Summary:

Is Gap full coverage?

No, gap insurance is not the same as full coverage, but it can be part of full coverage. Full coverage is commonly defined as the combination of a state’s minimum required insurance, comprehensive insurance, and collision insurance, though gap coverage is included if required by a lender or lessor.

Will gap insurance pay off my loan?

Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car’s depreciated value. Gap insurance may also be called “loan/lease gap coverage.”

What would cause gap insurance to not cover?

Gap insurance does not cover routine maintenance, a damaged car that is not declared a total loss, or missed car payments. Gap insurance covers the difference between a car’s actual cash value and the balance left on the loan or lease if the car is totaled or stolen.

Does gap cover negative equity?

Some gap insurance policies might cover you for the total loan balance, including negative equity rolled into your new car loan. For example, if you trade in a car on which you owe more than it’s worth, that negative equity is rolled into your new loan.

What is an example of a gap insurance?

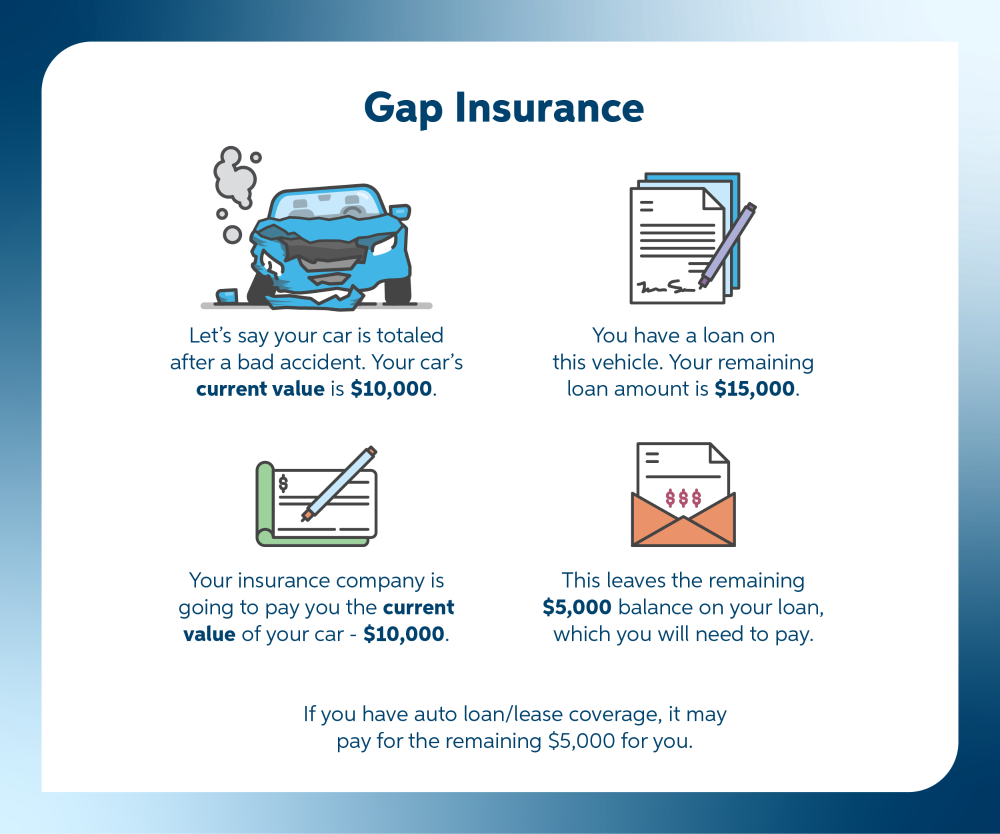

When your loan amount is more than your vehicle is worth, gap insurance coverage pays the difference. For example, if you owe $25,000 on your loan and your car is only worth $20,000, your gap coverage covers the $5,000 gap, minus your deductible.

Does gap insurance cover engine failure?

GAP insurance does not apply in the event of engine failure, mechanical malfunctions, owner death, or in cases where extended warranty coverage conflicts.

Is gap insurance refund after payoff?

When you cancel your GAP policy early, you’ll receive a GAP insurance refund reimbursing you with a portion of your unused premiums. This usually occurs after you repay your loan, or if you sell or trade in your vehicle before you pay off your loan.

Why didn’t Gap pay off my car?

The most common reasons are a loss that isn’t covered by the policy or that the policy has lapsed. Gap insurance only pays in one situation: After an accident, your car is a total loss and you owe more than it’s worth.

Questions:

- Is gap insurance the same as full coverage?

- What does gap insurance cover?

- Can gap insurance pay off my loan?

- Will gap insurance cover routine maintenance?

- Does gap insurance cover missed car payments?

- Can gap insurance cover negative equity?

- What happens if my car is worth less than my loan amount?

- Does gap insurance cover engine failure?

- Can I get a refund for gap insurance?

- Why didn’t gap insurance pay off my car?

No, gap insurance is not the same as full coverage. Full coverage includes state minimum insurance, comprehensive insurance, and collision insurance.

Gap insurance covers the difference between the actual cash value of a car and the balance left on the loan or lease.

Yes, if your car is totaled or stolen and you owe more than its depreciated value, gap insurance can help pay off your loan.

No, gap insurance does not cover routine maintenance.

No, gap insurance does not cover missed car payments.

Yes, some gap insurance policies cover negative equity rolled into a new car loan.

Gap insurance pays the difference between the car’s actual cash value and the balance left on the loan or lease.

No, gap insurance does not cover engine failure.

Yes, if you cancel your gap insurance policy early, you may receive a refund of unused premiums.

There could be various reasons, such as the policy not covering the specific loss or the policy lapsing.

Is Gap full coverage

No, gap insurance is not the same as full coverage, but it can be part of full coverage. Full coverage is commonly defined as the combination of a state's minimum required insurance, comprehensive insurance, and collision insurance, though gap coverage is included if required by a lender or lessor.

Will gap insurance pay off my loan

Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car's depreciated value. Gap insurance may also be called "loan/lease gap coverage."

Cached

What would cause gap insurance to not cover

Gap insurance does not cover routine maintenance, a damaged car that is not declared a total loss, or missed car payments. Gap insurance covers the difference between a car's actual cash value and the balance left on the loan or lease if the car is totaled or stolen.

Cached

Does gap cover negative equity

Some gap insurance policies might cover you for the total loan balance, including negative equity rolled into your new car loan. For example, if you trade in a car on which you owe more than it's worth, that negative equity is rolled into your new loan.

What is an example of a gap insurance

When your loan amount is more than your vehicle is worth, gap insurance coverage pays the difference. For example, if you owe $25,000 on your loan and your car is only worth $20,000, your gap coverage covers the $5,000 gap, minus your deductible.

Does gap insurance cover engine failure

GAP insurance does not apply in the event of engine failure, mechanical malfunctions, owner death, or in cases where extended warranty coverage conflicts.

Is gap insurance refund after payoff

When you cancel your GAP policy early, you'll receive a GAP insurance refund reimbursing you with a portion of your unused premiums. This usually occurs after you repay your loan, or if you sell or trade in your vehicle before you pay off your loan.

Why didn t Gap pay off my car

The most common reasons are a loss that isn't covered by the policy or that the policy has lapsed. Gap insurance only pays in one situation: After an accident, your car is a total loss and you owe more than it's worth.

Does gap insurance cover a missed payment

Gap insurance doesn't cover missed or late payment fees, repossessions, extended warranty costs or car repairs…just loan balances.

Does Gap have a limit

Some gap insurance policies limit the total amount you can receive. For example, Progressive's gap insurance policy covers up to 25% of the vehicle's ACV. It's possible this gap payout wouldn't cover the whole loan if your car had depreciated significantly.

How do I get out of paying negative equity

Refinancing the loan or selling the vehicle are two of the most commonly used ways to deal with negative equity. You may also consider trading in your vehicle for a different car, though that can lead to additional auto loan debt if you're rolling the original loan balance over.

How much is too much negative equity on a car

How much negative equity is too much The best way to determine if the negative equity is too much is to calculate the Loan-to-Value ratio (LTV). Ideally, the loan amount should not exceed 125% of the resale value.

What is gap insurance and how does it work

When your loan amount is more than your vehicle is worth, gap insurance coverage pays the difference. For example, if you owe $25,000 on your loan and your car is only worth $20,000, your gap coverage covers the $5,000 gap, minus your deductible.

What does it mean to be in the gap with insurance

Gap insurance covers the difference between what you owe on your car and what it's worth. You might need it if your car is worth less than what you owe on your car loan.

What happens if your engine blows and you still owe money

You can arrange to surrender the collateral (the car with the blown engine) to the bank. The little or nothing that they get from salvage value should then be deducted from the remaining balance owed, which you can expect them to sue you for.

What to do when your car dies and you still owe money on it

Auto loans don't disappear when the car owner passes away. Any debts the person owed in life will still need to be paid. Typically car loans have a death clause that details the repayment process if the borrower dies. If there's a will, the heir or heirs might inherit the loan along with the vehicle.

How much refund should I expect from gap insurance

If you already paid for gap insurance, you can cancel it and request a refund from your car insurance company for any unused portion of the coverage. For example, if you have six months of coverage left on a 12-month gap insurance policy and you cancel, you can be reimbursed for the unused six months minus any fees.

What is Gap refund settlement

GAP Insurance Refund After Total Loss Accident

If a vehicle is totaled after an accident or is stolen, GAP covers the amount owed on the loan beyond the vehicle's value at the time of loss so that the customer may 'walk away' without any obligation to continue to make payments on a vehicle they no longer own.

What happens to gap insurance when you payoff your car

When you cancel your GAP policy early, you'll receive a GAP insurance refund reimbursing you with a portion of your unused premiums. This usually occurs after you repay your loan, or if you sell or trade in your vehicle before you pay off your loan.

Is GAP insurance refund after payoff

When you cancel your GAP policy early, you'll receive a GAP insurance refund reimbursing you with a portion of your unused premiums. This usually occurs after you repay your loan, or if you sell or trade in your vehicle before you pay off your loan.

How does skip a payment affect GAP insurance

Payment skips on automobile loans with GAP coverage may affect the amount covered in the event of a claim. Skipped payment(s) may be deducted from any GAP benefit. Loan less than 6 months are not eligible for the Skip-A-Payment program. Skip payments are not guaranteed and are subject to approval.

How much does Gap refund

If you already paid for gap insurance, you can cancel it and request a refund from your car insurance company for any unused portion of the coverage. For example, if you have six months of coverage left on a 12-month gap insurance policy and you cancel, you can be reimbursed for the unused six months minus any fees.

What happens if your car breaks down and you still owe money

If you purchased Guaranteed Asset Protection (GAP) insurance when taking out your car loan, it should pay the difference between the value of the vehicle if it is totaled and the amount remaining on your loan. Many auto lenders require such coverage– so check your policy or contact your insurance agent.

What is the best way to get rid of a car with negative equity

Refinancing the loan or selling the vehicle are two of the most commonly used ways to deal with negative equity. You may also consider trading in your vehicle for a different car, though that can lead to additional auto loan debt if you're rolling the original loan balance over.

Can you negotiate negative equity

You also can negotiate a trade-in deal that rolls over the negative equity. Trading in a car with negative equity can be difficult, but with a little bit of research, you can find a deal that works well for you.