Summary:

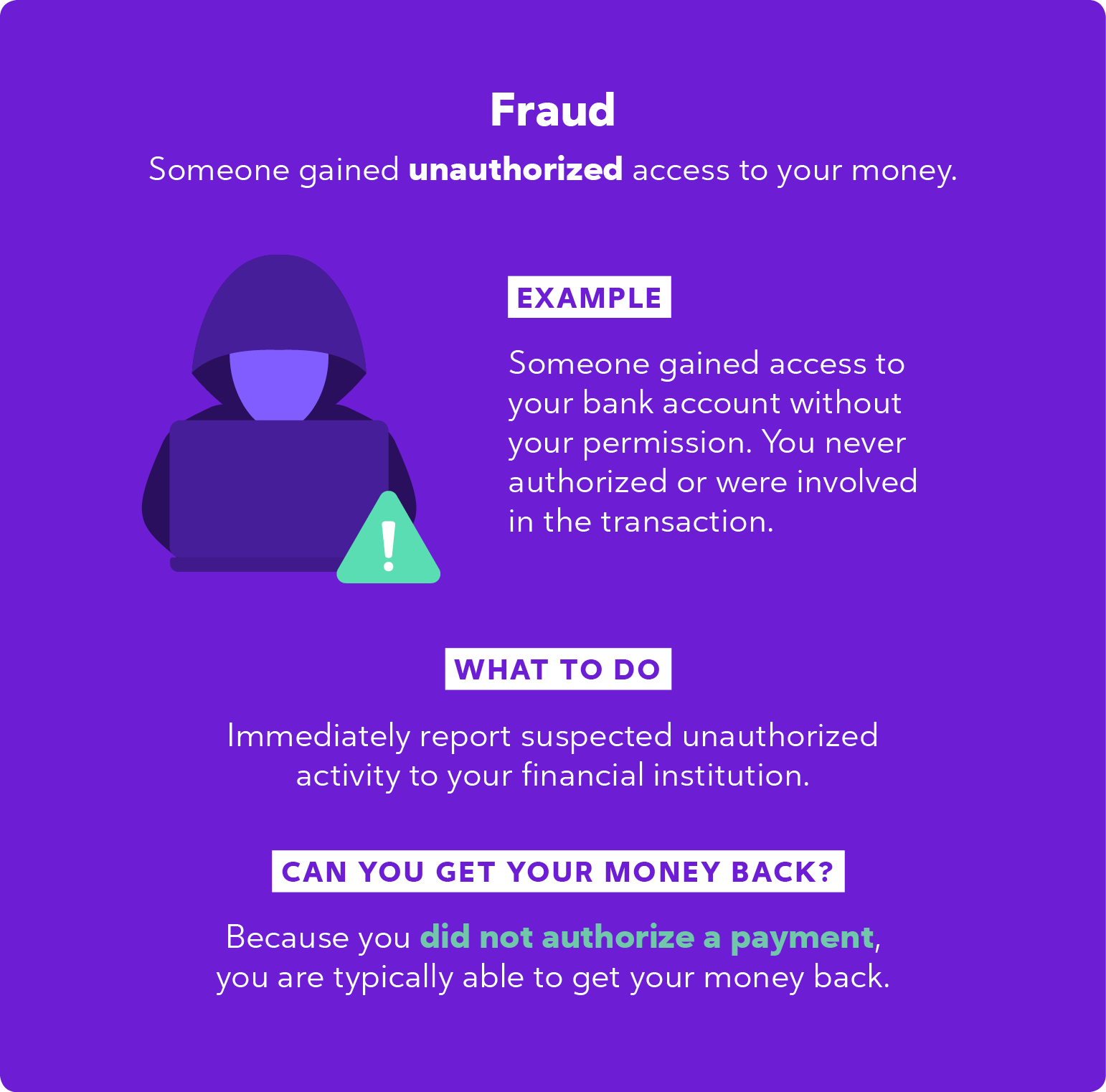

1. Can a bank refund a fraud payment? Your bank can only refuse to refund an unauthorised payment if: it can prove you authorised the payment, it can prove you acted fraudulently, or it can prove you deliberately failed to protect your card details.

2. How do I get a refund for stolen money from my bank? Contact your bank or card provider immediately to alert them and report the incident. Reporting is crucial to getting your money back. You may be liable for any losses incurred before reporting. You can also report it to Action Fraud.

3. Are banks responsible for fraud? Both the bank and the customer share the responsibility for banking fraud. Banks must ensure the security of customer financial data and accounts by implementing strong security systems and protocols.

4. How common is refund fraud? According to the National Retail Federation, consumers returned over $816 billion worth of merchandise in 2022, with an average retailer incurring $165,000 in merchandise returns for every $1 million in sales. About one in ten refund requests are cases of return fraud.

5. What happens if you report a payment as fraud? Once you report fraudulent charges and provide the necessary documentation, the bank has 30 days to respond and initiate an investigation. The investigation must be completed within 90 days.

6. How do I recover money from fraudsters? Start by reporting the scam to your bank’s fraud team. They will conduct an investigation within 15 days and provide an outcome regarding the refund.

7. What do banks do when money is stolen? Most banks will issue a temporary credit card while they investigate to keep customers satisfied. However, if the bank identifies a seemingly legitimate transaction on your account and you file a claim against it, you may be required to reimburse the bank.

Questions:

- Can a bank refuse to refund an unauthorised payment? Banks can refuse to refund unauthorised payments if certain conditions are met.

- Why is reporting a stolen money incident important? Reporting the incident is crucial for the refund process and to avoid liability for any losses.

- Who shares the responsibility for banking fraud? Both the bank and the customer hold responsibility for banking fraud.

- What percentage of refund requests involve return fraud? Approximately one in ten refund requests are related to return fraud.

- Within what time frame must a bank respond to a fraud report? Banks must respond within 30 days and complete their investigation within 90 days.

- What should you do to recover money from fraudsters? Start by reporting the scam to your bank’s fraud team and wait for their investigation outcome.

- What action do banks take when money is stolen? Most banks issue a temporary credit card while investigating a stolen money incident.

Can a bank refund a fraud payment

Your bank can only refuse to refund an unauthorised payment if: it can prove you authorised the payment. it can prove you acted fraudulently. it can prove you deliberately, or with 'gross negligence', failed to protect the details of your card, PIN or password in a way that allowed the payment.

How do I get a refund for stolen money from my bank

Contact your bank or card provider to alert them. Reporting is an important first step to getting your money back, and you could be liable for all money lost before you report it. If you've been targeted, even if you don't fall victim, you can report it to Action Fraud.

Are banks responsible for fraud

The responsibility for banking fraud lies with both the bank and the customer. Banks are responsible for ensuring the security of customers' financial data and accounts. They should have strong security systems and protocols in place to protect customers' accounts from fraud and theft.

How common is refund fraud

The Cost of Return Fraud

According to the National Retail Federation, consumers returned more than $816 billion worth of merchandise purchased in 2022. For every $1 million in sales, the average retailer also incurred $165,000 in merchandise returns. And, more than one in ten refund requests are cases of return fraud.

What happens if you report a payment as fraud

Once you report fraudulent charges and provide any necessary documentation, the bank has 30 days to respond to your issue and begin an investigation. From there, the bank has to complete the investigation within 90 days.

How do I recover money from fraudsters

Report the scam to your bank's fraud team – the first step if for you to report the issue to your bank's fraud team. This will kick off an investigation at the bank. Fraud investigation – your bank has 15 days to investigate and then report back with an outcome on whether it will give you money back.

What do banks do when money is stolen

Most banks will issue a temporary credit card right away while they investigate in order to keep customers happy. Careful though — if the bank sees a transaction on your account that seems legitimate and you put a claim against it, you could be asked to pay it back.

How do you prove fraud to a bank

In general, to prove a fraud, the government must establish that you made a knowingly false statement, that you intended the recipient to rely on the statement, that the recipient did, in fact, rely on the statement, and that in so doing the recipient suffered a financial loss.

Who investigates money fraud

The FBI works with partners to investigate mortgage and financial institution fraud cases.

How long does bank take to refund fraud

If the merchant can prove to the issuing bank that the transaction is legitimate and the cardholder's claims are false, they can get their money back. However, this process will generally take at least 30 days, and often longer. The process for fighting friendly fraud is called chargeback representment.

How long does it take for money to be refunded fraud

Getting your money back

Your bank should refund any money stolen from you as a result of fraud and identity theft. They should do this as soon as possible – ideally by the end of the next working day after you report the problem.

Can a bank reverse a payment after it has posted

Can the bank reverse a payment Yes, in some cases. Banks can initiate chargebacks, forcing reversals on settled transactions. They can also reverse payments if authorization errors appear in the transaction.

What happens if bank does not refund money

If the complaint is not resolved in time, the customer can complain to the Banking Ombudsman within 30 days of receiving the bank's reply. He can knock the door of the ombudsman even if he is not satisfied with the bank's answer or the bank does not respond to him.

What are the consequences of frauds

Depending on the severity of the fraud you committed, you might spend time in prison and have to pay costly fines. You may have requirements to pay restitution to your victims which could take many years to satisfy. Feelings of guilt or regret might plague you for a long time.

How long does it take for bank to refund stolen money

If the bank needs more time to investigate, they can take up to 45 days, but they must at least temporarily return the funds to the cardholder's account by the 10-day deadline. Many banks streamline this process by granting a provisional credit as soon as a dispute is filed.

How long does it take a bank to investigate fraud

In the US, banks are required to complete fraud investigations within 10 business days of the time they are advised of the claim. Banks can request an extension, but in most cases, they will be required to issue a temporary refund to the customer within 10 days.

How long do bank fraud investigations take

In the US, banks are required to complete fraud investigations within 10 business days of the time they are advised of the claim. Banks can request an extension, but in most cases, they will be required to issue a temporary refund to the customer within 10 days.

What happens when you file a fraud dispute with your bank

Once filed, your dispute is then turned over to the bank or card network for investigation. Your bank will typically give you a provisional refund, which will be in place until your claim can be validated by the bank.

How do I get cash back from fraud

How do I File a DisputeTap the Activity tab on your Cash App home screen.Select the transaction in question and tap the … in the top right corner of the screen.Select Need Help & Cash App Support.Tap Dispute this Transaction.

How long does it take for bank to reverse money

The person might refuse to return your money. In such a case, you may take legal action. Though, the situation becomes more complicated if your bank and the beneficiary's bank are different. If everything goes well and the person agrees to return your amount, then will take 8-10 working days to reverse the transaction.

How do banks investigate unauthorized transactions

How Do Banks Investigate Fraud Bank investigators will usually start with the transaction data and look for likely indicators of fraud. Time stamps, location data, IP addresses, and other elements can be used to prove whether or not the cardholder was involved in the transaction.

How do I get my money back from fraudsters

You will need a crime number from the police to help you work with your bank and other organisations. With the majority of online scams and cyber crimes you report to Action Fraud. Reporting will also help get the scam shut down and may help you progress getting your money back.

How do I get my money back from an unauthorized transaction

Contact the company or bank that issued the credit card or debit card. Tell them it was a fraudulent charge. Ask them to reverse the transaction and give you your money back.

Do frauds get caught

Unfortunately, the answer is not very often. Less than 1% of all credit card fraud cases are actually solved by law enforcement.

What are the 2 basic type of frauds

The courts classify fraud under two major types: criminal and civil. Civil fraud is when the fraud is an intentional misrepresentation of facts. Criminal fraud is when theft is involved in the fraud.