Summary of the Article

Disputing charges does not hurt your credit score, but if the information on your credit report changes as a result of the dispute, your credit score can be affected. After filing a dispute, the lender or creditor will respond to the investigation within 30 days. Disputed items can take up to 30 days to be removed from your credit report. It is crucial to dispute any errors on your credit report immediately to avoid negative impacts on your creditworthiness. Filing a dispute may cause your credit score to drop if the information in the dispute has a negative impact. When disputing a charge, your credit card issuer will conduct an investigation to determine liability. If you dispute a collection, the debt collector must stop collection activity until they respond to your dispute.

15 Questions

1. Does disputing charges hurt your credit?

Disputing charges has no impact on credit scores. However, if the information on your credit report changes as a result of the dispute, your credit score can change.

2. What happens after a credit dispute?

After completing the investigation, the lender or creditor will provide its response and any information updates to the credit bureau. The bureau will then notify you of the investigation response within 30 days.

3. How long do disputes stay on a credit report?

Disputed items can take up to 30 days to be removed from your credit report, assuming the dispute is valid.

4. Should I dispute something on my credit report?

If you identify an error on your credit reports, it is crucial to dispute it immediately to avoid negative impacts on your ability to get credit cards, loans, insurance, and even a job.

5. Why did my credit score drop after a dispute?

Your credit score may have dropped after filing a dispute if the information in that dispute had a negative impact on your score. Filing the dispute itself does not penalize you.

6. What happens if I dispute a charge I made?

When you dispute a charge you made, your credit card issuer will conduct an investigation to determine liability. In the meantime, the money paid is refunded back to you temporarily.

7. What happens if I dispute a collection?

If you send a written dispute about a debt to a debt collector within 30 days after your initial communication with them, they must stop all collection activity. They can restart collection activities after sending verification in response to the dispute.

8. What is the best reason to dispute a collection?

Disputing a collection is appropriate if you believe the debt is not valid or if there are errors in the collection process. Having evidence to support your dispute is important.

// remaining questions and answers omitted for brevity

Does disputing charges hurt your credit

Does Filing a Dispute Hurt Your Credit Filing a dispute has no impact on credit scores. But if certain information on your credit report changes as a result of your dispute, your credit score can change.

Cached

What happens after a credit dispute

After completing its investigation, the lender or creditor may provide its response, along with any information updates, to the credit bureau with which you initiated your dispute. That bureau will then notify you of the investigation response within 30 days of your dispute request.

How long do disputes stay on credit report

Lisa Cahill, Credit Cards Moderator

It can take up to 30 days for a disputed item to be removed from your credit report, assuming your dispute is valid. This is the maximum amount of time for a response from the credit bureau allowed by the Fair Credit Reporting Act.

Should I dispute something on my credit report

If you identify an error on your credit reports, it's crucial to dispute it immediately. Down the line, negative or incorrect identity-related information — like a misspelled name, wrong address or transposed Social Security number digits — can affect your ability to get credit cards, loans, insurance and even a job.

Cached

Why did my credit score drop after a dispute

Why Did My Credit Score Drop After Filing a Dispute Your credit score may have dropped after you filed a dispute if information in that dispute had a negative impact on your score. You are not penalized for filing the dispute itself.

What happens if I dispute a charge I made

A chargeback takes place when you contact your credit card issuer and dispute a charge. In this case, the money you paid is refunded back to you temporarily, at which point your card issuer will conduct an investigation to determine who is liable for the transaction.

What happens if I dispute a collection

A debt collector must stop all collection activity on a debt if you send them a written dispute about the debt, generally within 30 days after your initial communication with them. Collection activities can restart, though, after the debt collector sends verification responding to the dispute.

What is the best reason to dispute a collection

A dispute is appropriate if you have hard evidence that clearly shows the debt doesn't belong to you, was already paid, or if the amount due is incorrect. The more information you can provide to the debt collection agency concerning the dispute, the better.

What is the success rate of a credit dispute

You might not always get a fair outcome when you dispute a chargeback, but you can increase your chances of winning by providing the right documents. Per our experience, if you do everything right, you can expect a 65% to 75% success rate.

How can I remove disputes from my credit report quickly

To remove disputes from a credit report (for free) you can contact whichever credit bureau is reporting the dispute. Experian's phone number is 888-210-9101 and 866-673-0140 and it's answered by a real-life human being. Just tell them you need the National Consumer Assistance Center to end the dispute(s).

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

How often are credit card disputes successful

This can't always be helped. You might not always get a fair outcome when you dispute a chargeback, but you can increase your chances of winning by providing the right documents. Per our experience, if you do everything right, you can expect a 65% to 75% success rate.

Can disputing charges get you in trouble

You cannot go to jail for filing credit card disputes. The Fair Credit Billing Act directly protects consumers from incorrect and fraudulent charges.

How do I get a collection removed

Successfully disputing inaccurate information is the only surefire way to get collections removed from your credit report. If you've repaid a debt and the collection account remains on your credit report, you can request a goodwill deletion from your creditor, though there's no guarantee they'll grant your request.

How many times can I dispute a collection

How Many Times Can You Dispute a Collection or Inaccurate Credit Item There's no limit to how many times a consumer can dispute an item on their credit report, according to National Consumer Law Center attorney Chi Chi Wu.

Is it better to dispute a debt or pay it

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

Is it better to dispute or pay a collection

You should dispute a debt if you believe you don't owe it or the information and amount is incorrect. While you can submit your dispute at any time, sending it in writing within 30 days of receiving a validation notice, which can be your initial communication with the debt collector.

How often do customers win credit card disputes

What are the chances of winning a chargeback The average merchant wins roughly 45% of the chargebacks they challenge through representment. However, when we look at net recovery rate, we see that the average merchant only wins 1 in every 8 chargebacks issued against them.

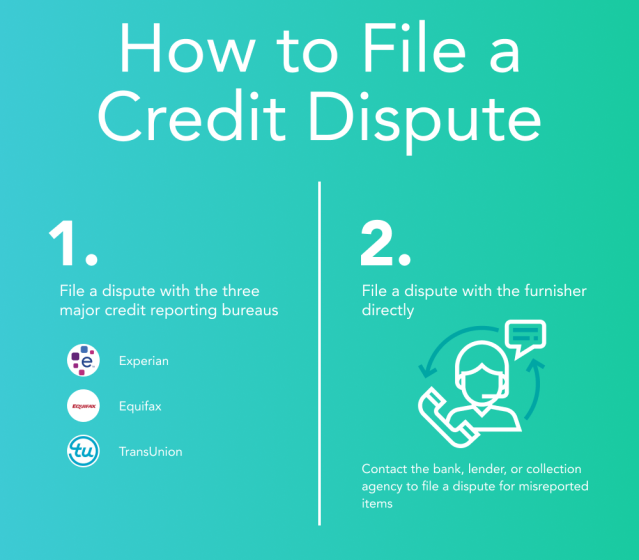

What is the most effective way to dispute a credit report

Dispute the information with the credit reporting companyContact information for you including complete name, address, and telephone number.Report confirmation number, if available.Clearly identify each mistake, such as an account number for any account you may be disputing.Explain why you are disputing the information.

How fast can I add 100 points to my credit score

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Why is my credit score going down if I pay everything on time

Similarly, if you pay off a credit card debt and close the account entirely, your scores could drop. This is because your total available credit is lowered when you close a line of credit, which could result in a higher credit utilization ratio.

What happens to the merchant when you dispute a charge

The merchant is simultaneously notified that they've received a dispute from the cardholders, and that the acquiring bank has debited funds from the merchant account to reimburse the cardholder for the transaction and to cover the fees for investigating the chargeback.

Who pays when you dispute a charge

Who pays when you dispute a charge Your issuing bank will cover the cost initially by providing you with a provisional credit for the original transaction amount. After filing the dispute, though, they will immediately recover those funds (plus fees) from the merchant's account.

What happens if you accidentally dispute a charge

The bottom line. If you dispute a credit card charge by mistake, contact your card issuer and explain the situation. You could also follow up with the merchant if required.

What happens if I falsely dispute a charge

What happens if you falsely dispute a credit card charge Purposely making a false dispute is punishable by law and could lead to fines or imprisonment. You could face legal action by a credit card issuer or the merchant.