e a debt Disputing a debt can be a good idea if you believe that the debt is not valid or if you have already paid it off. By disputing the debt, you can challenge the collection agency and ask for proof that the debt is legitimate. If they cannot provide the necessary documentation, the debt may be removed from your credit report.

Can you dispute a charge on your credit card Yes, you can dispute a charge on your credit card if you believe that it is fraudulent or if you did not receive the goods or services as promised. It is important to act quickly and notify your credit card company as soon as possible. They will investigate the charge and may issue a refund if they find that it is unauthorized.

How do you dispute a credit report To dispute a credit report, you can start by contacting the credit bureaus (Experian, TransUnion, and Equifax). You can do this online, by phone, or by mail. Provide them with the necessary information and explain the error or discrepancy in your credit report. The credit bureaus will investigate your dispute and provide you with a response.

What are the consequences of disputing a credit card charge Disputing a credit card charge does not have any negative consequences on your credit score. However, it is important to continue making your credit card payments on time while the dispute is being resolved. If the dispute is successful, you may receive a refund or a credit to your account.

Can you remove a dispute from your credit report Once a dispute has been resolved, it should be updated or removed from your credit report. If you find that a dispute is still appearing on your credit report, you can contact the credit bureaus and request that it be removed. Provide them with any supporting documentation or evidence to support your request.

What should you do if a disputed debt is sold to a collection agency If a disputed debt is sold to a collection agency, you should continue to dispute the debt with the collection agency. Provide them with the necessary documentation and explain that the debt is still being disputed. The collection agency should then stop any collection activity on the debt until the dispute is resolved.

Can disputing a debt lead to legal action Disputing a debt should not automatically lead to legal action. However, if the debt is not resolved and the collection agency believes it is valid, they may choose to pursue legal action. It is important to respond to any legal notices or summonses and seek legal advice if necessary.

How long does it take to resolve a credit dispute The length of time it takes to resolve a credit dispute can vary. Generally, the credit bureaus have 30 days to investigate and respond to your dispute. However, it may take longer if they require additional information or documentation. It is important to be patient and follow up with the credit bureaus if necessary.

What should you do if your dispute is not resolved If your dispute is not resolved to your satisfaction, you can escalate the issue by contacting the Consumer Financial Protection Bureau (CFPB) or seeking legal advice. They can help you navigate the dispute process and ensure that your rights are protected.

Can you dispute a credit report online Yes, you can dispute a credit report online through the websites of the credit bureaus. They typically have a dispute form that you can fill out with the necessary information. Make sure to provide a clear explanation of the error or discrepancy and any supporting documentation.

Overall, disputing errors on your credit report is an important step in maintaining an accurate credit history. It allows you to correct mistakes and protect your creditworthiness. Remember to act promptly, provide clear documentation, and follow up with the credit bureaus to ensure that your dispute is resolved successfully.

Is it a good idea to dispute credit report

If you find mistakes on your credit reports, you should dispute them. Here's how you can dispute errors you find. Errors can appear on one or more of your credit reports due to an error in the information provided about you or as the result of fraud or identity theft.

Can disputes be removed from credit report

To remove disputes from a credit report (for free) you can contact whichever credit bureau is reporting the dispute. Experian's phone number is 888-210-9101 and 866-673-0140 and it's answered by a real-life human being. Just tell them you need the National Consumer Assistance Center to end the dispute(s).

Cached

How long does it take for your credit score to go up after a dispute

If you file a dispute regarding information on your Equifax credit report, you can generally expect to receive the results of the investigation within 30 days. If the information on your credit report is found to be inaccurate or incomplete, your credit report will be updated, generally within about 30 days.

Is it bad to dispute a charge

Disputing a charge does not have an impact on your credit. You don't need to worry about a dispute causing your credit score to drop. You must keep paying your credit card bill like normal during the dispute process.

Cached

Is it better to dispute a debt or pay it

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

What is the best reason to dispute credit

Successful disputes typically involve inaccurate or incomplete information, including items such as: Account information, such as closed accounts reported as open, timely payments incorrectly reported as delinquent, and inaccurate credit limits or account balances.

What happens if I dispute a collection

A debt collector must stop all collection activity on a debt if you send them a written dispute about the debt, generally within 30 days after your initial communication with them. Collection activities can restart, though, after the debt collector sends verification responding to the dispute.

What is the best reason to dispute a collection

A dispute is appropriate if you have hard evidence that clearly shows the debt doesn't belong to you, was already paid, or if the amount due is incorrect. The more information you can provide to the debt collection agency concerning the dispute, the better.

Can your credit score go up 50 points in a month

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

How can I raise my credit score 40 points fast

Here are six ways to quickly raise your credit score by 40 points:Check for errors on your credit report.Remove a late payment.Reduce your credit card debt.Become an authorized user on someone else's account.Pay twice a month.Build credit with a credit card.

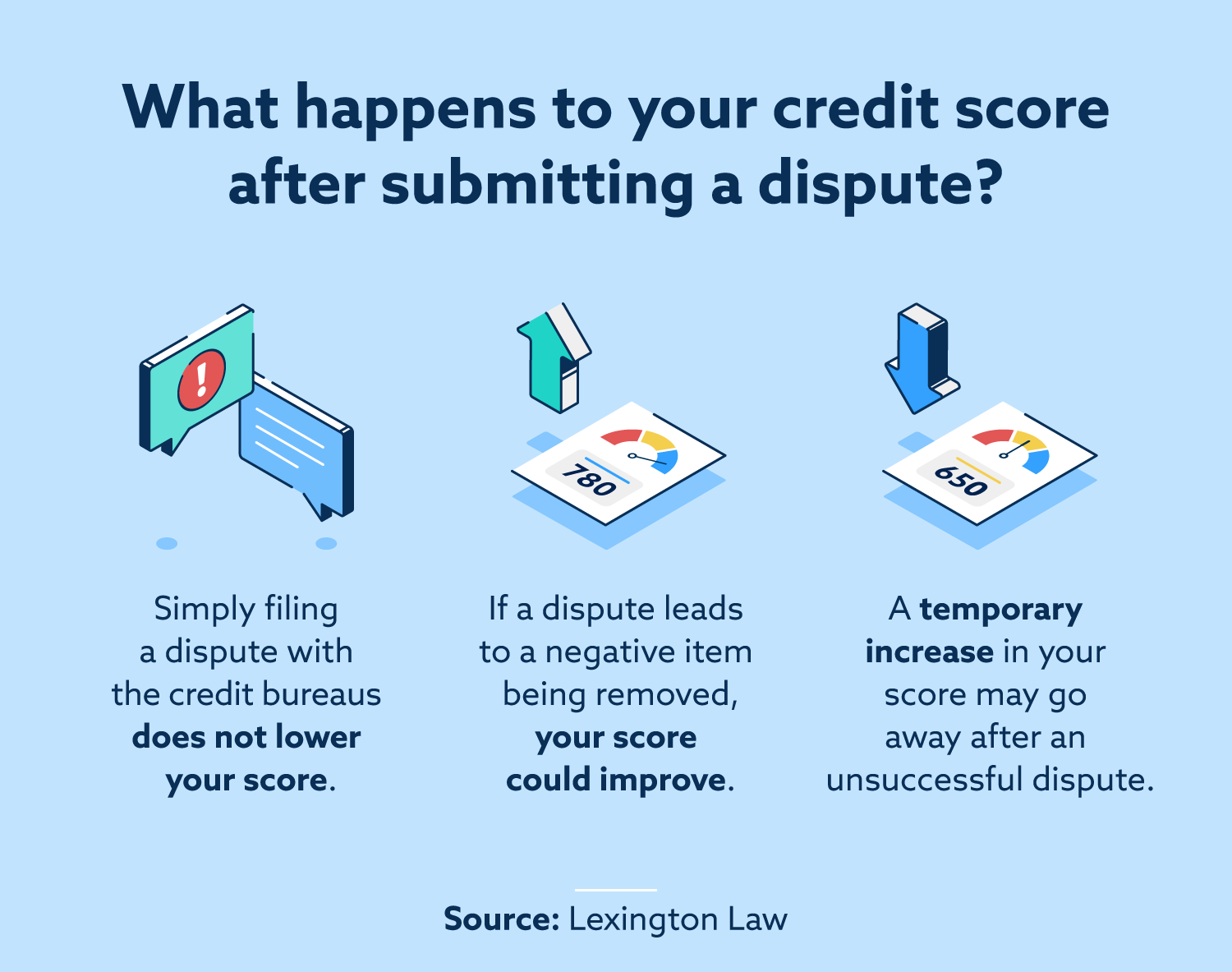

Why did my credit score drop after dispute

Filing a dispute has no impact on credit scores. But if certain information on your credit report changes as a result of your dispute, your credit score can change. The nature of that change—whether your score goes up, down or stays the same—depends on what you are disputing and the outcome of the dispute.

What is a good excuse to dispute a charge

We can divide all valid disputes into one of five basic categories: criminal fraud, authorization errors, processing errors, fulfillment errors, or merchant abuse.

What happens if I try to dispute a collection

A debt collector must stop all collection activity on a debt if you send them a written dispute about the debt, generally within 30 days after your initial communication with them. Collection activities can restart, though, after the debt collector sends verification responding to the dispute.

Is it good to dispute collections

If you believe any account information is incorrect, you should dispute the information to have it either removed or corrected. If, for example, you have a collection or multiple collections appearing on your credit reports and those debts do not belong to you, you can dispute them and have them removed.

What happens if I dispute a debt on my credit report

You have 30 days to dispute a debt or part of a debt from when you receive the required information from the debt collector. Once you dispute the debt, the debt collector can't call or contact you to collect the debt or the disputed part until the debt collector has provided verification of the debt in writing to you.

How can I get a collection removed without paying

You can ask the creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

How many times can I dispute a collection

How Many Times Can You Dispute a Collection or Inaccurate Credit Item There's no limit to how many times a consumer can dispute an item on their credit report, according to National Consumer Law Center attorney Chi Chi Wu.

Is it smart to dispute a collection

You should dispute a debt if you believe you don't owe it or the information and amount is incorrect. While you can submit your dispute at any time, sending it in writing within 30 days of receiving a validation notice, which can be your initial communication with the debt collector.

How long does it take to build credit from 500 to 700

6-18 months

The credit-building journey is different for each person, but prudent money management can get you from a 500 credit score to 700 within 6-18 months. It can take multiple years to go from a 500 credit score to an excellent score, but most loans become available before you reach a 700 credit score.

How to get a 700 credit score in 30 days

Best Credit Cards for Bad Credit.Check Your Credit Reports and Credit Scores. The first step is to know what is being reported about you.Correct Mistakes in Your Credit Reports. Once you have your credit reports, read them carefully.Avoid Late Payments.Pay Down Debt.Add Positive Credit History.Keep Great Credit Habits.

How to get a 900 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

How often are credit card disputes successful

This can't always be helped. You might not always get a fair outcome when you dispute a chargeback, but you can increase your chances of winning by providing the right documents. Per our experience, if you do everything right, you can expect a 65% to 75% success rate.

What happens to the merchant when you dispute a charge

Once the payment dispute is officially filed, it officially progresses to a chargeback. The funds are moved from the merchant's account to the consumer's. The merchant has no say in this; in fact, the seller may not even know about the dispute until the money is debited from their account.

What happens if I dispute everything on my credit report

Does Filing a Dispute Hurt Your Credit Filing a dispute has no impact on credit scores. But if certain information on your credit report changes as a result of your dispute, your credit score can change.