Summary of the Article:

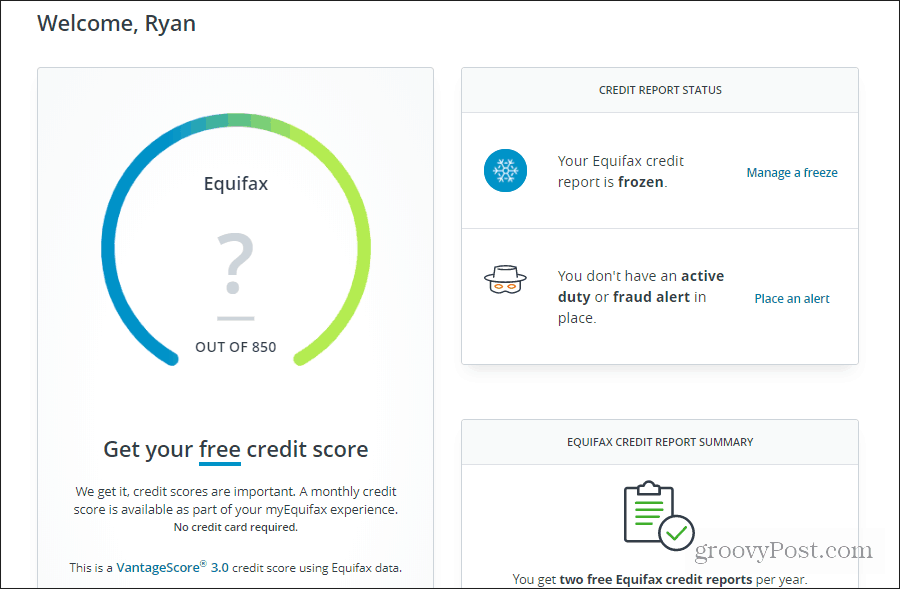

– How do I contact Equifax to unfreeze my credit: At Equifax, you can manage your freeze online with your username and password after creating a myEquifax account. You can also manage your freeze by phone: call us at (888) 298-0045. You’ll be required to give certain information to verify your identity.

– Can you call to unfreeze credit: The quickest and easiest way to unfreeze your credit report is to contact the credit bureau (or bureaus) you used to freeze your credit either online or by phone. But you also have the option to contact them by mail.

– How long does it take to unfreeze credit Equifax: Freezing and unfreezing your credit can be done as often as you like, but keep in mind that it can take up to an hour for each process to occur. If you freeze your credit and then realize that you need to unfreeze it, wait at least an hour to ensure that your credit is fully frozen.

– What number do I call to unfreeze my credit: 888-397-3742. Removing a security freeze takes up to three days following receipt of your mailed request. Phone: Additionally, you can request removal of an Experian security freeze by calling 888-EXPERIAN (888-397-3742).

– Do I need to unfreeze all three bureaus: You have to unfreeze your credit at all three credit bureaus individually unless you know which credit bureau a creditor is using for credit checks and choose to lift your freeze at just that one.

– Do I need to call all 3 credit bureaus to freeze my credit: You must contact each of the three credit bureaus to freeze your credit. Creating free online accounts with each bureau is the quickest way to manage your freezes. Alternatively, you can contact the bureaus via phone or mail.

– How long should I wait to unfreeze credit: But to be safe, you may need to wait up to an hour for the request to be processed. The timing for unfreezing credit by phone is similar to doing it online. If you request to unfreeze your credit by mail, you may have to wait for up to three days after the credit bureau receives your request for the change to happen.

– How many times can I unfreeze my credit: It’s free to freeze and unfreeze your credit report as often as you like. Ultimately, freezing your credit adds an extra layer of security to your identity and allows you to have control over who can access your credit information.

Questions and Answers:

- Q: How do I contact Equifax to unfreeze my credit?

- Q: Can you call to unfreeze credit?

- Q: How long does it take to unfreeze credit Equifax?

- Q: What number do I call to unfreeze my credit?

- Q: Do I need to unfreeze all three bureaus?

- Q: Do I need to call all 3 credit bureaus to freeze my credit?

- Q: How long should I wait to unfreeze credit?

- Q: How many times can I unfreeze my credit?

A: At Equifax, you can manage your freeze online with your username and password after creating a myEquifax account. You can also manage your freeze by phone: call us at (888) 298-0045. You’ll be required to give certain information to verify your identity.

A: Yes, the quickest and easiest way to unfreeze your credit report is to contact the credit bureau (or bureaus) you used to freeze your credit either online or by phone. You also have the option to contact them by mail.

A: Freezing and unfreezing your credit can be done as often as you like, but keep in mind that it can take up to an hour for each process to occur. If you freeze your credit and then realize that you need to unfreeze it, wait at least an hour to ensure that your credit is fully frozen.

A: To unfreeze your credit, you can call the number 888-397-3742. Removing a security freeze may take up to three days following receipt of your mailed request. Additionally, you can request removal of an Experian security freeze by calling 888-EXPERIAN (888-397-3742).

A: Yes, you have to unfreeze your credit at all three credit bureaus individually unless you know which credit bureau a creditor is using for credit checks and choose to lift your freeze at just that one.

A: Yes, you must contact each of the three credit bureaus to freeze your credit. Creating free online accounts with each bureau is the quickest way to manage your freezes. Alternatively, you can contact the bureaus via phone or mail.

A: To be safe, you may need to wait up to an hour for the request to be processed. The timing for unfreezing credit by phone is similar to doing it online. If you request to unfreeze your credit by mail, you may have to wait for up to three days after the credit bureau receives your request for the change to happen.

A: It’s free to freeze and unfreeze your credit report as often as you like. Ultimately, freezing your credit adds an extra layer of security to your identity and allows you to have control over who can access your credit information.

How do I contact Equifax to unfreeze my credit

At Equifax, you can manage your freeze online with your username and password after creating a myEquifax account. You can also manage your freeze by phone: call us at (888) 298-0045. You'll be required to give certain information to verify your identity.

Cached

Can you call to unfreeze credit

The quickest and easiest way to unfreeze your credit report is to contact the credit bureau (or bureaus) you used to freeze your credit either online or by phone. But you also have the option to contact them by mail.

Cached

How long does it take to unfreeze credit Equifax

Freezing and unfreezing your credit can be done as often as you like, but keep in mind that it can take up to an hour for each process to occur. If you freeze your credit and then realize that you need to unfreeze it, wait at least an hour to ensure that your credit is fully frozen.

What number do I call to unfreeze my credit

888-397-3742

Removing a security freeze takes up to three days following receipt of your mailed request. Phone: Additionally, you can request removal of an Experian security freeze by calling 888-EXPERIAN (888-397-3742).

Cached

Do I need to unfreeze all three bureaus

You have to unfreeze your credit at all three credit bureaus individually, unless you know which credit bureau a creditor is using for credit checks and choose to lift your freeze at just that one.

Do I need to call all 3 credit bureaus to freeze my credit

You must contact each of the three credit bureaus to freeze your credit. Creating free online accounts with each bureau is the quickest way to manage your freezes. Alternatively, you can contact the bureaus via phone or mail.

How long should I wait to unfreeze credit

But to be safe, you may need to wait up to an hour for the request to be processed. The timing for unfreezing credit by phone is similar to doing it online. If you request to unfreeze your credit by mail, you may have to wait for up to three days after the credit bureau receives your request for the change to happen.

How many times can I unfreeze my credit

It's free to freeze and unfreeze your credit report as often as you like. Ultimately, freezing your credit adds an extra layer of security to your identity and accounts.

Do I need to unfreeze my credit with all three

You have to unfreeze your credit at all three credit bureaus individually, unless you know which credit bureau a creditor is using for credit checks and choose to lift your freeze at just that one.

Does it cost to unfreeze your credit

It's now free to freeze and unfreeze your credit reports with the three major credit reporting bureaus. A credit freeze doesn't prevent people who already have access to your credit history from viewing your credit file. In lieu of a credit freeze, you can also place a fraud alert on your credit file.

Do I have to unfreeze all three credit bureaus to apply for credit card

If you're looking to apply for a loan or credit card, you will need to unfreeze your credit report. You'll have to unfreeze your credit report individually with each credit bureau. However, if you know which bureau a creditor is using, you can just unfreeze that one.

How do I unfreeze all 3 credits

You can't unfreeze at all three with a single action. You'll have to unfreeze your credit with each credit bureau individually. How do I unfreeze my credit You can unfreeze and freeze your credit reports online or by mail, or by calling each credit bureau.

How do I unlock all 3 credit reports

You can unfreeze your credit report at each of the three bureaus—Experian, TransUnion and Equifax—online through your accounts, over the phone or by mailing the correct documentation.

Does Equifax freeze all three bureaus

With a security freeze, your credit reports cannot be accessed (with some exceptions) to open new credit unless you temporarily lift or permanently remove the credit freeze. You'll need to place a security freeze on your credit reports at each of the three nationwide credit bureaus – Equifax, Experian and TransUnion.

Do I need to call all 3 credit bureaus to unfreeze my credit

You have to unfreeze your credit at all three credit bureaus individually, unless you know which credit bureau a creditor is using for credit checks and choose to lift your freeze at just that one.

How long does Equifax freeze last

An initial (one-year) fraud alert can be placed if you believe you are or may become a victim of fraud or identity theft. The fraud alert lasts for one year. If you want to keep it active on your credit reports, you'll need to renew it after that time.

How do I lift a freeze from all credit bureaus

In order to place or remove a credit freeze on your credit reports, you must contact each of the three major credit bureaus (Equifax, Experian and TransUnion) individually. It might be worth asking your potential creditor or employer which bureau it uses for credit checks.

Will my score still go up if I freeze my credit

A credit freeze won't have any impact on your credit score, nor will it impact your current credit accounts. While a credit freeze won't affect your credit score in any way, it will impact your ability to qualify for a loan or credit card unless you thaw your credit file before submitting your application.

Will my credit score go down if I freeze my account

No, freezing a credit card doesn't hurt your credit. As long as you keep your account in good standing, your frozen card will still help you improve your credit score. Also, there is no penalty or charge for freezing your account, and you can unfreeze it anytime you want.

How long does it take to unfreeze your credit

In most cases, if you request to remove the freeze (also known as "thawing" your credit report) online or by telephone, your Experian credit file can be unfrozen within a matter of minutes—although you should allow up to an hour. You can also request to lift your freeze by mail.

How long should I lift a credit freeze

In most instances a week is usually enough time for a business, credit card issuer, or potential employer to check your report. If you can find out which credit bureau they use, you only need to lift your freeze with that particular credit bureau.

How long does it take to remove Experian freeze

3 days

Updating your security freeze or unfreeze will take up to 3 days upon receiving your mailed request.

How long should you keep your credit frozen

"I recommend keeping it frozen until you need to use it. Let's face it, you know when you are going to apply for a mortgage, auto loan or credit card, so keep your credit frozen until you need it." Individuals can still access their credit report when frozen, but they can't apply for any new credit.

When should I unfreeze my credit

Applying for a credit card or loan: You should unfreeze your credit report when you're getting ready to apply for a credit card or loan. With a freeze in place, the credit card issuer or lender can't pull your credit report to determine whether you qualify for the loan.

How do you unfreeze all 3 credit bureaus

You can unfreeze your credit report at each of the three bureaus—Experian, TransUnion and Equifax—online through your accounts, over the phone or by mailing the correct documentation.