to remove the collection from your credit report without paying by negotiating a pay-for-delete agreement. This means that you would offer to pay the debt in full or settle it for a lower amount in exchange for the creditor removing the collection from your credit report. It is important to get any agreement in writing before making any payments. Keep in mind that not all creditors may be willing to negotiate a pay-for-delete agreement.

Can I talk to a live person at Experian

If you need help with anything related to your membership account, you should call the Experian's customer service at (866) 617-1894. You will need to call while the Experian office is open in order to speak with someone. The hours are 9 a.m. to 11 p.m. ET, Monday to Friday, and 11 a.m. to 8 p.m. ET, on the weekends.

Cached

What is the best way to dispute a collection on Experian

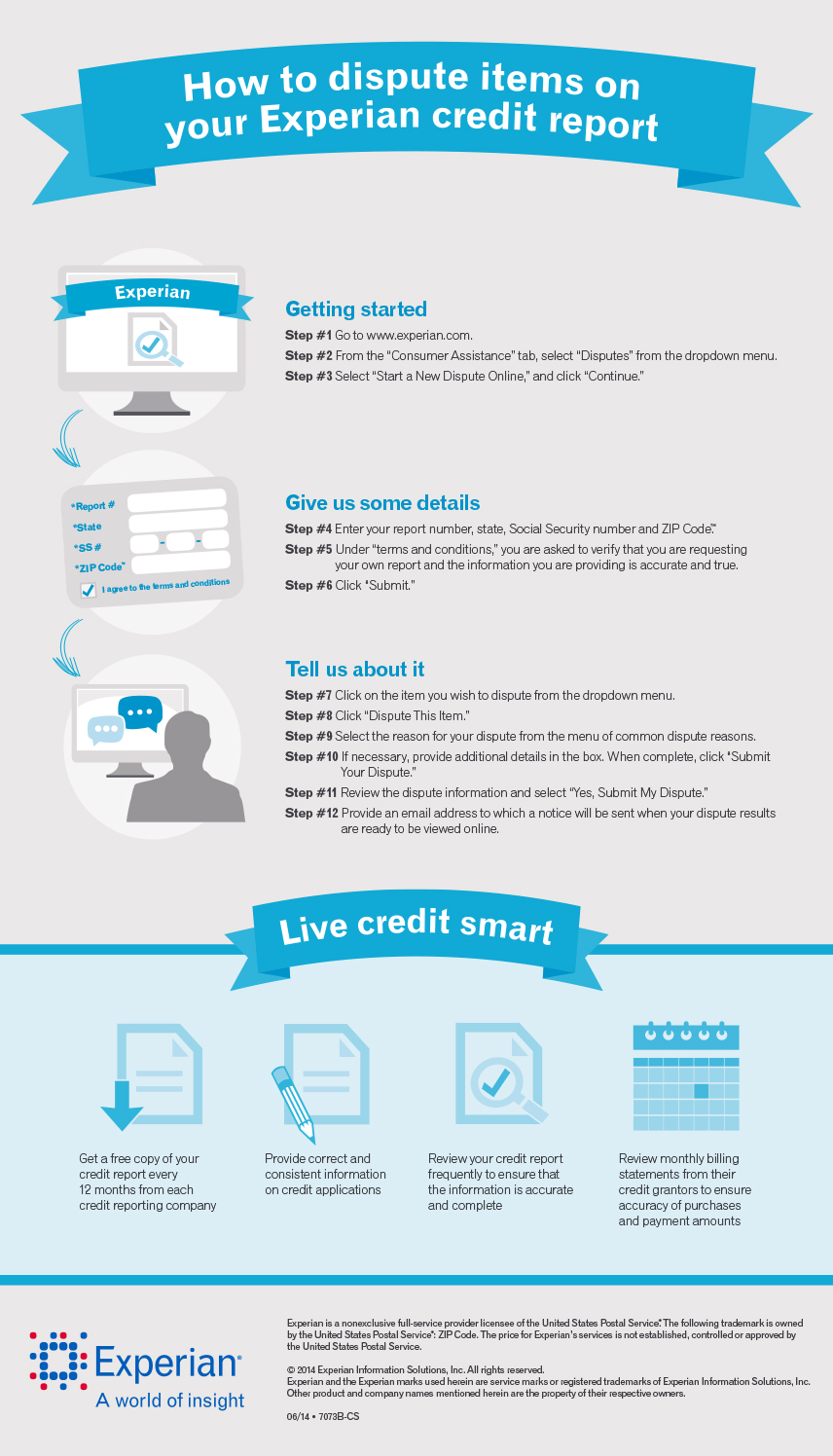

The fastest way to dispute inaccurate information is through Experian's online Dispute Center. Be specific about why the item is inaccurate and include any documentation you may have that supports your dispute. You can submit documents online or send them by mail.

Is it good to dispute on Experian

While the act of disputing an item does not impact your credit score, the outcome of your dispute may have some impact. For example, if your lender agrees to remove a late payment and you request an updated credit score once the change has been made, you may find that your credit score has increased as a result.

How long does Experian have to respond to a dispute

within 30 days

If you file a dispute to correct what you believe is an inaccuracy on your credit report, the credit bureau you notify must complete an investigation within 30 days (or 45 days in certain circumstances), according to the U.S. Fair Credit Reporting Act.

How do I dispute a credit report

Dispute the information with the credit reporting companyContact information for you including complete name, address, and telephone number.Report confirmation number, if available.Clearly identify each mistake, such as an account number for any account you may be disputing.Explain why you are disputing the information.

How do I contact Experian connect

1-888-397-3742

Please contact Experian's National Consumer Assistance Center at 1-888-397-3742 for assistance.

What is the best reason to dispute on Experian

Successful disputes typically involve inaccurate or incomplete information, including items such as: Account information, such as closed accounts reported as open, timely payments incorrectly reported as delinquent, and inaccurate credit limits or account balances.

How can I get a collection removed without paying

You can ask the creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

Is there a downside to disputing credit report

Does Filing a Dispute Hurt Your Credit Filing a dispute has no impact on credit scores. But if certain information on your credit report changes as a result of your dispute, your credit score can change.

What happens if a credit dispute is denied

In case the card issuer denies your dispute, you still have options. You should follow up with the lender to ask for an explanation and any supporting documentation. If you think your dispute was incorrectly denied given that reasoning, you can file a complaint with the FTC, the CFPB or your state authorities.

How long does it take to get your money back after disputing it

How long does it take to get your money back after dispute A provisional credit should take 2-3 days to process. However, it may take weeks, or even months, before a dispute is finally settled. This will depend on whether the merchant decides to fight the dispute, and if they later escalate it to arbitration.

How do I get a dispute removed from my credit report

To remove disputes from a credit report (for free) you can contact whichever credit bureau is reporting the dispute. Experian's phone number is 888-210-9101 and 866-673-0140 and it's answered by a real-life human being. Just tell them you need the National Consumer Assistance Center to end the dispute(s).

What is the fastest way to dispute credit report

You can dispute credit report errors by gathering documentation about the error and sending a letter to the credit bureau that created the report. All three credit bureaus, Equifax, Experian and TransUnion, have an online dispute process, which is often the fastest way to fix a problem.

How do I email Experian customer care

Call – 022 – 6641 9000 (Monday to Friday – 9:30 am to 6:30 pm) Email – [email protected].

Is it better to dispute online or by phone

Each of the major credit bureaus (Experian, Equifax, and Trans Union) allow consumers to dispute information on their credit report by phone. Disputing by phone has the advantage of being a quicker and sometimes easier process than writing a dispute letter.

What is the 11 word phrase to stop debt collectors

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase “please cease and desist all calls and contact with me immediately” to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

How many points will credit go up if I pay off collections

With most of the current standard credit scoring models, paying a collection account off likely won't increase your credit score since the item will remain on your credit report. It will show up as “paid” instead of “unpaid,” which might positively influence a lender's opinion.

What is the success rate of a credit dispute

You might not always get a fair outcome when you dispute a chargeback, but you can increase your chances of winning by providing the right documents. Per our experience, if you do everything right, you can expect a 65% to 75% success rate.

Who pays when you dispute a charge

You shouldn't have to make payments toward the disputed amount, but keep in mind that you're still responsible for making payments toward the rest of your credit card balance during the investigation. If the investigation is resolved in your favor, you won't have to pay the disputed amount.

Will I get my money back in a disputed transaction

Generally, you'll have two options when disputing a transaction: refund or chargeback. A refund comes directly from a merchant, while a chargeback comes from your card issuer. The first step in the dispute process should be to go directly to the merchant and request a refund.

Does removing dispute hurt my credit

Requesting a change or update to your credit report—a process known as filing a dispute—has no direct impact on your credit. But certain changes made in response to disputes can affect your credit scores. Read on to learn how disputes work and why they may or may not impact your credit.

What is the 609 loophole

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports.

What is the email format for Experian

The most accurate and popular Experian PLC's email format is first. last (ex. [email protected]).

What is the most effective way to dispute a credit report

Dispute the information with the credit reporting companyContact information for you including complete name, address, and telephone number.Report confirmation number, if available.Clearly identify each mistake, such as an account number for any account you may be disputing.Explain why you are disputing the information.

Does it hurt your credit to dispute a charge

Does Filing a Dispute Hurt Your Credit Filing a dispute has no impact on credit scores. But if certain information on your credit report changes as a result of your dispute, your credit score can change.