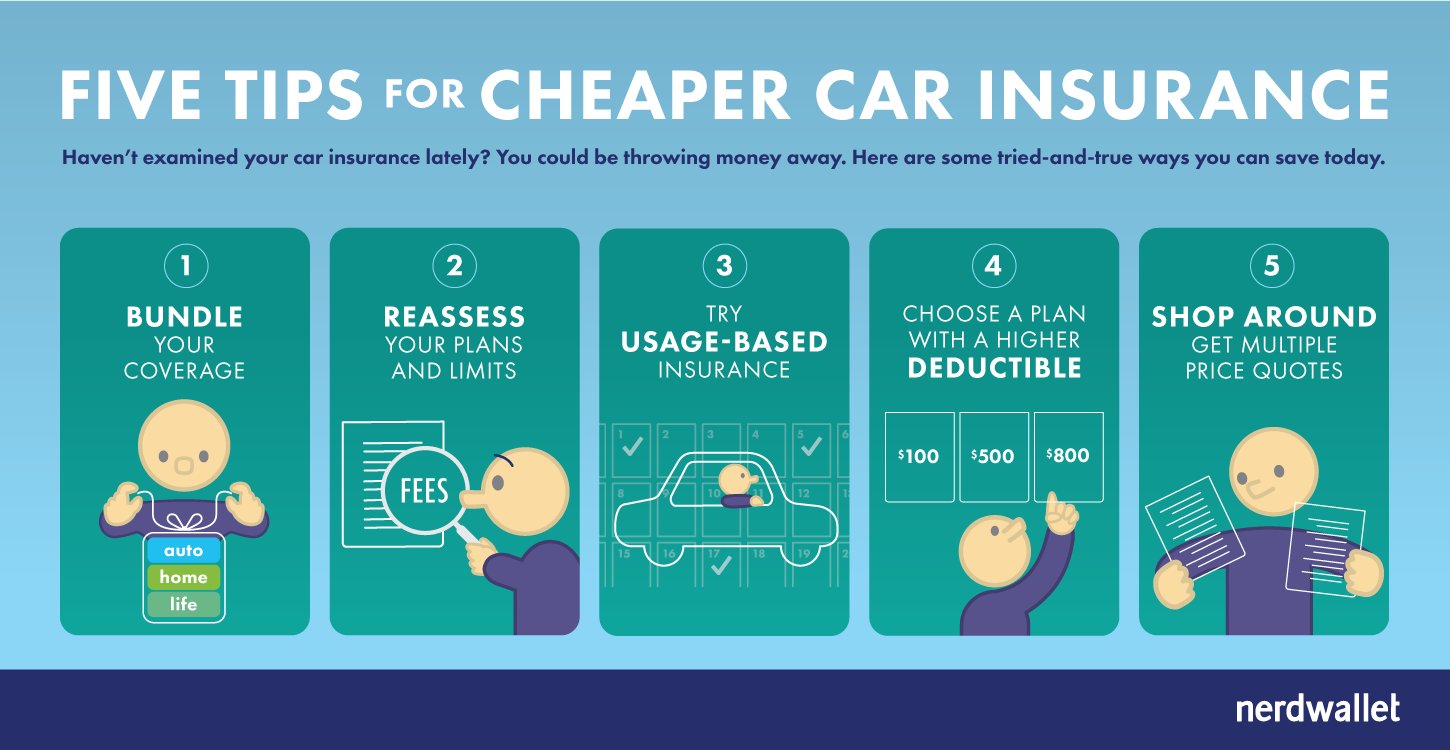

Summary: In this article, we will explore various ways to save on car insurance premiums. By increasing your deductible, checking for discounts, comparing quotes, maintaining a good driving record, participating in safe driving programs, taking defensive driving courses, exploring payment options, and improving your credit score, you can lower your car insurance costs significantly.

Key Points:

- Increasing your deductible can help save on car insurance.

- Check for discounts that you may qualify for.

- Comparing auto insurance quotes is essential to find the best deal.

- Having a good driving record can lead to lower premiums.

- Participating in safe driving programs can result in discounts.

- Taking defensive driving courses can help reduce your insurance costs.

- Exploring different payment options may provide savings.

- Improving your credit score can also lead to lower car insurance rates.

Questions:

- What is the fastest way to lower car insurance?

The fastest way to lower car insurance includes increasing your deductible, checking for discounts, comparing quotes, maintaining a good driving record, participating in safe driving programs, taking defensive driving courses, exploring payment options, and improving your credit score. - Who typically has the cheapest car insurance?

According to NerdWallet’s 2023 analysis, State Farm is considered the cheapest large auto insurance company in the nation for good drivers. - How can I reduce my insurance premiums?

To reduce insurance premiums, you can choose car safety and security features, set higher deductibles, take defensive driving courses, park your car in a garage, compare quotes, bundle insurance policies, and maintain good grades. - How do I get around paying high insurance?

One way to lower your car insurance is by getting a discount bulk rate for insuring multiple vehicles and drivers on the same policy. Maintaining a safe driving record is also crucial for obtaining lower rates. - What are three factors that lower the cost of car insurance?

Three factors that may lower car insurance costs include the type of car you drive, your driving habits, and the coverages, limits, and deductibles you choose. Other factors may include age, anti-theft features in your car, and your driving record. - Does credit score affect insurance rates?

Yes, a higher credit score can decrease your car insurance rate significantly. Almost every insurance company and state take credit score into account, although getting a quote does not impact your credit. - Which is cheaper, Geico or Progressive?

Geico and Progressive both offer cheap car insurance options. While Geico’s rates are generally lower overall, Progressive tends to offer better prices for high-risk drivers. - Does credit score affect insurance rates?

Yes, your credit score can have a significant impact on your insurance rate. Poor credit can increase annual rates by 72% compared to those with good credit.

What is the fastest way to lower car insurance

Here are some ways to save on car insurance1Increase your deductible.Check for discounts you qualify for.Compare auto insurance quotes.Maintain a good driving record.Participate in a safe driving program.Take a defensive driving course.Explore payment options.Improve your credit score.

Cached

Who typically has the cheapest car insurance

State Farm is the cheapest large auto insurance company in the nation for good drivers, according to NerdWallet's 2023 analysis of minimum coverage rates.

How can I reduce my insurance premiums

7 easy ways to help lower your car insurance premiumsChoose car safety and security features.Set higher deductibles on your auto insurance.Take a defensive driving course.Park your car in a garage.Compare auto insurance quotes.Bundle insurance policies.Get good grades.

How do I get around paying high insurance

One way to lower your car insurance is through a discount bulk rate for insuring several vehicles and drivers on the same policy. Lower car insurance rates may also be available if you have other insurance policies with the same company. Maintaining a safe driving record is key to getting lower car insurance rates.

Cached

What are 3 factors that lower your cost for car insurance

Some factors that may affect your auto insurance premiums are your car, your driving habits, demographic factors and the coverages, limits and deductibles you choose. These factors may include things such as your age, anti-theft features in your car and your driving record.

Does credit score affect insurance rate

A higher credit score decreases your car insurance rate, often significantly, with almost every insurance company and in most states. Getting a quote, however, does not affect your credit.

Who is cheaper Geico or Progressive

Is Progressive Cheaper Than Geico Both Geico and Progressive offer cheap car insurance to drivers across the country. Geico's rates are typically lower overall, but Progressive tends to offer better prices to high-risk drivers.

Does credit affect insurance rates

Yes. A higher or lower credit score can have a significant impact on your insurance rate. Poor credit increases annual rates by 72% compared to good credit.

What are 4 ways to cut your costs for insurance

Listed below are other things you can do to lower your insurance costs.Shop around.Before you buy a car, compare insurance costs.Ask for higher deductibles.Reduce coverage on older cars.Buy your homeowners and auto coverage from the same insurer.Maintain a good credit record.Take advantage of low mileage discounts.

Why my insurance is so high

Auto accidents and traffic violations are common explanations for an insurance rate increasing, but there are other reasons why car insurance premiums go up including an address change, new vehicle, and claims in your zip code.

What are the top 3 things you can do to lower your health insurance costs

How can I lower my monthly health insurance costYou can't control when you get sick or injured.See if you're eligible for the tax credit subsidy.Choose an HMO.Choose a plan with a high deductible.Choose a plan that pairs with a health savings account.Related Items.

What makes car insurance high

Common causes of overly expensive insurance rates include your age, driving record, credit history, coverage options, what car you drive and where you live. Anything that insurers can link to an increased likelihood that you will be in an accident and file a claim will result in higher car insurance premiums.

What is a good credit score for car insurance

A good insurance score is roughly 700 or higher, though it differs by company. You can improve your auto insurance score by checking your credit reports for errors, managing credit responsibly, and building a long credit history.

Does car insurance check your credit

Do all auto insurance companies check your credit Most insurers use credit checks to create a credit-based insurance score to help set your rate. Some insurers provide auto insurance with no credit check, which might seem appealing if you have a poor credit history.

Is Geico actually cheap

Geico has the cheapest liability-only insurance for most drivers in California. The company charges $31 per month on average for a minimum liability policy. That's 36% cheaper than the state average. The average cost of minimum coverage car insurance in California is $49 per month, or $587 per year.

Who has to pay the most for car insurance

Age affects the insurance cost gap between genders

While adult men and women pay about the same amount for car insurance, the gap changes as drivers get older. While all teens pay more for car insurance than older adults, teenage boys pay the most of all.

Does your credit go down if you don’t pay insurance

If you are late with your car insurance, utility bills, or other payments, they may eventually go to collections. When that happens, it can make a negative mark on your credit score. That can affect how easily you qualify for loans, credit cards, and other credit products.

Why am I paying too much for car insurance

Common causes of overly expensive insurance rates include your age, driving record, credit history, coverage options, what car you drive and where you live. Anything that insurers can link to an increased likelihood that you will be in an accident and file a claim will result in higher car insurance premiums.

Can you negotiate health insurance prices

Yes, you can negotiate with the hospital or healthcare office's billing department to ask for a lower balance.

Can my credit score lower my car insurance

A higher credit score decreases your car insurance rate, often significantly, with almost every insurance company and in most states. Getting a quote, however, does not affect your credit.

Does it hurt your credit score to get car insurance quotes

It is true that insurance companies check your credit score when giving you a quote. However, what they're doing is called a 'soft pull' — a type of inquiry that won't affect your credit score. You'll be able to see these inquiries on your personal credit reports, but that's it.

What does your credit score have to do with car insurance

A higher credit score decreases your car insurance rate, often significantly, with almost every insurance company and in most states. Getting a quote, however, does not affect your credit.

Who is cheaper GEICO or Progressive

Is Progressive Cheaper Than Geico Both Geico and Progressive offer cheap car insurance to drivers across the country. Geico's rates are typically lower overall, but Progressive tends to offer better prices to high-risk drivers.

How to negotiate with GEICO

How to Negotiate Your GEICO ClaimMake the First Offer. This piece of advice tends to contradict the belief that the party who makes the first offer frequently loses.Make an Aggressive but Not Outrageous First Offer.Know Your Bottom Number.Try to Mimic or Mirror the Claims Adjuster's Behavior.Give a Settlement Range.

How much of your income should go to car insurance

In general, experts recommend spending 10%–15% of your income on transportation, including car payment, insurance, and fuel.