Summary of the Article:

How to check if your Social Security Number (SSN) is being used:

1. Check your credit report online through AnnualCreditReport.com or call 1-877-322-8228 to request a free copy.

2. Review the earnings posted on your Social Security Statement and report any inconsistencies to the Internal Revenue Service (IRS) at 1-800-908-4490.

3. Pull your own credit reports from all three bureaus (Experian, Equifax, and TransUnion) to check for any fraudulent accounts.

4. Check your credit report to find out if someone took a loan in your name, then file a dispute with the credit bureaus to remove the entry.

5. Call the National 800 number (Toll Free 1-800-772-1213 or TTY 1-800-325-0778) to block automated telephone and electronic access to your SSN.

6. Take measures to prevent further unauthorized use by locking your SSN, creating an E-Verify account, or placing a freeze on your credit reports.

7. No, someone cannot access your bank account with just your SSN. They would need additional personal details and physical evidence to authenticate your identity.

Questions and Answers:

1. How do you check if my SSN is being used?

To check if someone is using your SSN, check your credit report online through AnnualCreditReport.com or call 1-877-322-8228 to request a free copy.

2. How do I check to see if someone is using my Social Security number for free?

You can review the earnings posted on your Social Security Statement and report any inconsistencies to the IRS at 1-800-908-4490 or online. This is a free method to check for abuse.

3. How do you check if anyone has used your credit?

The best way to find out is to pull your own credit reports from all three bureaus (Experian, Equifax, and TransUnion) to check for any fraudulent accounts.

4. How do I find out if someone took a loan in my name?

Check your credit report, which will list the account and lender. If you find any discrepancies, file a dispute with the credit bureaus to remove the entry.

5. How do I stop someone from using my Social Security number?

Call the National 800 number (Toll Free 1-800-772-1213 or TTY 1-800-325-0778) to request blocking of automated telephone and electronic access to your SSN.

6. How do I stop my SSN from being used?

To prevent unauthorized use of your SSN, you can lock your SSN, create an E-Verify account, or place a freeze on your credit reports with all three nationwide credit reporting agencies (CRAs).

7. Can someone access my bank account with my Social Security number?

No, because authentication of your identity requires additional personal details and physical evidence, such as your passport, ID, or driver’s license.

How do you check if my SSN is being used

To see if someone's using your SSN, check your credit report. You can check it online through AnnualCreditReport.com, the only authorized website for free credit reports. Or you can call their phone number at 1-877-322-8228 to request your free copy.

How do I check to see if someone is using my Social Security number for free

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

How do you check if anyone has used your credit

The best way to find out if someone has opened an account in your name is to pull your own credit reports to check. Note that you'll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

How do I find out if someone took a loan in my name

To find out who opened a loan in your name, check your credit report, which will list the account and lender. Then file a dispute with all the major credit bureaus (Experian, Equifax, and TransUnion) to remove the entry from your report.

How do I stop someone from using my Social Security number

This is done by calling our National 800 number (Toll Free 1-800-772-1213 or at our TTY number at 1-800-325-0778). Once requested, any automated telephone and electronic access to your Social Security record is blocked.

How do I stop my SSN from being used

There are measures you can take to help prevent further unauthorized use of your SSN and other personal information. You can lock your SSN by calling the Social Security Administration or by creating an E-Verify account. Also, you can contact all three of the nationwide CRAs to place a freeze on your credit reports.

Can someone access my bank account with my Social Security number

Can someone access my bank account with my Social Security number No, because you would have to provide even more personal details to authenticate your identity like physical evidence of your passport, ID, driver's license, etc.

Can someone take out a loan in my name without me knowing

If anyone, including a spouse, family member, or intimate partner, uses your personal information to open up an account in your name without your permission, this could be considered identify theft.

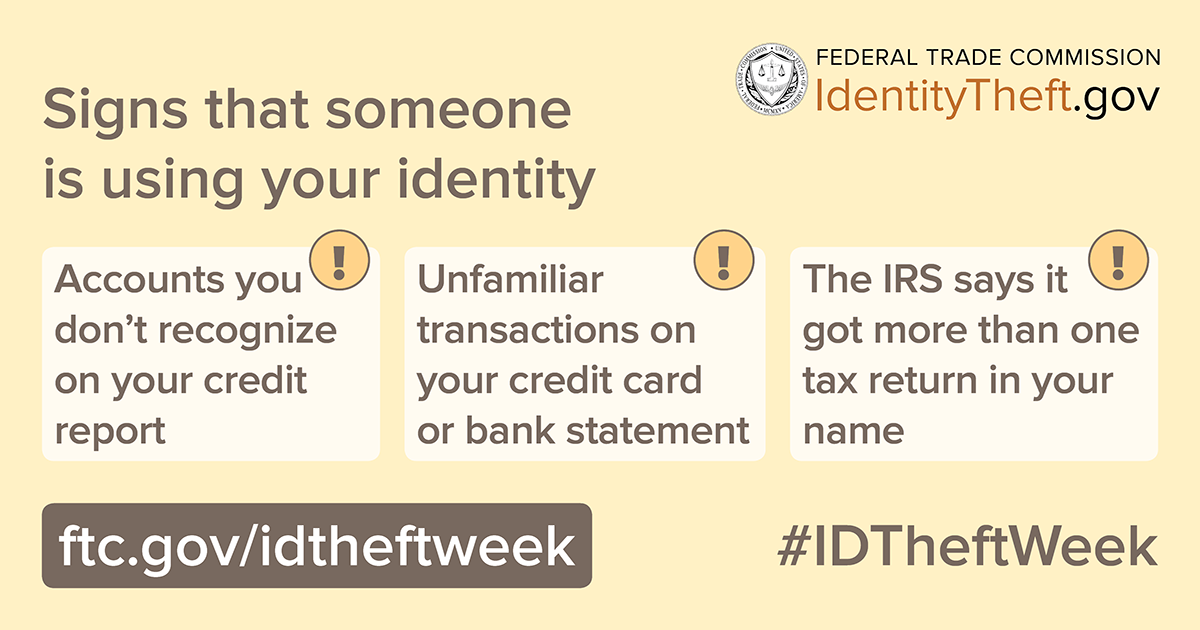

What are the first signs of identity theft

8 Warning Signs of Identity TheftUnrecognized bank or credit card transactions.Unfamiliar inquiries on your credit report.Unexpected bills or statements.Unexpected lack of bills or statements.Surprise credit score drop.Denial of loan or credit applications.Calls from debt collectors.

How do you check if my credit has been hacked

Check your credit reports.

Request copies of your credit report from all three nationwide credit bureaus – Equifax, Experian and TransUnion — and keep an eye out for any information that's inaccurate or incomplete, or unfamiliar accounts and addresses.

What happens if someone takes loans out in your name

Contact the lender

If someone took out a loan or opened a credit card in your name, contact the lender or credit card company directly to notify them of the fraudulent account and to have it removed from your credit report. For credit cards and even personal loans, the problem can usually be resolved quickly.

What to do if someone tries to take out a personal loan in your name

If someone is using your information to open a new account or take out loans in your name, submit an identity theft report with the Federal Trade Commision (FTC). You can do so online at IdentityTheft.gov. Once you enter your information, the FTC will give you a recovery plan with suggested steps you should take.

How much does it cost to lock your Social Security number

Security freezes are free, have no effect on your credit scores and can be lifted and replaced at any time.

What happens if someone used my SSN

A dishonest person who has your Social Security number can use it to get other personal information about you. Identity thieves can use your number and your good credit to apply for more credit in your name. Then, when they use the credit cards and don't pay the bills, it damages your credit.

What to do if someone used my SSN to open a bank account

If someone uses your SSN to obtain credit, loans, telephone accounts, or other goods and services, contact the Federal Trade Commission (FTC). The FTC collects complaints about identity theft from those whose identities have been stolen.

Can I change my SSN

Is it possible to get a new Social Security number Yes, but it is not easy. If you can show that you are in danger due to domestic violence or other abuse, or you are experiencing significant, ongoing financial harm due to identity theft, Social Security can assign you a different number.

Can you get a loan using someone else’s Social Security number

1. Financial identity theft. An identity thief can use your SSN together with your PII to open new bank accounts or access existing ones, take out credit cards, and apply for loans all in your name.

How do I stop someone from applying for credit in my name

Place when you've had your identity stolen and completed an FTC identity theft report at IdentityTheft.gov or filed a police report. It makes it harder for someone to open a new credit account in your name and removes you from unsolicited credit and insurance offers for 5 years.

What are three 3 warning signs of identity theft

8 Warning Signs of Identity TheftUnrecognized bank or credit card transactions.Unfamiliar inquiries on your credit report.Unexpected bills or statements.Unexpected lack of bills or statements.Surprise credit score drop.Denial of loan or credit applications.Calls from debt collectors.

What are 3 steps to take after identity has been stolen

If you suspect you may be a victim of identity theft, complete these tasks as soon as possible and document everything you do.Call your bank and other companies where fraud occurred.Contact a credit agency to place a fraud alert.Create an Identity Theft Affidavit.File a report with your local police department.

What are 3 steps you should take if you believe your identity has been compromised

Contact your police department, report the crime and obtain a police report. Decide whether you want to place a security freeze on your credit report.

What are the 2 possible signs that you have been hacked

Common warning signs of a cyberhackPassword reset emails.Random popups.Contacts receiving fake emails or text messages from you.Redirected internet searches.Computer, network, or internet connection slows down.Ransomware messages.

Can someone take a loan out in your name without you knowing

Scammers know that loan fraud can go undetected for months or even years — giving them all the time they need to ruin your credit. Instead, it's always better to proactively protect yourself from the threat of financial fraud. Here are a few steps you can take to protect yourself from loan fraud: Freeze your credit.

Is it a good idea to freeze your Social Security number

Locking your Social Security number prevents anyone — including you — from changing or accessing your Social Security record. If your Social Security number is compromised and you're already the victim of identity theft, act quickly to safeguard your personal information.

Can I block my SSN from being used

If you know your Social Security information has been compromised, you can request to Block Electronic Access. This is done by calling our National 800 number (Toll Free 1-800-772-1213 or at our TTY number at 1-800-325-0778).