are unable to, it’s important to work out a payment plan with the creditor to avoid legal consequences and further damage to your credit.

What happens to unpaid collections after 7 years

Although the unpaid debt will go on your credit report and cause a negative impact to your score, the good news is that it won't last forever. Debt after 7 years, unpaid credit card debt falls off of credit reports. The debt doesn't vanish completely, but it'll no longer impact your credit score.

Cached

Should I pay off a 7 year old collection

The best way is to pay

Most people would probably agree that paying off the old debt is the honorable and ethical thing to do. Plus, a past-due debt could come back to bite you even if the statute of limitations runs out and you no longer technically owe the bill.

Will collections go away after 7 years

The short answer: Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

Cached

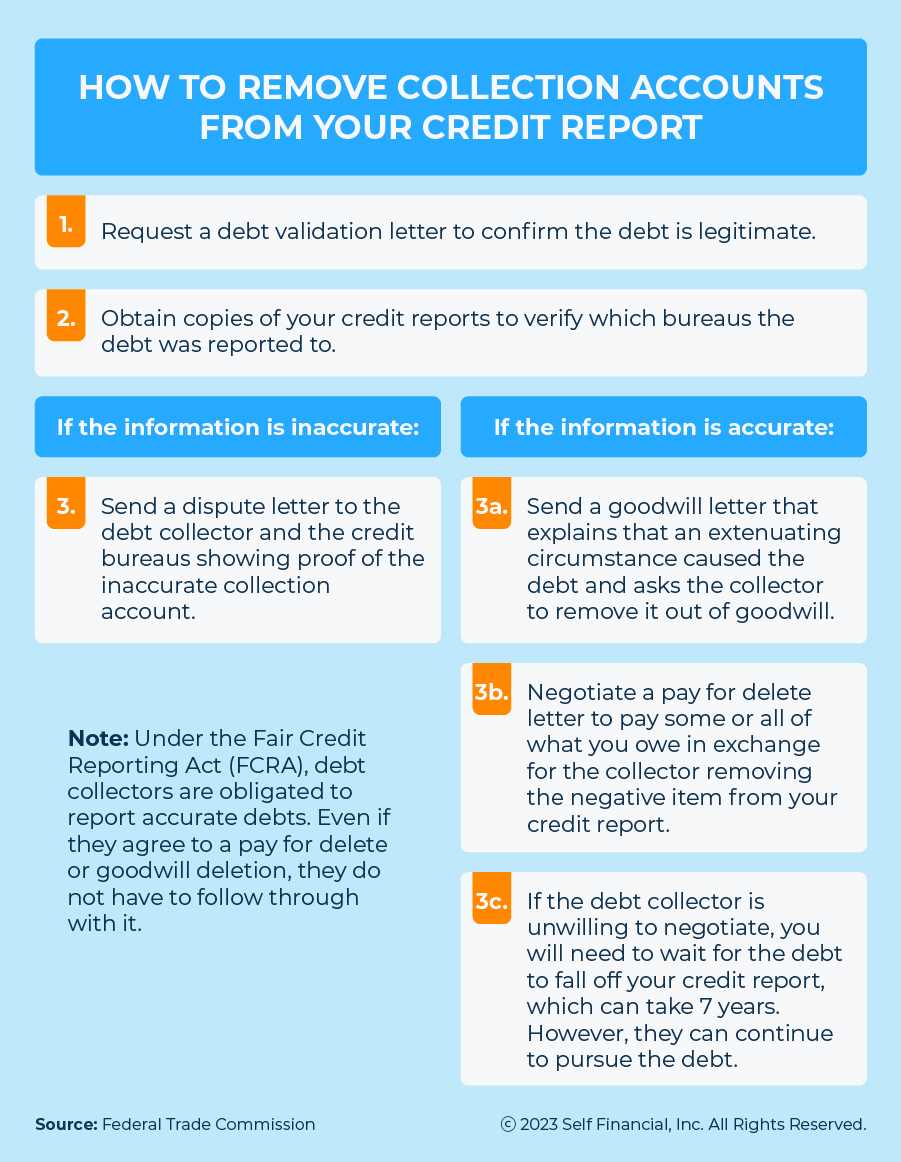

How do I get a collection removed from my credit report after 7 years

You can ask the creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

Cached

Do collections go away if you don’t pay

A debt doesn't generally expire or disappear until its paid, but in many states, there may be a time limit on how long creditors or debt collectors can use legal action to collect a debt.

How long before a debt becomes uncollectible

four years

The statute of limitations on debt in California is four years, as stated in the state's Code of Civil Procedure § 337, with the clock starting to tick as soon as you miss a payment.

Can a 10 year old debt still be collected

Debt collectors may not be able to sue you to collect on old (time-barred) debts, but they may still try to collect on those debts. In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

What happens if you never pay collections

If you ignore a debt in collections, you can be sued and have your bank account or wages garnished or may even lose property like your home. You'll also hurt your credit score. If you aren't paying because you don't have the money, remember that you still have options!

Is it true that after 7 years your credit is clear

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

Why you shouldn’t pay debt collectors

Having an account sent to collections will lead to a negative item on your credit report. The mark is likely to stay on your credit report for up to seven years even if you pay off your debt with the collection agency. It's also possible that paying off your collection account may not increase your credit score.

Why you should not pay a collection agency

Having an account sent to collections will lead to a negative item on your credit report. The mark is likely to stay on your credit report for up to seven years even if you pay off your debt with the collection agency. It's also possible that paying off your collection account may not increase your credit score.

Can a debt collector restart the clock on my old debt

Debt collectors can restart the clock on old debt if you: Admit the debt is yours. Make a partial payment. Agree to make a payment (even if you can't) or accept a settlement.

Is it true you don’t have to pay a collection agency

If you refuse to pay a debt collection agency, they may file a lawsuit against you. Debt collection lawsuits are no joke. You can't just ignore them in the hopes that they'll go away. If you receive a Complaint from a debt collector, you must respond within a time frame determined by your jurisdiction.