1 – Summary of the article:

Removing a credit alert from your credit reports can be done by contacting the three credit bureaus directly or letting the alert expire on its own. Depending on the type of fraud alert you selected, it will be automatically removed after one year (for initial fraud alerts) or seven years (for extended fraud alerts). If you want to remove a credit alert from Experian, you can do it online at their Fraud Center or by mail. To remove the alert from Equifax, you’ll need to call their customer service number and provide verification of your identity. For TransUnion, the fastest way to remove a fraud alert is through their Service Center or by calling their customer service number.

2 – How do I remove a credit alert?

You can remove a fraud alert from your credit reports by contacting all three credit bureaus directly or by letting the fraud alert expire on its own. Depending on what kind of fraud alert you selected, the alert will be automatically removed after one year (initial fraud alert) or seven years (extended fraud alert).

3 – How do I remove a credit alert from Experian?

If you want to remove your fraud alert or victim statement before it expires, you can do so either online at Experian’s Fraud Center or by mail. To remove the alert online, you can upload the documentation verifying your identity along with your request to have the alert removed.

4 – How do I remove a credit alert from Equifax?

To remove your fraud alert or active duty alert prior to expiration, please call (888) 836-6351, from 8 a.m. to midnight ET, 7 days a week. For your protection, you’ll need to provide copies of certain documents to verify your identity.

5 – How do I remove a credit alert from TransUnion?

If you want to remove your fraud alert, the fastest way to do so if through the TransUnion Service Center. You can also remove your fraud alert over the phone by calling TransUnion at 800-916-8800.

6 – How long is a credit alert?

A credit alert lasts one year. When you place a fraud alert on your credit report, you can get a free copy of your credit report from each of the three credit bureaus. After a year, you can renew it. To place a fraud alert, you can contact any one of the three credit bureaus (Equifax, Experian, and TransUnion).

7 – Why did I get a credit alert?

A credit alert is placed on your credit report to alert credit card companies and others who may extend you credit that you may have been a victim of fraud, including identity theft. Think of it as a “red flag” to potential lenders and creditors. Fraud alerts are free.

8 – What triggers a credit alert?

Any form of irregularity in the spending pattern of the account holder can trigger a bank fraud alert. Even small purchases that you don’t buy regularly can cause the alarm to trip off surprisingly.

9 – What is the difference between an initial fraud alert and an extended fraud alert?

An initial fraud alert lasts for one year and requires creditors to take reasonable steps to verify your identity before extending credit. An extended fraud alert lasts for seven years and includes two free credit reports from each credit bureau within the first year.

10 – How can I renew my fraud alert after it expires?

To renew your fraud alert after it expires, you will need to contact each of the three credit bureaus (Equifax, Experian, and TransUnion) again and submit a new request for a fraud alert.

How do I remove a credit alert

You can remove a fraud alert from your credit reports by contacting all three credit bureaus directly or by letting the fraud alert expire on its own. Depending on what kind of fraud alert you selected, the alert will be automatically removed after one year (initial fraud alert) or seven years (extended fraud alert).

Cached

How do I remove a credit alert from Experian

If you want to remove your fraud alert or victim statement before it expires, you can do so either online at Experian's Fraud Center or by mail. To remove the alert online, you can upload the documentation verifying your identity along with your request to have the alert removed.

How do I remove a credit alert from Equifax

How can I remove a fraud alert or active duty alert To remove your fraud alert or active duty alert prior to expiration, please call (888) 836-6351, from 8 a.m. to midnight ET, 7 days a week. For your protection, you'll need to provide copies of certain documents to verify your identity.

Cached

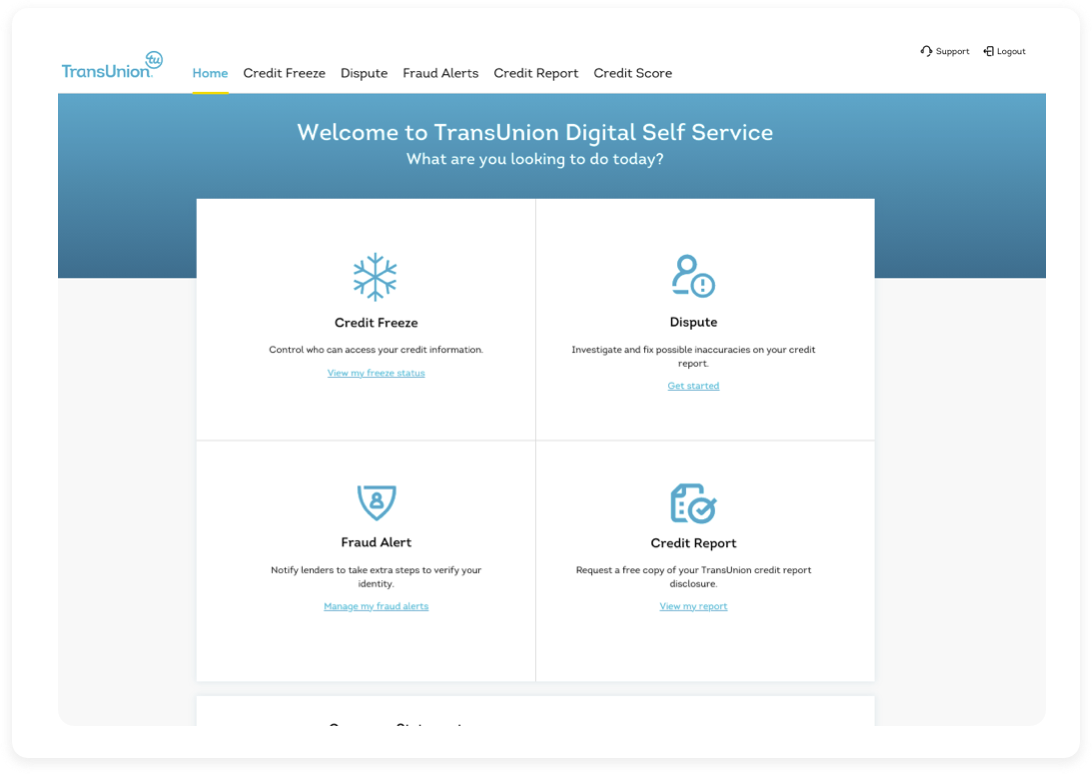

How do I remove a credit alert from TransUnion

If you want to remove your fraud alert, the fastest way to do so if through the TransUnion Service Center. You can also remove your fraud alert over the phone by calling TransUnion at 800-916-8800.

Cached

How long is a credit alert

one year

When you place a fraud alert on your credit report, you can get a free copy of your credit report from each of the three credit bureaus. Duration: A fraud alert lasts one year. After a year, you can renew it. How to place: Contact any one of the three credit bureaus — Equifax, Experian, and TransUnion.

Why did I get a credit alert

A fraud alert is a notice that is placed on your credit report that alerts credit card companies and others who may extend you credit that you may have been a victim of fraud, including identity theft. Think of it as a “red flag” to potential lenders and creditors. Fraud alerts are free.

What triggers credit alert

Changing Spending Habits Frequently

“Any form of irregularity in the spending pattern of the account holder will trigger a bank fraud alert consequently. Even small purchases that you don't buy regularly can cause the alarm to trip off surprisingly.”

What is the difference between a credit alert and a credit freeze

A fraud alert simply requires that creditors verify identity before opening new credit. A credit freeze cuts off access to your credit reports unless you lift the freeze, which makes it unlikely new credit accounts can be opened in your name without your consent.

What is credit alerts on TransUnion

A fraud alert is free and notifies creditors to take extra steps to verify your identity before extending credit. You can add a 1-year, 7-year, or Active Duty Military fraud alert. Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score.

What happens when you put an alert on your credit

You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft. Credit reporting companies will keep that alert on your file for one year. After one year, the initial fraud alert will expire and be removed.