I mail my Experian credit bureau

If you'd like to have a copy of your credit report delivered to you by mail, call 866-200-6020. By mail: You can dispute without a credit report by writing to Experian, P.O. Box 4500, Allen, TX 75013.

How do I write a dispute letter to Experian

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

Is Experian or Credit Karma more accurate

Experian vs. Credit Karma: Which is more accurate for your credit scores You may be surprised to know that the simple answer is that both are accurate. Read on to find out what's different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.

How do I remove a dispute from Experian

To remove disputes from a credit report (for free) you can contact whichever credit bureau is reporting the dispute. Experian's phone number is 888-210-9101 and 866-673-0140 and it's answered by a real-life human being. Just tell them you need the National Consumer Assistance Center to end the dispute(s).

Can you email disputes to credit bureaus

You can submit a dispute to the credit reporting company by phone, by mail, or online. Explain the error and what you want changed. Clearly identify each mistake separately, state the facts, explain why you are disputing the information, and request that it be removed or corrected.

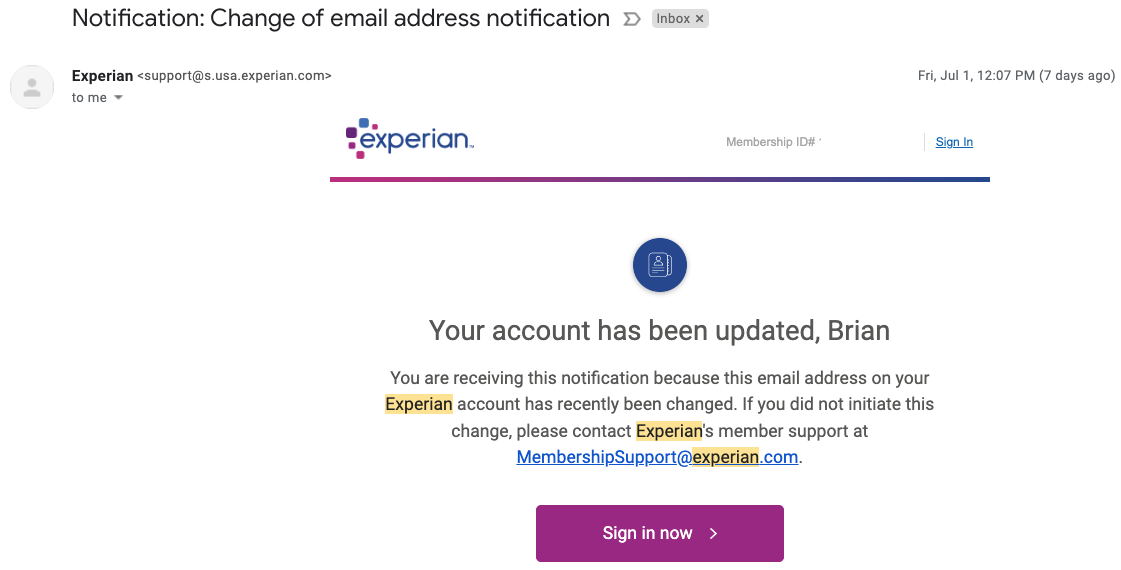

Does Experian email you

Experian maintains a database of permission-based email addresses that are used by Experian and other marketers to send you offers of interest via email. To opt out of this database, send an email to [email protected] from the email address you wish to unsubscribe.

Where do I send a dispute letter

The three major credit bureaus also allow you to submit an online dispute.Experian. Dispute Department. PO Box 4500. Allen, TX 75013.Equifax. PO Box 740256. Atlanta, GA 30374-0256.TransUnion. TransUnion Consumer Solutions. PO Box 2000. Chester, PA 19016-2000.

Which score is more accurate FICO or Experian

Experian's advantage over FICO is that the information it provides is far more detailed and thorough than a simple number. A pair of borrowers could both have 700 FICO Scores but vastly different credit histories.

Is Experian FICO score the most accurate

While Experian is the largest bureau in the U.S., it's not necessarily more accurate than the other credit bureaus.

Does removing dispute hurt my credit

Requesting a change or update to your credit report—a process known as filing a dispute—has no direct impact on your credit. But certain changes made in response to disputes can affect your credit scores. Read on to learn how disputes work and why they may or may not impact your credit.

How long does it take Experian to remove a dispute

While you will often have the results of your dispute much sooner, the Fair Credit Reporting Act (FCRA) requires that Experian allow 30 days for the dispute process to be completed.

Where do I mail Experian com disputes

By mail: You can dispute without a credit report by writing to Experian, P.O. Box 4500, Allen, TX 75013. (Printing out Dispute by Mail instructions can streamline the process; you can also scan the completed form and submit it electronically to Experian.com/upload).

Is it better to dispute online or by mail

Ultimately, online disputes are fine for supplementing the credit repair process but, they should not be used as the cornerstone of your credit repair strategy. Make sure that you mail dispute letters detailing the incorrect information and the reasons for the removals.

How trustworthy is Experian

Credit scores from the three main bureaus (Experian, Equifax, and TransUnion) are considered accurate. The accuracy of the scores depends on the accuracy of the information provided to them by lenders and creditors. You can check your credit report to ensure the information is accurate.

How do I dispute an Experian credit report by mail

By mail: You can dispute without a credit report by writing to Experian, P.O. Box 4500, Allen, TX 75013. (Printing out Dispute by Mail instructions can streamline the process; you can also scan the completed form and submit it electronically to Experian.com/upload).

Is Experian a true FICO score

FICO® Score 2 is the "classic" FICO® Score version available from Experian. FICO® Score 4 is the version of the classic FICO® Score offered by TransUnion. FICO® Score 5 is the Equifax version of the "classic" FICO® Score.

Which score is higher Experian or Equifax

The main difference is Experian grades it between 0 – 1000, while Equifax grades the score between 0 – 1200. This means that there is not only a clear 200 point difference between these two bureaus but the “perfect scores” are also different, which is 1000 as reported by Experian and 1200 as reported by Equifax.

What is the difference between my FICO score and my Experian score

FICO, Experian, and Equifax all provide information on individuals' credit habits for the use of lenders. FICO provides just a numerical credit score, based on an individual's payment habits and the amount of debt that they carry. Credit bureaus like Experian and Equifax offer detailed credit histories on individuals.

How can I remove disputes from my credit report quickly

To remove disputes from a credit report (for free) you can contact whichever credit bureau is reporting the dispute. Experian's phone number is 888-210-9101 and 866-673-0140 and it's answered by a real-life human being. Just tell them you need the National Consumer Assistance Center to end the dispute(s).

Can removing disputes hurt your credit

Filing a Dispute Will Not Affect Your Score

In fact, it's important that you get the misinformation corrected or removed so that it doesn't affect your score down the road. If you are correcting identification or contact information, the change will not affect your score.

Is it good to dispute on Experian

While the act of disputing an item does not impact your credit score, the outcome of your dispute may have some impact. For example, if your lender agrees to remove a late payment and you request an updated credit score once the change has been made, you may find that your credit score has increased as a result.

What is the fastest way to dispute credit report

You can dispute credit report errors by gathering documentation about the error and sending a letter to the credit bureau that created the report. All three credit bureaus, Equifax, Experian and TransUnion, have an online dispute process, which is often the fastest way to fix a problem.