ffer between Credit Sesame and Experian:

1. Different scoring models: Credit Sesame uses the VantageScore 3.0 scoring model, while Experian uses their own scoring model. These models can have different algorithms and criteria for calculating scores.

2. Different credit data: Credit Sesame and Experian may have access to different credit data from various sources. This can include credit accounts, payment history, inquiries, and public records.

3. Timing of score updates: Credit Sesame and Experian may update their scores at different times. If there have been recent changes to your credit report, one may reflect those changes earlier than the other.

4. Credit utilization: Your credit utilization, which is the amount of available credit you are using, can affect your score. If your utilization ratio differs between Credit Sesame and Experian, it can lead to score differences.

5. Credit reporting errors: Errors in your credit report can impact your score. If there are discrepancies or inaccuracies in the data used by Credit Sesame or Experian, it can result in score variations.

6. Different credit monitoring services: Credit Sesame and Experian may use different monitoring services to track and interpret credit data. These services may prioritize certain factors differently, resulting in score differences.

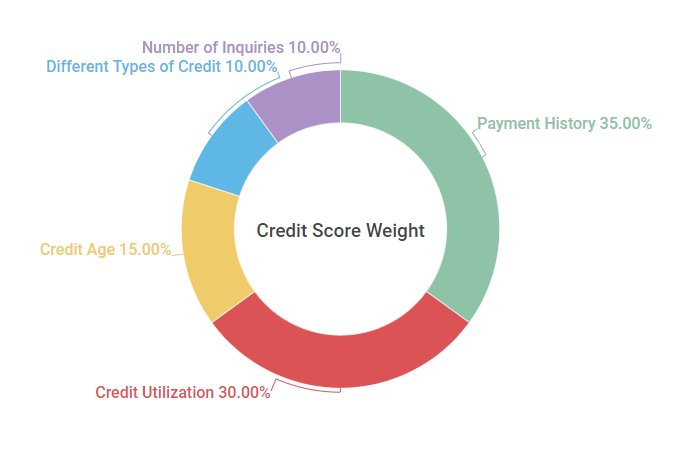

7. Credit score factors: Each scoring model weighs different factors differently. Credit Sesame and Experian may consider different factors more heavily in their calculations, resulting in score variations.

8. Different credit file access: Credit Sesame and Experian may have different levels of access to your credit file. This can include the availability of certain report data or history, which can impact the accuracy of the scores.

9. Credit account types: The types of credit accounts you have, such as credit cards, loans, or mortgages, can impact your score. If the types of accounts differ between Credit Sesame and Experian, it can lead to score variations.

10. Different credit monitoring algorithms: The algorithms used by Credit Sesame and Experian to analyze credit data can be different. These algorithms may have varying levels of complexity or different approaches to interpreting data, resulting in score differences.

Keep in mind that even though there may be differences between your Credit Sesame and Experian scores, both can still provide valuable insight into your credit health. It’s important to review and monitor both scores to get a comprehensive understanding of your credit standing.

Does Credit Sesame use FICO score

The credit score you see on Credit Sesame is based on the VantageScore® 3.0 scoring model. It's provided by TransUnion, but when you upgrade to our premium services, we show your score from all three credit bureaus.

Cached

How can I find out myFICO score

If your bank, credit card issuer, auto lender or mortgage servicer participates in FICO ® Score Open Access, you can see your FICO ® Scores, along with the top factors affecting your scores, for free.

Why is my credit score different on credit sesame

There are several reasons why the score your bank is using and the score in your Credit Sesame account might differ: Your bank might use a different credit scoring model. Your bank might use a different credit bureau. Your bank might have pulled your score on a different day.

What credit report does Credit Sesame pull

TransUnion

Which Credit Bureau Do You Work With A free Credit Sesame account utilizes information from TransUnion, one of the three credit reports from the major national credit bureaus. Upgrade to a premium Credit Sesame plan for credit report info from all three bureaus: TransUnion, Experian and Equifax.

Is Credit Karma or Credit Sesame more accurate

Credit Sesame offers better identity protection options. Credit Karma offers a more detailed credit score simulator. Credit Karma provides access to more financial services (like tax prep and the unclaimed money finder). Credit Sesame makes it easier to get an overall view of your situation on its dashboard.

What apps show FICO score

With myFICO, you can view and monitor your FICO Scores and credit reports right from your fingertips. You'll get alerts on your iOS device when changes are detected. Certain features are available only with eligible myFICO subscriptions. Learn more at www.myfico.com.

Can I get myFICO score on Credit Karma

Though Credit Karma does not currently offer FICO® scores, the scores you see on Credit Karma (VantageScore 3.0 credit scores from TransUnion and Equifax) provide valuable insight into your financial health. It's important to keep in mind that no one credit score is the end-all, be-all.

Why is my credit sesame score higher than experian

There are several reasons why your score might differ from what you've seen elsewhere: You may be seeing a different credit scoring model. You may be seeing your score for a different credit bureau. You may be seeing a score that was pulled on a different day.

Is Credit Karma more accurate than Credit Sesame

Credit Sesame offers better identity protection options. Credit Karma offers a more detailed credit score simulator. Credit Karma provides access to more financial services (like tax prep and the unclaimed money finder). Credit Sesame makes it easier to get an overall view of your situation on its dashboard.

Is 683 a good FICO score

A FICO® Score of 683 falls within a span of scores, from 670 to 739, that are categorized as Good.

Is Credit Sesame a good idea

The simple answer is yes. Credit Sesame is safe and uses the same security measures as banks and the government to keep your information safe and secure. Credit Sesame is not a scam; it is providing a legitimate service.

Why is Credit Karma higher than FICO

Credit Karma uses a different scoring system than the one mortgage lenders use. There are two main scoring systems: FICO – it was created in the 1950s and is used by mortgage lenders. VantageScore – it began in 2006 and is what Credit Karma uses.

What is the best site for accurate FICO score

Generally, Credit Karma is the overall best site in terms of getting free credit scores and free credit reports. It provides free weekly scores and reports from Transunion and Equifax that are available without having to provide your credit card first.

What is the best way to get your FICO score

One of the best ways to access your FICO® credit score for free is through Discover Credit Scorecard. This program is free whether you are a Discover customer or not. To get started, you'll be asked for some personal information, including your Social Security number.

Which score is better FICO or Credit Karma

Your Credit Karma score should be the same or close to your FICO score, which is what any prospective lender will probably check. The range of your credit score (such as "good" or "very good") is more important than the precise number, which will vary by source and edge up or down often.

Is FICO or Credit Sesame more accurate

The score is accurate for what it is, but this is not the same score lenders look at when you make an application for a loan. Lenders look at what is known as a FICO score, this is calculated differently to the score sesame provides and even has a different range (360-840 for sesame and 300-850 for FICO).

Why is my FICO score different than my credit score

Why is my FICO® score different from my credit score Your FICO Score is a credit score. But if your FICO score is different from another of your credit scores, it may be that the score you're viewing was calculated using one of the other scoring models that exist.

What is more accurate Credit Karma or FICO

Credit Karma compiles its own accurate VantageScore based on that information. Your Credit Karma score should be the same or close to your FICO score, which is what any prospective lender will probably check.

What does a 850 FICO score look like

Your 850 FICO® Score is nearly perfect and will be seen as a sign of near-flawless credit management. Your likelihood of defaulting on your bills will be considered extremely low, and you can expect lenders to offer you their best deals, including the lowest-available interest rates.

What is a perfect FICO score

850 FICO

An 850 FICO® Score isn't as uncommon as you might think. Statistically, there's a good chance you've attended a wedding, conference, church service or other large gathering with someone who has a perfect score. As of the third quarter (Q3) of 2021, 1.31% of all FICO® Scores in the U.S. stood at 850.

Is Credit Karma or Credit Sesame better

Credit Sesame offers better identity protection options. Credit Karma offers a more detailed credit score simulator. Credit Karma provides access to more financial services (like tax prep and the unclaimed money finder). Credit Sesame makes it easier to get an overall view of your situation on its dashboard.

Is Credit Sesame and Experian the same

Credit Sesame does not provide free access to your credit data from the two other credit bureaus, Experian and Equifax. Credit Sesame does not provide your FICO® Score—the credit score used by most lenders.

How far off is Credit Karma from FICO

Your Credit Karma score should be the same or close to your FICO score, which is what any prospective lender will probably check. The range of your credit score (such as "good" or "very good") is more important than the precise number, which will vary by source and edge up or down often.

How far off is Credit Karma from your actual credit score

Here's the short answer: The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

Which score is more accurate FICO or Experian

Experian's advantage over FICO is that the information it provides is far more detailed and thorough than a simple number. A pair of borrowers could both have 700 FICO Scores but vastly different credit histories.