Summary of the Article: How to Get Rid of Credit Fraud

1. To remove an Experian fraud alert: Contact the credit bureau online or by mail with your request. Fill out the form and put your request to remove the fraud alert in writing.

2. You can remove a fraud alert from your credit reports: Contact all three credit bureaus directly or let the fraud alert expire on its own. The expiration depends on the type of fraud alert you selected.

3. Initial fraud alerts and active-duty alerts: Expire after one year, while extended fraud alerts remain on your credit reports for seven years unless you request earlier removal.

4. Credit card fraud: Involving theft of the card or number can result in prison sentences of 1 to 5 years. Identity theft is treated more harshly with sentences up to 10 or 20 years.

5. To remove red flags from your credit report: File a dispute directly with the creditor or contact the company that provided the information. Lenders are required to investigate and respond to disputes. Include supporting documentation.

6. To remove a fraud alert on Equifax: Call (888) 836-6351 and provide necessary documents to verify your identity.

7. The success rate of catching credit fraud: Varies depending on cardholders’ actions and prevention methods taken by banks and card issuers. Estimates suggest less than 1% of credit card fraud is caught, but the actual number is unknown.

Questions:

- How do I get rid of credit fraud?

- Can you remove a fraud alert from your credit report?

- How long does it take to get fraud off your credit report?

- How serious is credit fraud?

- How do I remove red flags from my credit report?

- How do I get rid of a fraud alert on Equifax?

- How often do credit fraud get caught?

Answer: To remove an Experian fraud alert, contact the credit bureau online or by mail with your request and fill out the necessary form to verify your identity.

Answer: You can remove a fraud alert from your credit reports by contacting all three credit bureaus directly or letting the fraud alert expire on its own.

Answer: Initial fraud alerts and active-duty alerts expire after one year, while extended fraud alerts remain for seven years unless removed earlier.

Answer: Credit card fraud can result in prison sentences of 1 to 5 years, while identity theft can lead to harsher punishments of 10 to 20 years in prison.

Answer: File a dispute directly with the creditor or contact the company that provided the information, including supporting documentation, to support your claim.

Answer: Call (888) 836-6351 and provide the necessary documents to verify your identity in order to remove a fraud alert on Equifax.

Answer: The rate of catching credit card fraud varies depending on cardholders’ actions and prevention methods taken by banks and card issuers. The exact number is unknown but could be less than 1%.

How do I get rid of credit fraud

To remove an Experian fraud alert, you'll need to contact the credit bureau online or by mail with your request. Remove the fraud alert online: Head to Experian's Fraud Alert Center. Fill out this form verifying your identity, and putting in writing your request to remove the fraud alert from your credit report.

Cached

Can you remove a fraud alert from your credit report

You can remove a fraud alert from your credit reports by contacting all three credit bureaus directly or by letting the fraud alert expire on its own. Depending on what kind of fraud alert you selected, the alert will be automatically removed after one year (initial fraud alert) or seven years (extended fraud alert).

Cached

How long does it take to get fraud off your credit report

Initial fraud alerts and active-duty alerts expire after one year, and extended fraud alerts remain on your credit reports for seven years unless you request the alert to be removed sooner.

How serious is credit fraud

Credit card fraud that involves the theft of the card or the number typically has a prison sentence of 1 to 5 years. Identity theft is treated much more harshly with prison sentences up to 10 or 20 years.

How do I remove red flags from my credit report

File a dispute directly with the creditor. You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Lenders are required to investigate and respond to all disputes. Remember to include as much documentation as possible to support your claim.

How do I get rid of a fraud alert on Equifax

How can I remove a fraud alert or active duty alert To remove your fraud alert or active duty alert prior to expiration, please call (888) 836-6351, from 8 a.m. to midnight ET, 7 days a week. For your protection, you'll need to provide copies of certain documents to verify your identity.

How often do credit fraud get caught

It really depends on the actions taken by a cardholder after they notice a possible attack and the prevention methods a bank or card issuer takes to detect fraud. Some estimates say less than 1% of credit card fraud is actually caught, while others say it could be higher but is impossible to know.

Who pays for credit fraud

You, the consumer, typically aren't liable for credit card fraud, but someone pays the tab. So who foots the bill when a thief uses your credit card or its number to illegally buy stuff The short answer is it's typically the merchant where you bought something or the bank that issued the credit card.

How can I clean my credit report myself

How To Fix Your Credit In 7 Easy StepsCheck Your Credit Score & Report.Fix or Dispute Any Errors.Always Pay Your Bills On Time.Keep Your Credit Utilization Ratio Below 30%Pay Down Other Debts.Keep Old Credit Cards Open.Don't Take Out Credit Unless You Need It.

How to change your credit score illegally

Illegal ways to change a credit score include:Employer Identification Numbers – Are social security numbers that are obtained by companies.Credit Privacy Numbers – A CPN, or credit privacy number, is a nine-digit number that's formatted just like a Social Security number (SSN).

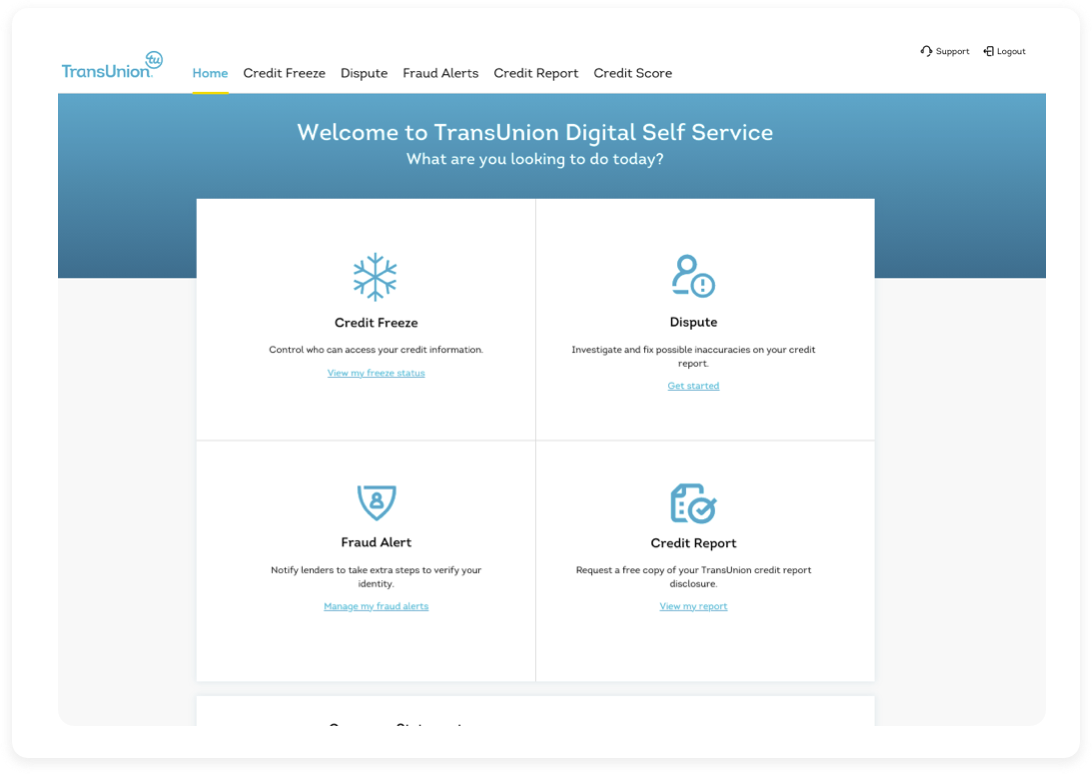

How do I remove fraud from TransUnion

The fastest way to remove a fraud alert is through the TransUnion Service Center. Log in or create an account to get started. You can also do this over the phone by calling us at 800-916-8800.

How long does it take to get caught for fraud

Typically bank fraud investigations take up to 45 days.

Do banks refund scammed money

Contact your bank immediately to let them know what's happened and ask if you can get a refund. Most banks should reimburse you if you've transferred money to someone because of a scam.

Is it worth paying someone to fix your credit

However tempting it may be to pay someone to undo damage, you are your own best resource. In short, no one can legally remove accurate and timely negative information from a credit report, and everything a credit repair clinic can do for you legally, you can do for yourself at little or no cost.

How can I get a collection removed without paying

You can ask the creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

What is the 609 loophole

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports.

How do I remove a charge-off without paying

Having an account charged off does not relieve you of the obligation to repay the debt associated with it. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily be rebuilt by paying other bills on time.

How do I clean up my TransUnion credit report

You submit an investigation request (dispute).

If you believe that an item contained in your TransUnion credit report is inaccurate or needs updating, send TransUnion a request for investigation or request to change information. You can start your investigation online. You can also submit a dispute by phone or mail.

How do I remove a disputed account from my credit report

To remove disputes from a credit report (for free) you can contact whichever credit bureau is reporting the dispute. Experian's phone number is 888-210-9101 and 866-673-0140 and it's answered by a real-life human being. Just tell them you need the National Consumer Assistance Center to end the dispute(s).

What is the lowest sentence for fraud

Though sentences differ widely, a misdemeanor conviction can lead to up to a year in a local jail, while a felony conviction can lead to multiple years in prison. Federal charges can lead to 10 years or more in federal prison.

What happens if someone fraudulently uses your credit card

Notify Your Credit Card Issuer

Some issuers allow for fraud reporting in their app or on their website, though you may need to call the number on the back of your card. If fraud is confirmed, the issuer will likely cancel that card and issue you a new one with different numbers.

Do banks track down fraudsters

Banks hire personnel, such as internal credit fraud investigators, who use electronic transaction trails and account-based rules to determine the origin of fraudulent transactions.

How do I get my money back from unauthorized transactions

Contact the company or bank that issued the credit card or debit card. Tell them it was a fraudulent charge. Ask them to reverse the transaction and give you your money back.

Who can clean my credit report

Unfortunately, there's no way to quickly clean your credit reports. Under federal law, the credit bureaus have 30 – 45 days to conduct their investigations when you dispute information. If the credit bureaus can verify the information on your credit reports, it can remain for up to seven to 10 years.

What happens if you never pay collections

If you ignore a debt in collections, you can be sued and have your bank account or wages garnished or may even lose property like your home. You'll also hurt your credit score. If you aren't paying because you don't have the money, remember that you still have options!