Summary of the Article:

1. How can I borrow instant loan from UBA?

To borrow an instant loan from UBA, you have several options. You can dial *919*28# on your phone, send “Loan” to Leo on Instagram, WhatsApp, Apple messages, Facebook messenger, or Google Business Chat, or select the Click Credit feature on the UBA Mobile App.

2. How can I be eligible for UBA loan?

To be eligible for a UBA loan, you will need to provide certain documents. These include a UBA consumer loan application form, a letter of lien or set-off or deposit hypothecation agreement in your name, a letter of confirmation of collateral, an original certificate of deposit or savings passbook, and a memorandum of charge over the investment or cash deposit.

3. What is the code for UBA instant loan?

The code for UBA’s instant loan is *919*28#. By dialing this code, you can enter the desired loan amount and select the loan period.

4. Does UBA borrow people money?

Yes, UBA offers personal loans to individuals. With the UBA Personal Loan, you can borrow up to N30 million with a flexible repayment period of 48 months and a competitive interest rate.

5. How can I take a loan instantly?

To take a loan instantly, you can follow these steps: compare lenders online, check eligibility, fill out the online application, provide your PAN number and Aadhaar number, wait for approval, and repay the loan according to the terms and conditions set by the lender.

6. How do I get access to an instant loan?

You can get access to an instant loan by using various methods such as dialing *901*11# or *426*11#, using Internet Banking, WhatsApp Banking, Access Mobile App, or QuickBucks App. These services are available 24/7 and do not require a visit to the bank.

7. How do I know if I qualify for a loan?

Financial institutions evaluate loan applications based on several criteria. Some common requirements include credit score and history, income, debt-to-income ratio, collateral, and origination fee. These factors are used to determine if you qualify for a loan.

8. How do I get approved for a bank loan?

To get approved for a bank loan, you can follow these steps: run the numbers to determine how much you need and can afford, check your credit score, consider different loan options, shop around for the best interest rates, choose a lender and apply, provide the necessary documentation, accept the loan offer, and start making payments according to the agreement.

Question 1: How can I borrow instant loan from UBA?

Answer 1: To borrow an instant loan from UBA, you have several options. You can dial *919*28# on your phone, send “Loan” to Leo on Instagram, WhatsApp, Apple messages, Facebook messenger, or Google Business Chat, or select the Click Credit feature on the UBA Mobile App.

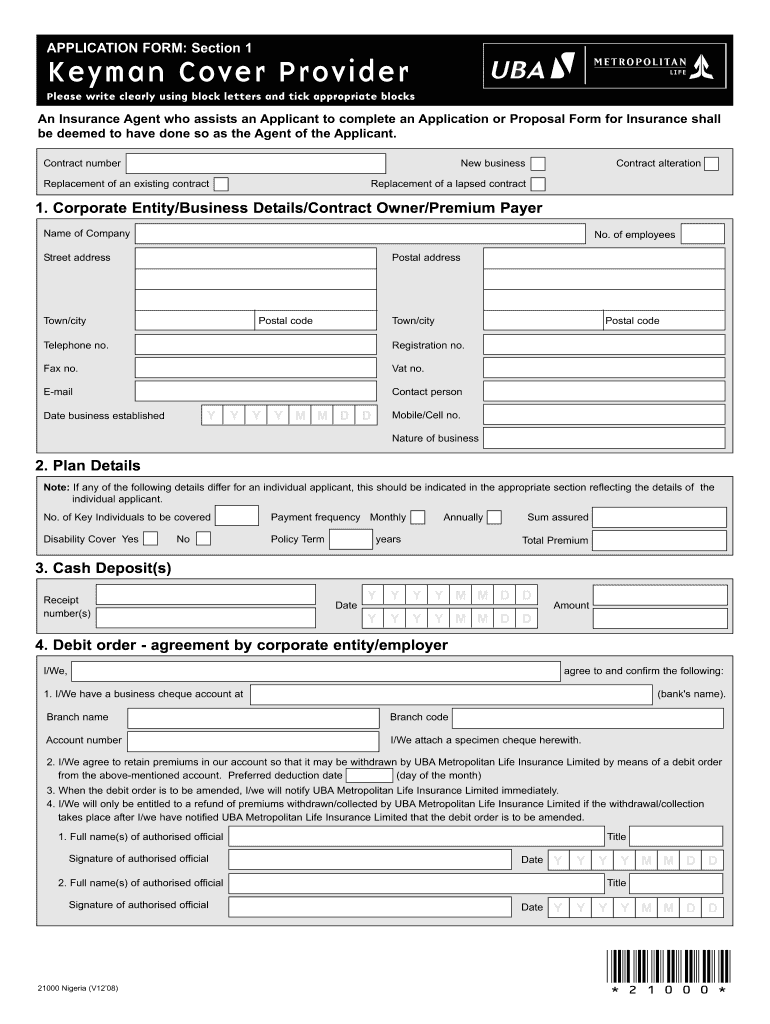

Question 2: How can I be eligible for UBA loan?

Answer 2: To be eligible for a UBA loan, you will need to provide certain documents. These include a UBA consumer loan application form, a letter of lien or set-off or deposit hypothecation agreement in your name, a letter of confirmation of collateral, an original certificate of deposit or savings passbook, and a memorandum of charge over the investment or cash deposit.

Question 3: What is the code for UBA instant loan?

Answer 3: The code for UBA’s instant loan is *919*28#. By dialing this code, you can enter the desired loan amount and select the loan period.

Question 4: Does UBA borrow people money?

Answer 4: Yes, UBA offers personal loans to individuals. With the UBA Personal Loan, you can borrow up to N30 million with a flexible repayment period of 48 months and a competitive interest rate.

Question 5: How can I take a loan instantly?

Answer 5: To take a loan instantly, you can follow these steps: compare lenders online, check eligibility, fill out the online application, provide your PAN number and Aadhaar number, wait for approval, and repay the loan according to the terms and conditions set by the lender.

Question 6: How do I get access to an instant loan?

Answer 6: You can get access to an instant loan by using various methods such as dialing *901*11# or *426*11#, using Internet Banking, WhatsApp Banking, Access Mobile App, or QuickBucks App. These services are available 24/7 and do not require a visit to the bank.

Question 7: How do I know if I qualify for a loan?

Answer 7: Financial institutions evaluate loan applications based on several criteria. Some common requirements include credit score and history, income, debt-to-income ratio, collateral, and origination fee. These factors are used to determine if you qualify for a loan.

Question 8: How do I get approved for a bank loan?

Answer 8: To get approved for a bank loan, you can follow these steps: run the numbers to determine how much you need and can afford, check your credit score, consider different loan options, shop around for the best interest rates, choose a lender and apply, provide the necessary documentation, accept the loan offer, and start making payments according to the agreement.

How can I borrow instant loan from UBA

Get a loan in one minute.Just dial *919*28#Send “Loan” to Leo on Instagram, WhatsApp, Apple messages, Facebook messenger or Google Business Chat.Select the Click Credit feature on the UBA Mobile App.

How can I be eligible for UBA loan

Document required:UBA consumer loan application form.Letter of Lien or set-off or Deposit Hypothecation Agreement in your name.Letter of confirmation of collateral.Original certificate of deposit or savings passbook.Memorandum of charge over the investment or cash deposit.

What is the code for UBA instant loan

For UBA quick loan code: Dial *919*28# Enter amount. Select period.

Does UBA borrow people money

Personal Loans

With the UBA Personal Loan, you can get up to N30 million, to help you live your dreams. You also enjoy a flexible repayment period of 48 months at a highly competitive interest rate.

How can I take loan instantly

To get an instant loan online, compare lenders, check eligibility, fill out the online application, share your PAN number and Aadhaar number, wait for approval, and repay the loan according to terms. You can apply for an instant loan online, get approved, and receive the funds you need quickly and easily.

How do I get access instant loan

You can get access to an instant loan by dialing *901*11#, *426*11# or via Internet Banking, WhatsApp Banking, Access Mobile App and QuickBucks App. 24/7 service which does not require visits to the bank and application is done conveniently via *901*11#, *426#, QuickBucks App, Internet Banking, Mobile App.

How do I know if I qualify for a loan

Here are five common requirements that financial institutions look at when evaluating loan applications.Credit Score and History. An applicant's credit score is one of the most important factors a lender considers when evaluating a loan application.Income.Debt-to-income Ratio.Collateral.Origination Fee.

How do I get approved for a bank loan

How to get a personal loan in 8 stepsRun the numbers.Check your credit score.Consider your options.Choose your loan type.Shop around for the best personal loan rates.Pick a lender and apply.Provide necessary documentation.Accept the loan and start making payments.

How do I borrow a loan with USSD code

How to Apply for Loans Using USSD CodesDial the USSD code for the financial institution offering the loan.Select the loan option from the menu.Provide the required information, such as loan amount, repayment period, and personal information.Review the terms and conditions of the loan.

Which app can I use to borrow money

Summary of cash advance apps

| Loan app | Loan amount | Other fees |

|---|---|---|

| Brigit | $20-$250. | $9.99 monthly subscription fee. |

| EarnIn | Up to $100 per day, $750 per pay period. | None. |

| Empower | $10-$250. | $8 monthly subscription fee unless you opt out. |

| Dave | Up to $500. | $1 monthly membership fee. |

Can I borrow money from my account

Passbook loans — sometimes called pledge savings loans — are a type of secured loan that uses your savings account balance as collateral. These loans are offered by financial institutions, like banks and credit unions, and can be a convenient way to borrow money while rebuilding your credit.

Where can I borrow money in 5 minutes

Specta is an online lending platform that gives you loans of up to 5 Million in one transaction all within 5 minutes! No collateral, no paperwork and no visit to any office. With Specta, you can take care of urgent personal and business needs anywhere, anytime.

How to get urgent money

Need Money Urgently 9 Ways You Can Get Fast CashGet a personal loan.Try P2P lending.Sell your unwanted possessions.Withdraw cash using a credit card.Avail a payday loan.Sell your stocks.Borrow money from friends/family.Get a loan against your PPF account.

What is the fastest way to get a loan approved

The easiest loans to get approved for are payday loans, car title loans, pawnshop loans and personal loans with no credit check. These types of loans offer quick funding and have minimal requirements, so they're available to people with bad credit. They're also very expensive in most cases.

What is instant loan approval

Instant approval for personal loans means that the lender disburses funds on the same day or the next day after receiving a loan application from qualified borrowers. Instant approval loans are convenient when you need emergency funding for unplanned expenses like medical bills.

What are the easiest loans to get approved for

The easiest loans to get approved for are payday loans, car title loans, pawnshop loans and personal loans with no credit check. These types of loans offer quick funding and have minimal requirements, so they're available to people with bad credit. They're also very expensive in most cases.

How much credit score needed for loan

Ans. No lender specifies a minimum CIBIL score requirement for a personal loan application. However, a score of 750 and above is preferred by lenders for loan applications. This score reflects the creditworthiness of the borrower and the chances of lenders approving the loan application with this score increases.

What is the minimum loan you can get from a bank

For the most personal loan lenders, $1,000-$5,000 is the lowest amount you can borrow. But the minimum loan amount can vary substantially from one lender to another.

What is the USSD code for lend me

Dial *565 *0# from the number linked to your bank account.

What app lets you borrow $200

From getting your paycheck early to effortlessly saving money, Chime makes banking – and borrowing up to $200 – a breeze. SpotMe is Chime's answer to the dreaded overdraft fee. You can overdraft your Chime account up to $200 on debit card purchases without any fees – instantly.

What app will give me $50 instantly

Best $50 Loan Instant Apps of 2023 For Bad Credit & No Credit CheckGreen Dollar Loans: Best Alternative to Any $50 Loan Instant App Online for Bad Credit.Big Buck Loans: Best for $50 Loan Instant No Credit Check Alternatives for Unemployed Individuals.

What is the easiest loan to get

The easiest loans to get approved for are payday loans, car title loans, pawnshop loans and personal loans with no credit check. These types of loans offer quick funding and have minimal requirements, so they're available to people with bad credit.

Which app lets you borrow money

Top money borrowing apps of 2023

| App | Maximum loan amount | Time to funding |

|---|---|---|

| Chime | $20-$200 | At the point of sale |

| Dave | Up to $500 | Instant |

| MoneyLion | $25-$500 | 12-48 hours for a fee; 3-5 business days free of charge |

| Possible Finance | Up to $500 | Instant |

How to get $1,000 fast without a loan

Here are some great ways to make $1000 fast, in a week or less:Make Deliveries.Drive for Uber or Lyft.Take Online Surveys.Start Freelancing.Earn Cash Back When You Shop.Sell Stuff.Sell Jewelry You Don't Want.Maximize Bank Bonuses.

What apps let you borrow money immediately

Summary of cash advance apps

| Loan app | Loan amount | Fast-funding fee |

|---|---|---|

| EarnIn | Up to $100 per day, $750 per pay period. | $1.99-$3.99. |

| Empower | $10-$250. | $1-$8. |

| Dave | Up to $500. | $1.99-$13.99. |

| MoneyLion | $10-$500. | $0.49-$8.99. |