Summary of the article: How to remove hard inquiries from your credit report

1. Obtain free copies of your credit report.

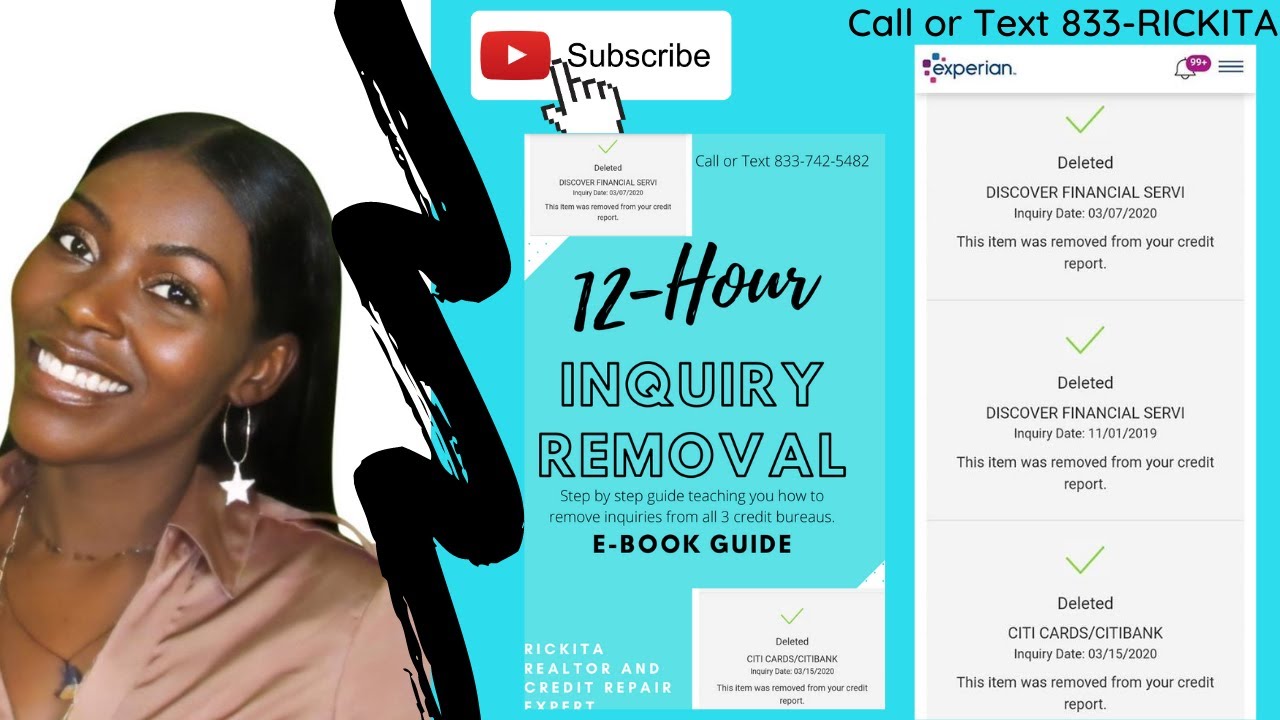

2. Flag any inaccurate hard inquiries.

3. Contact the original lender.

4. Start an official dispute.

5. Include all essential information in your dispute.

6. Submit your dispute to the credit bureau.

7. Wait for a verdict from the credit bureau.

8. The only way to remove hard inquiries in a single day is to dispute them as errors.

9. If you find an unauthorized or inaccurate hard inquiry, you can file a dispute letter and request its removal.

10. Hard inquiries can be removed if they are the result of identity theft, otherwise, they will naturally fall off after two years.

Questions:

1. How can I remove hard inquiries from my credit report in 24 hours?

2. How can I get credit inquiries removed fast?

3. How do I remove hard inquiries in 15 minutes?

4. Can you get hard inquiries removed early?

5. How do you knock off hard inquiries?

6. What do you say to get hard inquiries removed?

7. How fast can inquiries be removed? How long do inquiries stay on your credit report?

8. Can you remove inquiries online?

9. Can you remove hard inquiries without disputing them?

10. Can you remove hard inquiries if they are legitimate but unauthorized?

11. How often should I check my credit report for hard inquiries?

12. Can hard inquiries be removed if they lower my credit score?

13. Are soft inquiries treated differently than hard inquiries?

14. Can I remove hard inquiries if I have proof that they are inaccurate?

15. What are the consequences of having too many hard inquiries on my credit report?

Answers:

1. The only way to remove hard inquiries from your credit report in 24 hours is to dispute them as errors. This process involves obtaining free copies of your credit report, flagging any inaccurate hard inquiries, contacting the original lender, starting an official dispute, including all essential information, submitting your dispute, and waiting for a verdict from the credit bureau.

2. The fastest way to get credit inquiries removed is by disputing them as errors. Follow the steps mentioned earlier to initiate the dispute and request the removal of the inquiries.

3. If you find an unauthorized or inaccurate hard inquiry, you can file a dispute letter and request the credit bureau to remove it from your report. The bureau is obligated to investigate dispute requests, unless they consider them frivolous.

4. If a hard credit inquiry is legitimate and you knew about the credit application, there is no way to remove it other than waiting. After 12 months, it will no longer impact your credit score, and it will fall off your credit report after two years.

5. Disputing hard inquiries involves working with the credit reporting agencies and possibly the creditor who made the inquiry. Hard inquiries cannot be removed unless they are the result of identity theft, and they will naturally fall off after two years.

6. To get hard inquiries removed, you can write a dispute letter to the credit bureau. State that you obtained a copy of your credit report, noticed an unauthorized credit inquiry from the company, and dispute its presence on your report, requesting removal.

7. Hard inquiries stay on your credit reports for two years, but their impact on your credit scores may only last for a year or even just a few months. Soft inquiries, on the other hand, typically stay on your credit reports for 12-24 months.

8. It depends on the credit bureau and their online dispute resolution system. Some credit bureaus may allow you to initiate the removal process online, while others may require you to send a dispute letter via mail.

9. Hard inquiries can only be removed through the dispute process. If the inquiries are inaccurate or unauthorized, you have the right to request their removal.

10. If a hard inquiry is both legitimate and unauthorized, it may be difficult to have it removed. However, you can still file a dispute and provide any evidence or proof that the inquiry was not authorized by you.

11. It is recommended to check your credit report regularly, at least once a year, to identify any unauthorized or inaccurate hard inquiries. This will help you take action and dispute them promptly.

12. Hard inquiries themselves do not lower your credit score significantly. However, having too many recent inquiries can be seen as a negative factor by lenders, as it may indicate that you are seeking credit from multiple sources simultaneously. This can potentially lower your credit score.

13. Soft inquiries, such as those made for pre-approved credit offers or background checks, do not impact your credit score. They are visible on your credit report but do not affect your creditworthiness.

14. If you have proof that a hard inquiry on your credit report is inaccurate, you should include that evidence in your dispute letter to the credit bureau. Providing supporting documentation can strengthen your case for removal.

15. Having too many hard inquiries on your credit report can be viewed as a red flag by lenders, as it suggests that you are actively seeking credit. This can make it harder for you to obtain new credit, and it may negatively impact your credit score if you have multiple recent inquiries.

How can I remove hard inquiries from my credit report in 24 hours

How Do You Dispute (and Remove) Unauthorized InquiriesObtain free copies of your credit report.Flag any inaccurate hard inquiries.Contact the original lender.Start an official dispute.Include all essential information.Submit your dispute.Wait for a verdict.

Cached

How can I get credit inquiries removed fast

The only way to get hard inquiries removed from your credit report in a single day is to dispute them as errors.

Cached

How do I remove hard inquiries from 15 minutes

If you find an unauthorized or inaccurate hard inquiry, you can file a dispute letter and request that the bureau remove it from your report. The consumer credit bureaus must investigate dispute requests unless they determine your dispute is frivolous.

Cached

Can you get hard inquiries removed early

If you spot a hard credit inquiry on your credit report and it's legitimate (i.e., you knew you were applying for credit), there's nothing you can do to remove it besides wait. It won't impact your score after 12 months and will fall off your credit report after two years.

Cached

How do you knock off hard inquiries

Disputing hard inquiries on your credit report involves working with the credit reporting agencies and possibly the creditor that made the inquiry. Hard inquiries can't be removed, however, unless they're the result of identity theft. Otherwise, they'll have to fall off naturally, which happens after two years.

What do you say to get hard inquiries removed

I recently obtained a copy of my credit report from <name of the credit bureau — Equifax, Experian, and/or TransUnion>. It indicated that a credit inquiry was made by your company. However, this inquiry was not authorized by me. Therefore, I am writing to dispute this inquiry and have it removed from my credit report.

How fast can inquiries be removed

How long do inquiries stay on your credit report Hard inquiries are taken off of your credit reports after two years. But your credit scores may only be affected for a year, and sometimes it might only be for a few months. Soft inquiries will only stay on your credit reports for 12-24 months.

Can you remove inquiries online

If you can't trace the reason for a hard inquiry or you believe it was done without your consent, you can dispute it online. If the credit bureau can't confirm it as a legitimate inquiry, it's required to remove it.

Can you remove hard inquiries online

If you can't trace the reason for a hard inquiry or you believe it was done without your consent, you can dispute it online. If the credit bureau can't confirm it as a legitimate inquiry, it's required to remove it.

Is 7 hard inquiries bad

However, multiple hard inquiries can deplete your score by as much as 10 points each time they happen. People with six or more recent hard inquiries are eight times as likely to file for bankruptcy than those with none. That's way more inquiries than most of us need to find a good deal on a car loan or credit card.

How many inquiries is okay

There's no such thing as “too many” hard credit inquiries, but multiple applications for new credit accounts within a short time frame could point to a risky borrower. Rate shopping for a particular loan, however, may be treated as a single inquiry and have minimal impact on your creditworthiness.

Is 3 inquiries bad

A single hard inquiry will drop your score by no more than five points. Often no points are subtracted. However, multiple hard inquiries can deplete your score by as much as 10 points each time they happen.

How do you get rid of negative inquiries

Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years. Lenders use your credit reports to scrutinize your past debt payment behavior and make informed decisions about whether to extend you credit and under what terms.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

How many credit inquiries is OK

There's no such thing as “too many” hard credit inquiries, but multiple applications for new credit accounts within a short time frame could point to a risky borrower. Rate shopping for a particular loan, however, may be treated as a single inquiry and have minimal impact on your creditworthiness.

Is having 10 inquiries bad

However, multiple hard inquiries can deplete your score by as much as 10 points each time they happen. People with six or more recent hard inquiries are eight times as likely to file for bankruptcy than those with none. That's way more inquiries than most of us need to find a good deal on a car loan or credit card.

How many points will my credit score go down with 3 hard inquiries

While a hard inquiry does impact your credit scores, it typically only causes them to drop by about five points, according to credit-scoring company FICO®. And if you have a good credit history, the impact may be even less.

What is the 609 loophole

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports.

How long does it take to go from 550 to 750 credit score

How Long Does It Take to Fix Credit The good news is that when your score is low, each positive change you make is likely to have a significant impact. For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.

How fast can I add 100 points to my credit score

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Why do I have 3 hard inquiries

Sometimes when you apply for credit, each application triggers a hard inquiry. That's how credit card applications work, for example. That means applying for multiple credit cards over a short period of time will lead to multiple hard inquiries.

Is 4 hard inquiries too many

There's no such thing as “too many” hard credit inquiries, but multiple applications for new credit accounts within a short time frame could point to a risky borrower. Rate shopping for a particular loan, however, may be treated as a single inquiry and have minimal impact on your creditworthiness.

What is a 623 dispute letter

A business uses a 623 credit dispute letter when all other attempts to remove dispute information have failed. It refers to Section 623 of the Fair Credit Reporting Act and contacts the data furnisher to prove that a debt belongs to the company.

What is the 11 word credit loophole

In case you are wondering what the 11 word phrase to stop debt collectors is supposed to be its “Please cease and desist all calls and contact with me immediately.”

How can I raise my credit score 100 points overnight

How To Raise Your Credit Score by 100 Points OvernightGet Your Free Credit Report.Know How Your Credit Score Is Calculated.Improve Your Debt-to-Income Ratio.Keep Your Credit Information Up to Date.Don't Close Old Credit Accounts.Make Payments on Time.Monitor Your Credit Report.Keep Your Credit Balances Low.