Summary of the Article: Conventional Loans Vs. FHA Loans

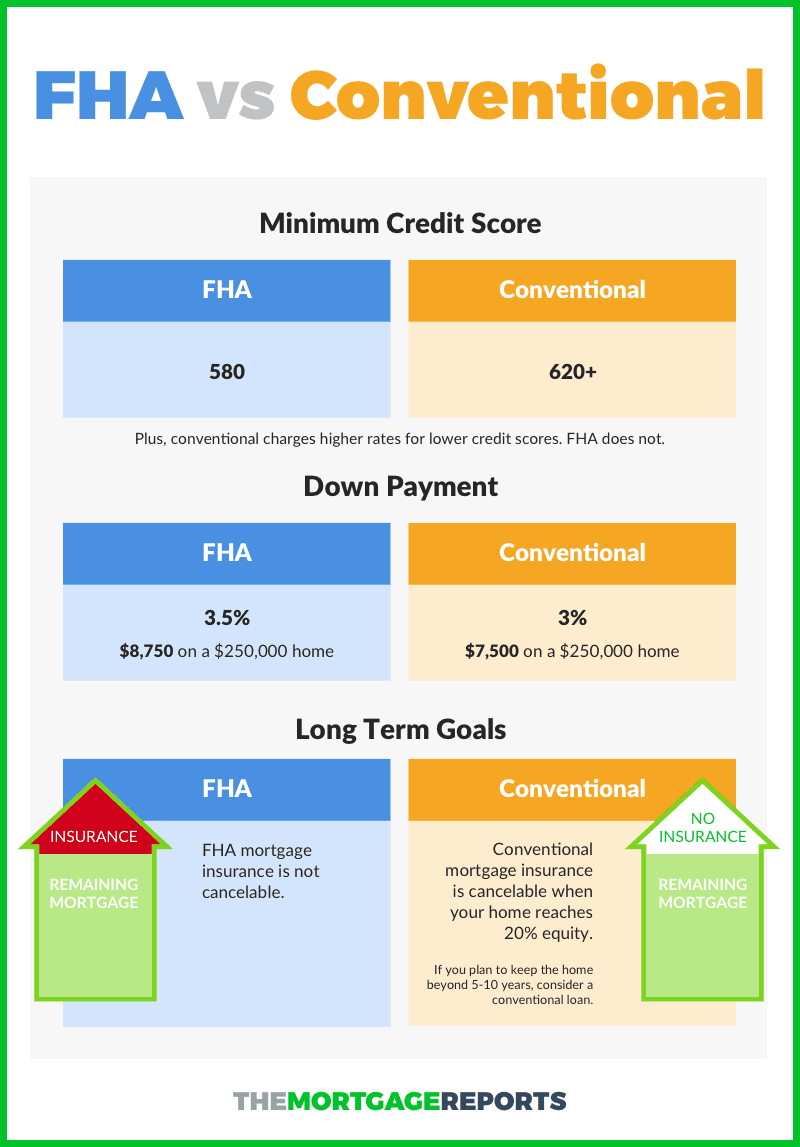

Credit scores above 580 only require a minimum down payment of 3.5%. While conventional loans offer a slightly smaller down payment (3%), you must have a credit score of at least 620 to qualify.

Home buyers can make a conventional down payment anywhere between 3% and 20% (or more) depending on the lender, the loan program, and the price and location of the home. Keep in mind that when you put down less than 20% on a conventional loan, you are required to pay private mortgage insurance (PMI).

It is a common misconception that in order to obtain a conventional loan, you must pay a 20% down payment, but that is not the case. In fact, you can qualify for a conventional loan by putting down as low as a 5% down payment.

Most lenders offer conventional loans with PMI for down payments ranging from 5 percent to 15 percent. Some lenders may offer conventional loans with 3 percent down payments.

The maximum LTV ratio for Fannie Mae’s standard mortgage product is up to 97 percent for first-time homebuyers, allowing first-time borrowers who exceed the HomeReady™ Mortgage income limit to still buy a home with as little as 3 percent down.

A conventional loan is often better if you have good or excellent credit because your mortgage rate and PMI costs will go down. But an FHA loan can be perfect if your credit score is in the high-500s or low-600s. For lower-credit borrowers, FHA is often the cheaper option. These are only general guidelines, though.

But in general, the cost of private mortgage insurance, or PMI, is about 0.5 to 1.5% of the loan amount per year. This annual premium is broken into monthly installments, which are added to your monthly mortgage payment. So a $300,000 loan would cost around $1,500 to $4,500 annually — or $125 to $375 per month.

Available to qualified first-time homebuyers for a low down payment of just 3%, the Freddie Mac HomeOne® mor

Questions:

1. Are there conventional loans with 3% down?

Yes, conventional loans can have a down payment as low as 3%.

2. What is the maximum down payment for a conventional loan?

The maximum down payment for a conventional loan varies but can go up to 20% or more depending on the lender, loan program, and home price and location.

3. Can you buy a conventional loan with 5% down?

Yes, you can qualify for a conventional loan with as little as a 5% down payment.

4. How little can you put down on a conventional mortgage?

Most lenders offer conventional loans with private mortgage insurance (PMI) for down payments ranging from 5% to 15%. Some lenders may even offer 3% down payment options.

5. Can you do 3% down on a Fannie Mae loan?

Yes, first-time homebuyers can buy a home with as little as 3% down through Fannie Mae’s standard mortgage product.

6. Is conventional better than FHA?

A conventional loan is often better if you have good or excellent credit, as it can result in a lower mortgage rate and PMI costs. However, an FHA loan may be more affordable for borrowers with lower credit scores.

7. How much is PMI on a $300,000 loan?

The cost of private mortgage insurance (PMI) is typically around 0.5-1.5% of the loan amount per year. For a $300,000 loan, the annual PMI cost would be approximately $1,500 to $4,500, or $125 to $375 per month.

8. Does Freddie Mac have a 3% down program?

Yes, Freddie Mac offers the HomeOne® mortgage program which allows qualified first-time homebuyers to purchase a home with a low down payment of just 3%.

9. Can you use gift funds for a down payment on a conventional loan?

Yes, gift funds can be used for a down payment on a conventional loan, subject to certain guidelines and documentation requirements.

10. Do conventional loans have a higher interest rate than FHA loans?

The interest rates for conventional loans and FHA loans can vary depending on factors such as credit score, loan amount, and loan term. It is best to compare rates from different lenders to determine which option offers the most favorable terms for your specific situation.

11. How long do you have to pay PMI on a conventional loan?

The length of time you are required to pay private mortgage insurance (PMI) on a conventional loan can vary based on factors such as the down payment amount and the loan-to-value (LTV) ratio. However, once the loan-to-value ratio reaches 78%, PMI can typically be removed.

12. Can you refinance a conventional loan to get rid of PMI?

Yes, it is possible to refinance a conventional loan to eliminate PMI. However, you will need to meet certain requirements such as having a loan-to-value ratio below 80% and having a good credit score.

13. Do conventional loans have income limits?

Conventional loans do not have specific income limits, but lenders typically consider your debt-to-income ratio when determining your eligibility for a loan.

14. Can you use a conventional loan to buy an investment property?

Yes, conventional loans can be used to finance the purchase of an investment property. However, lenders often require a larger down payment and have stricter qualification criteria compared to loans for primary residences.

15. Can you get a conventional loan with a low credit score?

While conventional loans generally have stricter credit requirements compared to FHA loans, it is still possible to get a conventional loan with a low credit score. However, having a higher credit score can improve your chances of securing a competitive interest rate and favorable loan terms.

Are there conventional loans with 3% down

Conventional Loans Vs.

Credit scores above 580 only require a minimum down payment of 3.5%. While conventional loans offer a slightly smaller down payment (3%), you must have a credit score of at least 620 to qualify.

Cached

What is the maximum down payment for conventional loan

Home buyers can make a conventional down payment anywhere between 3% and 20% (or more) depending on the lender, the loan program, and the price and location of the home. Keep in mind that when you put down less than 20% on a conventional loan, you are required to pay private mortgage insurance (PMI).

Can you buy conventional with 5% down

It is a common misconception that in order to obtain a conventional loan, you must pay a 20% down payment, but that is not the case. In fact, you can qualify for a conventional loan by putting down as low as a 5% down payment.

How little can you put down on a conventional mortgage

Most lenders offer conventional loans with PMI for down payments ranging from 5 percent to 15 percent. Some lenders may offer conventional loans with 3 percent down payments.

CachedSimilar

Can you do 3 down on Fannie Mae

The maximum LTV ratio for Fannie Mae's standard mortgage product is up to 97 percent for first-time homebuyers, allowing first-time borrowers who exceed the HomeReady™ Mortgage income limit to still buy a home with as little as 3 percent down.

Is conventional better than FHA

A conventional loan is often better if you have good or excellent credit because your mortgage rate and PMI costs will go down. But an FHA loan can be perfect if your credit score is in the high-500s or low-600s. For lower-credit borrowers, FHA is often the cheaper option. These are only general guidelines, though.

How much is PMI on a $300 000 loan

But in general, the cost of private mortgage insurance, or PMI, is about 0.5 to 1.5% of the loan amount per year. This annual premium is broken into monthly installments, which are added to your monthly mortgage payment. So a $300,000 loan would cost around $1,500 to $4,500 annually — or $125 to $375 per month.

Does Freddie Mac have a 3 down program

Available to qualified first-time homebuyers for a low down payment of just 3%, the Freddie Mac HomeOne® mortgage is a low down payment option that serves the needs of many first-time homebuyers, along with no cash-out refinance borrowers.

Will home prices jump another 11% this year and 3% in 2023 Fannie Mae says

Home prices to jump another 11% this year and 3% in 2023, Fannie Mae says. For the first time since the early 1980s, the average 30-year fixed mortgage rate has climbed two percentage points in just a four-month window—climbing from 3.11% in December to 5.11% as of Thursday.

Why do realtors prefer conventional over FHA

Sellers often prefer conventional buyers because of their own financial views. Because a conventional loan typically requires higher credit and more money down, sellers often deem these reasons as a lower risk to default and traits of a trustworthy buyer.

Is it harder to get a conventional loan or FHA

FHA loans and conventional loans are two of the most common mortgages. FHA loans are backed by the Federal Housing Administration (FHA) and offered by FHA-approved lenders. These loans are generally easier to qualify for than conventional loans and have smaller down payment requirements.

Is it better to put 20 down or pay PMI

Putting down 20% on a home purchase can reduce your monthly payment, eliminate private mortgage insurance and possibly give you a lower interest rate.

How much income do I need for a 300K mortgage

To purchase a $300K house, you may need to make between $50,000 and $74,500 a year. This is a rule of thumb, and the specific salary will vary depending on your credit score, debt-to-income ratio, type of home loan, loan term, and mortgage rate.

Does Fannie Mae allow 3% down

The maximum LTV ratio for Fannie Mae's standard mortgage product is up to 97 percent for first-time homebuyers, allowing first-time borrowers who exceed the HomeReady™ Mortgage income limit to still buy a home with as little as 3 percent down.

Does Fannie Mae have a 3% down program

The HomeReady® mortgage includes innovative income flexibilities that can help your customers qualify for an affordable mortgage with a down payment as low as 3%. View 97% LTV/CLTV/HCLTV financing options that help you serve qualified first-time home buyers and support the refinance of Fannie Mae loans.

Are mortgage rates expected to drop in 2023

The Mortgage Bankers Association predicts rates will fall to 5.5 percent by the end of 2023 as the economy weakens. The group revised its forecast upward a bit — it previously expected rates to fall to 5.3 percent.

Will mortgage rates go down in 2023 2024

These organizations predict that mortgage rates will decline through the first quarter of 2024. Fannie Mae, Mortgage Bankers Association and National Association of Realtors expect mortgage rates to drop through the first quarter of 2024, by half a percentage point to about nine-tenths of a percentage point.

Why would a seller only accept a conventional loan

Sellers often prefer conventional buyers because of their own financial views. Because a conventional loan typically requires higher credit and more money down, sellers often deem these reasons as a lower risk to default and traits of a trustworthy buyer.

Why do people prefer conventional vs FHA

FHA loans allow lower credit scores and require less elapsed time for major credit problems. Conventional loans, however, may require less paperwork and offer better options to avoid costly mortgage insurance premiums.

Can you avoid PMI with 3 down

To avoid PMI for most loans, you'll need at least 20 percent of the home's purchase price set aside for a down payment. For example, if you're buying a home for $250,000, you need to be able to put down $50,000.

Can I afford a 300k house on a 50k salary

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. That's because annual salary isn't the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

Can I afford a 300k house on a $70 K salary

Home buying with a $70K salary

If you're an aspiring homeowner, you may be asking yourself, “I make $70,000 a year: how much house can I afford” If you make $70K a year, you can likely afford a home between $290,000 and $360,000*.

Does Freddie Mac allow 3% down

Available to qualified first-time homebuyers for a low down payment of just 3%, the Freddie Mac HomeOne® mortgage is a low down payment option that serves the needs of many first-time homebuyers, along with no cash-out refinance borrowers.

What is the smallest down payment for a conventional loan

3%

The minimum down payment requirement for a conventional loan is 3% of the loan amount. However, lenders may require borrowers with high DTI ratios or low credit scores to make a larger down payment. Even if it's not required, if you're able to make a higher down payment, you may want to consider doing so.

What are mortgage rates expected to be in 2023

“We expect that 30-year mortgage rates will end 2023 at 5.2%,” the organization noted in its forecast commentary. It since has walked back its forecast slightly but still sees rates dipping below 6%, to 5.6%, by the end of the year.