Can a debt collector take money from my bank account without authorization?

Yes, if a debt collector has a court judgment, they may be able to garnish your bank account or wages. Certain debts owed to the government may also result in garnishment, even without a judgment.

How can I stop my bank account from being garnished?

There are several steps you can take to try and stop your bank account from being garnished:

1. Pay your debts if you can afford it.

2. Make a plan to reduce your debt.

3. If you cannot afford to pay your debt, see if you can set up a payment plan with your creditor.

4. Challenge the garnishment.

5. Do not put money into an account at a bank or credit union.

6. See if you can settle your debt.

7. Consider bankruptcy.

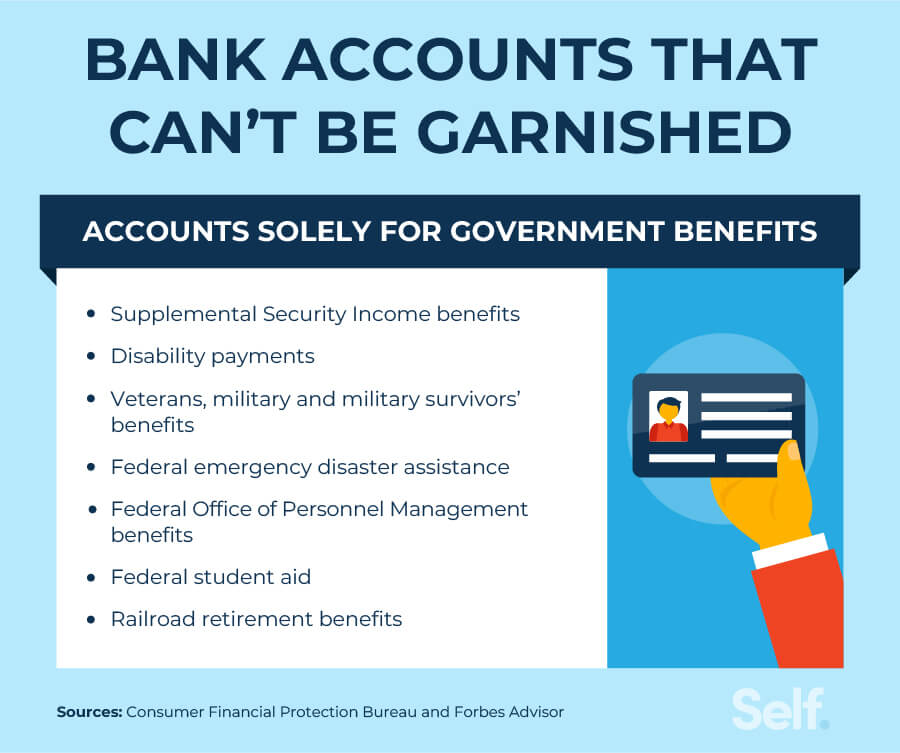

What type of bank accounts cannot be garnished?

Bank accounts solely for government benefits, such as Social Security funds and veterans’ benefits, are protected by federal law and cannot be garnished.

Can a creditor freeze my bank account without notifying me?

No, a judgment creditor does not have to give you specific notice before freezing your bank account. However, a creditor or debt collector is required to notify you (1) that they have filed a lawsuit against you and (2) that they have obtained a judgment against you.

What can one do if money is taken out of your account without authorization?

If money has been taken from your bank account without permission, there are certain steps you should take:

1. Contact your bank or card provider to alert them.

2. Report the unauthorized transaction.

3. Change your account passwords and PINs.

4. Monitor your account for any further unauthorized activity.

5. Consider filing a police report or reporting the incident to the relevant authorities.

Who can access your bank account without your permission?

Only the account holder has the right to access their bank account. If you have a joint bank account, both account holders have access to the funds. However, in the case of a personal bank account, your spouse has no legal right to access it without your permission.

How do you get around a garnishment?

There are three ways to try and stop a garnishment:

1. Make a full payment to the creditor, including their court costs. If the debt is fully satisfied, the judgment will be satisfied, and the wage garnishment will stop.

2. File an objection with the court.

3. File for bankruptcy protection.

Remember, it’s important to consult with a legal professional for guidance on your specific situation.

Can a debt collector take money from my bank account without authorization

If a debt collector has a court judgment, then it may be able to garnish your bank account or wages. Certain debts owed to the government may also result in garnishment, even without a judgment.

Cached

How can I stop my bank account from being garnished

Pay your debts if you can afford it. Make a plan to reduce your debt.If you cannot afford to pay your debt, see if you can set up a payment plan with your creditor.Challenge the garnishment.Do no put money into an account at a bank or credit union.See if you can settle your debt.Consider bankruptcy.

Cached

What type of bank accounts Cannot be garnished

Bank accounts solely for government benefits

Federal law ensures that creditors cannot touch certain federal benefits, such as Social Security funds and veterans' benefits. If you're receiving these benefits, they would not be subject to garnishment.

Cached

Can a creditor freeze my bank account without notifying me

No. A judgment creditor does not have to give you specific notice before freezing your bank account. However, a creditor or debt collector is required to notify you (1) that it has filed a lawsuit against you; and (2) that it has obtained a judgment against you.

Cached

What can one do if money is taken out of your account without authorization

If money has been taken from your bank account without permission, there are certain steps you should take. This applies whether your identity has been stolen, your card cloned, there's been an unrecognised bank transfer or you've been the victim of a scam. Contact your bank or card provider to alert them.

Who can access your bank account without your permission

Only the account holder has the right to access their bank account. If you have a joint bank account, you both own the account and have access to the funds. But in the case of a personal bank account, your spouse has no legal right to access it.

How do you get around a garnishment

Three Ways to Stop a GarnishmentFull Payment to the Creditor. If the creditor receives full satisfaction of the debt obligation including their court cost, the judgment will be satisfied and the wage garnishment stopped.Filing an Objection with the Court.File for Bankruptcy Protection.

How long does a levy stay on your bank account

What Are My Options To Avoid A Bank Levy During the time after a creditor puts a levy on your bank account, funds in your account up to the amount of the judgment are frozen, and the bank will hold the money for 15 days.

What states completely prohibit creditor garnishments of bank accounts

Bank garnishment is legal in all 50 states. However, four states prohibit wage garnishment for consumer debts. According to Debt.org, those states are Texas, South Carolina, Pennsylvania, and North Carolina.

Will my bank tell me if my account is frozen

No. Unfortunately, the law provides that when the bank receives a restraining notice, it must freeze your account immediately, before notifying you. That is why most people discover that their account is frozen when they try to use their ATM cards and they suddenly do not work.

How many times can a creditor freeze your bank account

A creditor can levy your bank account multiple times until the judgement is paid in full. In other words, you aren't safe from future levies just because a creditor already levied your account.

Can you block a company from taking money out of your bank account

Give your bank a "stop payment order"

Even if you have not revoked your authorization with the company, you can stop an automatic payment from being charged to your account by giving your bank a "stop payment order" . This instructs your bank to stop allowing the company to take payments from your account.

Can my wife’s bank account be garnished for my debt

The relevant information to focus on here is that California is a community property state, which means that legally married couples jointly own everything – including debt. As a result, it is possible for a creditor to garnish a spouse's bank account if their spouse owes a debt.

How do creditors find your bank account

Creditors and debt collectors can find your bank accounts through your previous payment records, credit applications, skip tracers, and information subpoenas. Most of the time, the creditor must obtain a court order before garnishing your bank accounts, but this isn't the case for some government entities.

What is the most they can garnish from your paycheck

The Debt Collection Improvement Act authorizes federal agencies or collection agencies under contract with them to garnish up to 15% of disposable earnings to repay defaulted debts owed to the U.S. government.

Can you negotiate after a garnishment

Another way to stop a wage garnishment is by negotiating with your creditor. Many creditors are reluctant to settle debts once they have a garnishment. However, an attorney can help you negotiate the best settlement by offering a lump sum amount or payment terms.

Will I be notified if my bank account is levied

Advance warning: Once your creditor makes the request, your bank will freeze your account and review the situation. 23 Your bank might not notify you that a bank levy is in progress—and creditors might not alert you either.

Are you notified before a bank levy

Eventually, the creditor may try to recoup its money by filing a lawsuit and proving to the courts that you owe the debt. The creditor has to notify you at this point, which should signal that a levy could be in your future.

What is the most a creditor can garnish

Limitations on the Amount of Earnings that may be Garnished (General)

| Weekly | Biweekly | Monthly |

|---|---|---|

| $290.00 or more: MAXIMUM 25% | $580.00 or more: MAXIMUM 25% | $1,256.66 or more: MAXIMUM 25% |

How long can a bank freeze your account for an investigation

about ten days

An account freeze resulting from an investigation will usually last for about ten days. However, there's no set limit for how long a freeze may last. A bank can effectively suspend your account at any time for as long as they need to in order to complete a thorough investigation.

Can a bank freeze your account and take your money

Yes. The bank may temporarily freeze your account to ensure that no funds are withdrawn before the error is corrected, as long as the amount of funds frozen does not exceed the amount of the deposit. Or the bank may simply place a hold on the deposit amount.

Can you open a new bank account if your account is frozen

But in the meantime, if your account is frozen or might be, we recommend that you open a new bank account at a new bank where you don't owe any money. Notify your employer to deposit your paycheck into this new account. Move any money from your old account to your new account.

Who can legally freeze your bank account

Banks may freeze bank accounts if they suspect illegal activity such as money laundering, terrorist financing, or writing bad checks. Creditors can seek judgment against you, which can lead a bank to freeze your account. The government can request an account freeze for any unpaid taxes or student loans.

What is it called when a company takes money from your bank account

A wage or bank account garnishment occurs when a creditor takes a portion of your paycheck or money from your bank account to collect a debt.

What is it called when a company takes money out of your account without permission

Creditor Fraud

If you make any payments with your current debit card or other forms of electronic transactions, you grant the credit card company the authority to withdraw money from your account.