Can I get scammed if someone sends me money on Zelle?

According to Zelle’s roots connecting to the largest banks in America, it is fairly safe from hacks and scams. Most Zelle scams occur when scammers fraudulently induce victims to transfer money or share account details.

How do you know if someone is scamming you through Zelle?

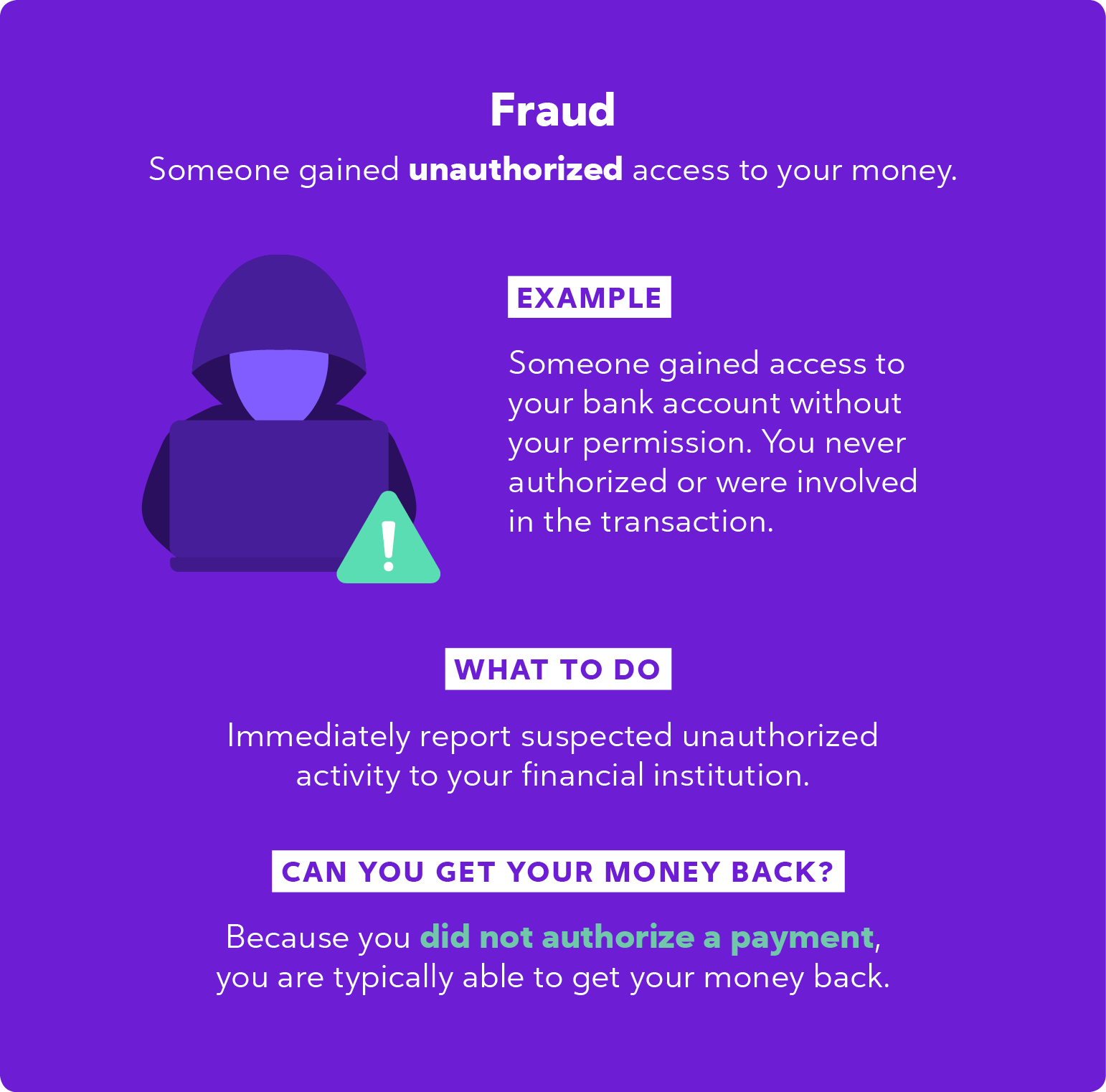

If someone accesses your account and conducts a Zelle transaction without your knowledge, that’s fraud. In such cases, you should get your money back as you didn’t authorize the activity. However, if you are aware of the transaction and authorized a payment to be sent, that’s a scam.

Can someone steal your bank info from Zelle?

No, a scammer cannot access your bank account through Zelle. It is important to be cautious and aware of potential scams when using any digital payment platform like Zelle or Cash App to avoid losing money.

Is it safe to give my Zelle info to receive money?

When you send and receive money with Zelle, no sensitive account details are shared. Only an email address or U.S. mobile number tied to a bank account in the U.S. is required. Authentication and monitoring features are in place to help secure your payments. However, it is advised to only use Zelle with people you trust.

What are the risks of using Zelle?

Risks can arise when banks or credit unions receiving Zelle payments do not adequately know their customers, screen out stolen or synthetic identities, or monitor accounts for unlawful use. This puts them at risk of running afoul of AML laws.

What to do if a stranger sends you money on Zelle?

If you feel you have been the victim of fraud or have been scammed, contact your bank or credit union immediately. In cases of unauthorized payments, consumers have legal rights and protections under the Electronic Funds Transfer Act (Reg E).

What’s safer: Zelle or Venmo?

Zelle transfers money directly to and from FDIC-insured bank accounts, providing protection for funds up to $250,000 per account. On the other hand, funds stored in Venmo are not FDIC-insured, making Zelle a safer option in terms of fund protection.

Can I get scammed if someone sends me money on Zelle

Can Your Bank Account Be Hacked Through Zelle Because Zelle's roots connect to the largest banks in America, Zelle is fairly safe from hacks. Most Zelle scams boil down to scammers fraudulently inducing victims to transfer money or share account details.

Cached

How do you know if someone is scamming you through Zelle

According to Early Warning Services, if someone accesses your account and conducts a Zelle transaction without your knowledge, that's a fraud. Because you didn't authorize the activity, you should get your money back. However, if you are aware of the transaction and authorized a payment to be sent, that's a scam.

Cached

Can someone steal your bank info from Zelle

No, a scammer cannot access your bank account through Zelle. However, it is important to be aware of potential scams and always exercise caution when using any digital payment platform like Zelle or Cash App so you don't lose money.

Cached

Is it safe to give my Zelle info to receive money

No sensitive account details are shared when you send and receive money with Zelle® – only an email address or U.S. mobile number tied to a bank account in the U.S. Authentication and monitoring features are in place to help make your payments secure, but, pay it safe: Only use Zelle® with people you trust, and always …

What are the risks of using Zelle

Risks can also arise when banks or credit unions are on the receiving end of Zelle payments. They may run afoul of AML laws when they do not adequately know their customers, screen out stolen or synthetic identities, or monitor accounts for unlawful use.

What to do if a stranger sends you money on Zelle

Contact Your Financial Institution for Possible Recourse

Contact your bank or credit union immediately if you feel you've been the victim of fraud or have been scammed. In cases of unauthorized payments, consumers have legal rights and protections under the Electronic Funds Transfer Act (also known as "Reg E”).

What’s safer Zelle or Venmo

Unlike Zelle, Funds Stored in Venmo Are Not FDIC-Insured

Zelle transfers money directly to and from FDIC-insured bank accounts, so you know the funds you send or receive are protected up to $250,000 per account.

What is the safest way to receive money from a buyer

What is the safest way to accept payment Besides cash, a certified check is the safest way you can receive a payment to your business.

What’s safer Zelle or venmo

Unlike Zelle, Funds Stored in Venmo Are Not FDIC-Insured

Zelle transfers money directly to and from FDIC-insured bank accounts, so you know the funds you send or receive are protected up to $250,000 per account.

What if a scammer sends you money

If you suspect that you've been targeted by a scammer on a money transfer app, report it to reportfraud.ftc.gov. For more tips on how to protect yourself and your wallet against common scams, visit regions.com/fraudprevention.

What is the safest way to receive money from a stranger online

Wire Transfer

This is the most secure and instantaneous way to deliver money online between disparate banks. Receiving a wire transfer, however, requires you to give your payer a cumbersome amount of banking information, including your account number and bank routing number.

What is downside of using Zelle

You can't transfer funds from a credit card

Zelle only supports bank transfers. If you usually use your credit card to send money to family and friends, this isn't the right payments app for you. Be aware that you often have to pay a fee to make a credit card transfer with other payments apps.

Is it safer to send money through Zelle or Cash App

Cash App and Zelle are both safe digital finance platforms that use two-factor authentification and data encryption to keep your money and data safe.

What is the safest way for a stranger to send you money

Venmo – semi-anonymous with wide availability (process the same as PayPal's) Cash App – flexible and anonymous app if you're willing to deal with the limits. Paying by cash – the most anonymous payment method. Third-party private payment services – many different types of services to choose from.

What is the best payment method to not get scammed

By and large, credit cards are easily the most secure and safe payment method to use when you shop online. Credit cards use online security features like encryption and fraud monitoring to keep your accounts and personal information safe.

What to do if someone accidentally sends you money on Zelle

What if a Zelle payment is sent to the wrong person or for the wrong amountIf the recipient has not claimed the money, you can cancel the payment through digital banking.If the payment is accepted (i.e. completed) or you can't contact the recipient to retrieve your funds, you can file a dispute.

Is Zelle safer than Venmo

Unlike Zelle, Funds Stored in Venmo Are Not FDIC-Insured

Zelle transfers money directly to and from FDIC-insured bank accounts, so you know the funds you send or receive are protected up to $250,000 per account.

What to do when a stranger sends you money

Ask the sender to cancel the transaction immediately — in many cases, the sender can simply contact the app's customer support to cancel the transaction. If the sender refuses to do so, contact the app's customer support yourself, explain the situation, and ask them to reverse the transaction.

Is Zelle safer than PayPal

However, while Zelle may appear more secure, applications like Venmo and PayPal are just as secure. All of them use data encryption to protect users against unauthorized transactions and store users' data on servers in secure locations.

What is the most common way to get scammed

Common ScamsAdvance Fee Scams.Tech Support Scams.Phishing.Emergency Scams.IRS or Government Imposter Scams.Foreign Money Exchange Scams.Counterfeit Cashier's Checks.Bogus Debts.

What is the safest payment method to receive money

What is the safest way to accept payment Besides cash, a certified check is the safest way you can receive a payment to your business.

What happens if someone sent me money through Zelle

Someone sent me money with Zelle®, how do I receive it If you have already enrolled with Zelle®, you do not need to take any further action. The money will move directly into your bank account associated with your profile, typically within minutes1.

Is it safe for a stranger to send you money

Sending money domestically or internationally via bank or wire transfer is safe to do. But only if you are 100% confident about who the recipient is. Most bank transfer fraud is done through mistaken identity – rather than a fault in the system.

Who is more likely to get scammed

Younger adults reported losses to online shopping fraud – which often started with an ad on social media – far more often than any other fraud type, and most said they simply did not get the items they ordered. Younger adults were over four times more likely than older adults to report a loss on an investment scam.

Should I accept money from a stranger on Zelle

If you don't know the person or aren't sure you will get what you paid for (for example, items bought from an on-line bidding or sales site), we recommend you do not use Zelle® for these types of transactions, which are potentially high risk.