Summary of Article: How to Borrow Money from UBA Bank

In this article, we will discuss the process and requirements for borrowing money from UBA Bank, as well as other related information.

Key Points:

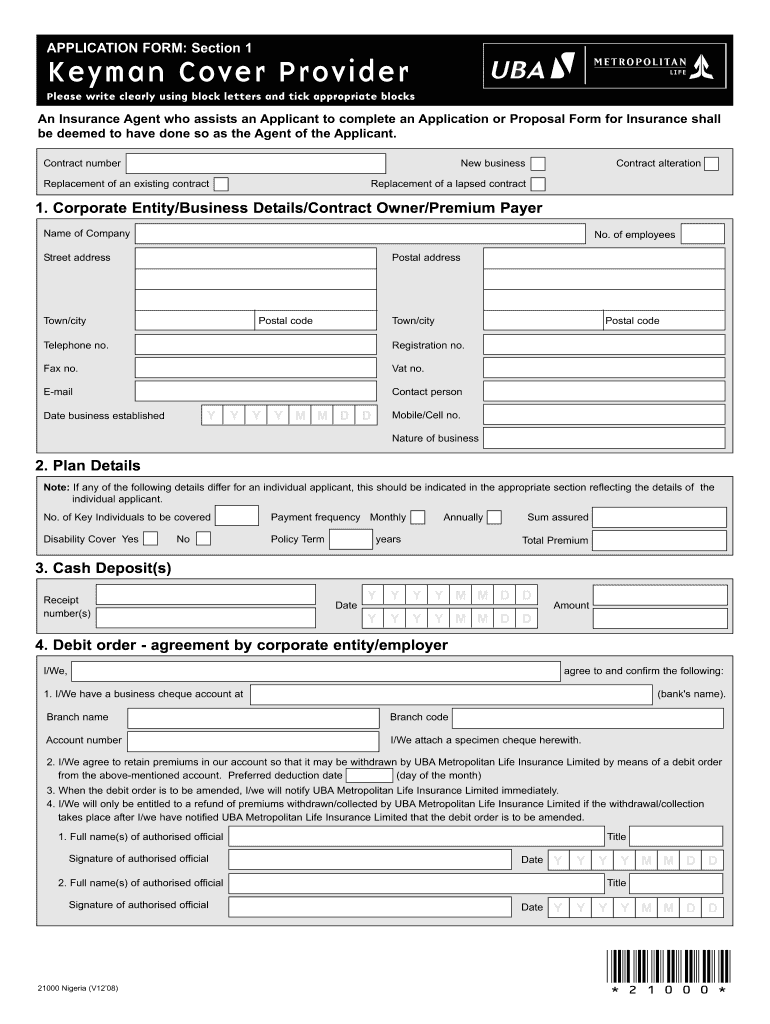

- Visit a UBA branch to complete a loan application form.

- Submit the completed form with supporting documents at any branch.

- After loan approval, execute an offer letter detailing the loan terms.

- The loan will be disbursed into your salary account with UBA Bank.

- The UBA Personal Loan offers up to N30 million with a flexible repayment period of 48 months.

- The UBA Bank Nigeria quick loan code is *919*28#.

- You can access the loan code from your mobile phone linked to your UBA bank account.

- To borrow money from UBA, your UBA account must be your salary account for at least 3 months.

- There are various cash advance apps available for borrowing money, such as Brigit, EarnIn, Empower, and Dave.

- Passbook loans allow you to use your savings account as collateral for a loan.

- Several platforms in Nigeria offer online loans, including Branch, FairMoney, Palmcredit, Carbon, Okash, Aella Credit, QuickCheck, and Umba.

- UBA Bank offers loans up to N5 million with a 12-month repayment period at an interest rate of 1.58% per month.

Questions and Answers:

- Question: How can I borrow money on my UBA account?

- Question: Does UBA borrow people money?

- Question: What is the code to borrow money from my UBA bank account?

- Question: Can I borrow money from UBA without a salary account?

- Question: Which app can I use to borrow money?

- Question: Can I borrow money from my bank account?

- Question: Which platform can I borrow money in Nigeria?

- Question: What is the interest rate for UBA bank loans?

Answer: To borrow money from UBA Bank, you need to visit a UBA branch and complete a loan application form. Then, submit the completed form with supporting documents. After loan approval, you will need to execute an offer letter detailing the loan terms. Finally, the loan will be disbursed into your salary account domiciled with UBA Bank.

Answer: Yes, UBA Bank offers personal loans of up to N30 million with a flexible repayment period of 48 months at a competitive interest rate.

Answer: The UBA Bank Nigeria quick loan code is *919*28#. You can access it from your mobile phone linked to your UBA bank account on any mobile network in Nigeria.

Answer: No, your UBA account must be your salary account through which you have received salary payments for at least 3 months to be eligible to borrow money from UBA Bank.

Answer: There are several cash advance apps available for borrowing money, such as Brigit, EarnIn, Empower, and Dave. Each app has its own loan amounts and fees. For example, Brigit offers loans ranging from $20 to $250 with a $9.99 monthly subscription fee.

Answer: Some banks and credit unions offer passbook loans, where you can use your savings account as collateral for a loan. The loan amount is usually up to 100% of the amount in your account, and the interest rate may be lower compared to other types of loans.

Answer: There are several platforms in Nigeria that offer online loans, including Branch, FairMoney, Palmcredit, Carbon, Okash, Aella Credit, QuickCheck, and Umba. Each platform has its own loan terms and requirements.

Answer: According to a statement released by UBA Bank, customers can apply for loans up to N5 million and pay back over a 12-month period at an interest rate of 1.58% per month.

How can I borrow money on my UBA account

How to apply– Visit a UBA branch to complete a loan application form.– Submit a completed loan application form with supporting documents at any branch– Execute an offer letter detailing the loan terms and requirements, following loan approval– Loan will be disbursed into salary account domiciled with the Bank

Does UBA borrow people money

Personal Loans

With the UBA Personal Loan, you can get up to N30 million, to help you live your dreams. You also enjoy a flexible repayment period of 48 months at a highly competitive interest rate.

What is the code to borrow money from my UBA bank account

What is the code to borrow money from UBA bank The UBA Bank Nigeria quick loan code is *919*28#. It is available to all UBA account holders in Nigeria and you can access it from all mobile networks. You can only access it on your mobile phone number linked to your UBA bank account.

Cached

Can I borrow money from UBA without salary account

Your UBA account must be your salary account through which they have paid salaries for at least 3 months.

Which app can I use to borrow money

Summary of cash advance apps

| Loan app | Loan amount | Other fees |

|---|---|---|

| Brigit | $20-$250. | $9.99 monthly subscription fee. |

| EarnIn | Up to $100 per day, $750 per pay period. | None. |

| Empower | $10-$250. | $8 monthly subscription fee unless you opt out. |

| Dave | Up to $500. | $1 monthly membership fee. |

Can I borrow money from my bank account

Passbook loans allow you to use your savings account as collateral for a loan. Most banks and credit unions let you borrow up to 100% of the amount in your account. Passbook loans may offer lower interest rates than a credit card or personal loan without collateral.

Which platform can I borrow money in Nigeria

We've detailed what we found below.Branch. Branch is a platform that offers quick online loans in Nigeria.FairMoney.Palmcredit.Carbon.Okash.Aella Credit.QuickCheck.Umba.

What is the interest rate for UBA bank loans

According to a statement released by the bank, customers can apply for loans up to N5 million and pay back over a 12-month period at an interest rate of 1.58% per month.

How do I borrow a loan with USSD code

How to Apply for Loans Using USSD CodesDial the USSD code for the financial institution offering the loan.Select the loan option from the menu.Provide the required information, such as loan amount, repayment period, and personal information.Review the terms and conditions of the loan.

Can I borrow money from the bank without credit

Is it possible to get a loan with no credit Yes, it is possible to get a loan with no credit or bad credit, but lenders will likely charge you a higher interest rate than if you had established credit history.

Can I get a loan with no job and no bank account

You can get a loan without a job by finding a cosigner or co-borrower, providing an alternative source of income, putting up collateral. Lenders won't discriminate against you just because you don't have a job, but they will require you to demonstrate the ability to repay what you borrow somehow.

What app lets you borrow $200

From getting your paycheck early to effortlessly saving money, Chime makes banking – and borrowing up to $200 – a breeze. SpotMe is Chime's answer to the dreaded overdraft fee. You can overdraft your Chime account up to $200 on debit card purchases without any fees – instantly.

How to get a cash advance

You can typically get a cash advance in a few different ways:At an ATM: If you have a PIN for your credit card, you can go to an ATM and get a cash advance.In person: Visit your bank and request a cash advance with your credit card.

How much can I borrow money from bank

Most lenders cap the amount you can borrow at just under five times your yearly wage.

How can I make urgent money in Nigeria

Keep reading!Freelancing. Freelancing is a fast-growing business in Nigeria and is one of the best ways to make money online.Crypto Trading.Virtual Assistant Jobs.Affiliate Marketing.E-commerce.Social Media Management.Blogging.Content Creation.

Where can I borrow money easily

Let's walk through each option so you know what to consider before you decide if borrowing money might be best for you.Banks.Credit unions.Online lenders.Cash advance apps.Cash advance from a credit card.Buy-now, pay-later apps.401(k) retirement account.Family and friends.

How much is Nigerian bank loan interest

The range for interest rates on personal loans in Nigeria is 5% to 30%, so anything within that can be considered acceptable relative to these factors.

How to get a loan from the bank

Check whether you qualify for a bank loan. Before applying for a bank loan, you'll want to know whether you qualify.Compare rates on bank loans.Submit your application for a bank loan.Review the loan agreement.Receive your funds.

What is the code for fast cash loan

How to apply for FCMB Fastcash Loan for Entrepreneurs, Individuals & Salary Earners. It is an instant loan and you can apply via the mobile app or USSD code *329*11#.

How do I get access instant loan

You can get access to an instant loan by dialing *901*11#, *426*11# or via Internet Banking, WhatsApp Banking, Access Mobile App and QuickBucks App. 24/7 service which does not require visits to the bank and application is done conveniently via *901*11#, *426#, QuickBucks App, Internet Banking, Mobile App.

What kind of credit score do you need to borrow money from a bank

Generally, borrowers need a credit score of at least 610 to 640 to even qualify for a personal loan. To qualify for a lender's lowest interest rate, borrowers typically need a score of at least 690.

What are the easiest loans to get approved for

The easiest loans to get approved for are payday loans, car title loans, pawnshop loans and personal loans with no credit check. These types of loans offer quick funding and have minimal requirements, so they're available to people with bad credit. They're also very expensive in most cases.

How can I get a personal loan without proof of income

You may be able to get a personal loan without income verification if you pledge collateral, use a co-signer or have an excellent credit score. June 6, 2023, at 4:58 p.m. Some people who need money fast to pay for unexpected expenses or large purchases turn to personal loans.

What loan can I get without a bank account

Payday, pawnshop loans and title loans are three types of loans where a bank account may not be necessary. Here's how each works: Payday loans: Payday loans are short-term loans that allow you to borrow a small sum of money (usually $500 or less) until your next paycheck.

How do I borrow $400 from Cash App

How To Borrow Money on Cash AppOpen Cash App.Tap on the home screen icon, if necessary, to navigate to the “Banking” header.Check for the word “Borrow.”If you see “Borrow,” you can take out a Cash App loan.Tap on “Borrow.”Tap “Unlock.”Cash App will tell you how much you'll be able to borrow.