Summary of the Article:

1. Experian does not show bank accounts: Your credit report only includes financial information related to debt, such as loan and credit card accounts. Savings or checking account balances, investments, and purchase transactions are not included.

2. Connecting your bank account to Experian is safe: Experian uses read-only access to your bank statement data to identify qualifying payments made to telecom and utility companies. They do not store any consumer bank credentials.

3. Experian knows your income: Using advanced analytics, Experian identifies income streams, both active and inactive, and assigns a confidence score to validate and sort income quickly.

4. What shows up on your Experian credit report: It contains information about your debt, payment history, and credit account management.

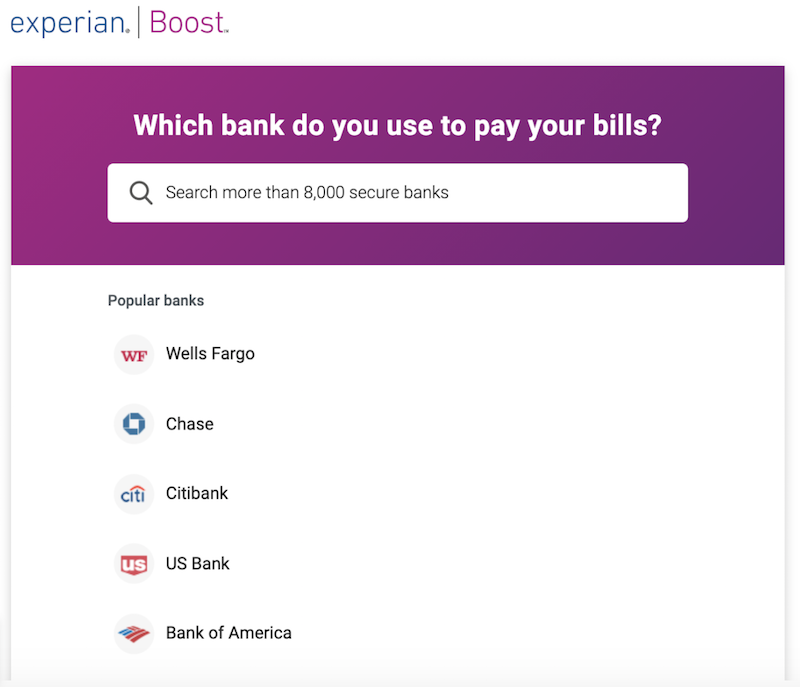

5. Experian needs your bank account for Experian Boost: Experian Boost connects to your bank and credit card accounts to find qualifying on-time bill payments and adds them to your credit file.

6. Banks report to Experian once a month: Lenders, credit card issuers, and other data reporters update credit information at the three national credit bureaus, including Experian, once a month.

7. Experian can be trusted: Credit scores from Experian, Equifax, and TransUnion are considered accurate, based on the information provided by lenders and creditors. You can check your credit report for accuracy.

8. Experian does SSN traces: Experian’s consumer credit database allows authorized subscribers to input up to 20 Social Security numbers for inquiries.

Questions:

1. Does Experian show bank accounts?

Experian only includes financial information related to debt, such as loan and credit card accounts. Savings or checking account balances, investments, and purchase transactions are not shown on your credit report.

2. Is it safe to connect your bank account to Experian?

Experian utilizes read-only access to your bank statement data, ensuring the process is secure. They do not store any consumer bank credentials.

3. Does Experian know my income?

Experian uses advanced analytics to identify income streams, both active and inactive, and assigns a confidence score to validate and sort income quickly.

4. What information shows up on your Experian credit report?

Your Experian credit report includes information about your debt, payment history, and how you manage your credit accounts.

5. Why does Experian need my bank account?

Experian may require access to your bank account for services like Experian Boost, which connects to your bank and credit card accounts to find qualifying on-time bill payments and adds them to your credit file.

6. How often do banks report to Experian?

Lenders, credit card issuers, and other data reporters update credit information at the three national credit bureaus, including Experian, once a month.

7. Can Experian be trusted?

Credit scores from Experian, Equifax, and TransUnion are considered accurate based on the information provided by lenders and creditors. It’s recommended to check your credit report for accuracy.

8. Does Experian perform SSN traces?

Experian allows authorized subscribers to input up to 20 Social Security numbers for inquiries in their consumer credit database.

Does Experian show bank accounts

While your credit report features plenty of financial information, it only includes financial information that's related to debt. Loan and credit card accounts will show up, but savings or checking account balances, investments or records of purchase transactions will not.

Cached

Is it safe to connect your bank account to Experian

Experian utilizes read-only access to your bank statement data to find your qualifying payments made to telecom and utility companies. This process is secure, and Experian does not store any consumer bank credentials—it only stores a record of any qualifying on-time payments.

Does Experian know my income

Experian uses advanced analytics to identify income streams, both active and inactive. Through our analytics we are able to rank income streams, assigning a confidence score. This makes it easy to validate and sort income quickly. Income is now identified in minutes through a detailed report.

What shows up on your Experian credit report

It contains information about how much debt you have, how often you pay your credit and debt bills on time, and how long you have been managing your credit accounts.

Why does Experian need my bank account

Experian Boost works by connecting to your bank and credit card accounts to find qualifying on-time bill payments and, with your permission, adding those payments to your credit file. The process takes about five minutes, and you'll see any changes to your credit scores instantly.

How often do banks report to Experian

once every month

Lenders, credit card issuers and other data reporters typically update your credit information at the three national credit bureaus (Experian, TransUnion and Equifax) once every month.

Can Experian be trusted

Credit scores from the three main bureaus (Experian, Equifax, and TransUnion) are considered accurate. The accuracy of the scores depends on the accuracy of the information provided to them by lenders and creditors. You can check your credit report to ensure the information is accurate.

Does Experian do SSN traces

Social Search is easy to use. As an authorized subscriber, you can input up to 20 Social Security numbers on an inquiry into Experian's consumer credit database. Our comprehensive system then searches for and retrieves identifying information on up to 10 consumers associated with the same Social Security number.

How do credit agencies verify income

They typically ask about your income on credit applications and may require proof, in the form of a pay stub or tax return, before finalizing lending decisions. Sometimes creditors ask for proof of employment and the name of your employer on credit application as well.

Does credit karma look at Experian

Credit Karma is different from Experian. While Experian compiles your credit report and determines your credit score, Credit Karma simply shows you credit scores and report information from Equifax and TransUnion.

What makes Experian score go up

Common reasons for a score increase include: a reduction in credit card debt, the removal of old negative marks from your credit report and on-time payments being added to your report. The situations that lead to score increases correspond to the factors that determine your credit score.

Can I trust Experian

Credit scores from the three main bureaus (Experian, Equifax, and TransUnion) are considered accurate. The accuracy of the scores depends on the accuracy of the information provided to them by lenders and creditors. You can check your credit report to ensure the information is accurate.

Will applying for a bank account affect my credit score

Opening a new bank account should only lower your credit score temporarily – but if you do it too often, your score won't have time to recover. Being close to your credit limit.

How do debt collectors find your bank account

Creditors and debt collectors can find your bank accounts through your previous payment records, credit applications, skip tracers, and information subpoenas. Most of the time, the creditor must obtain a court order before garnishing your bank accounts, but this isn't the case for some government entities.

How do I know if my bank is reporting to credit bureaus

They should report monthly, preferably on the billing cycle date. For credit card companies, this is usually the day that they issue your charges for the most recent billing cycle, also known as your statement date.

Does making an Experian account hurt your credit

Soft inquiries also occur when you check your own credit report or score or when you use credit monitoring services from Experian and other companies. These inquiries do not impact your credit score, and are listed in a separate section in your credit report from the ones that do.

Who is more accurate Experian or Credit Karma

Credit Karma: Which is more accurate for your credit scores You may be surprised to know that the simple answer is that both are accurate. Read on to find out what's different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.

What data does Experian collect

Contact data — name, postal address, email address, telephone number and date of birth • Life events — individuals who have recently moved home or had a baby • Insurance renewal — individuals' home and motor insurance renewal dates • Device information — we may also obtain information about the electronic devices you …

How does Experian verify identity

When you request a copy of your Experian credit report online, you will be asked a series of questions in order to verify your identity. The questions are derived from a number of sources, including the information contained in your credit report.

What happens if you put wrong income on credit card application

The consequences could also be serious if you unintentionally put the wrong information about your income on a credit card application. The credit card company may deny your application, or if you are approved, they may give you a lower credit limit than you expected.

Do credit card companies check your bank account

Credit card issuers are required by law to consider your ability to repay debt prior to extending a new line of credit. So, listing your annual income is a requirement on every credit card application. To that end, credit card issuers may also ask for proof of income, such as pay stubs, bank statements, or tax returns.

Is it better to use Experian or Credit Karma

Credit Karma: Which is more accurate for your credit scores You may be surprised to know that the simple answer is that both are accurate. Read on to find out what's different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

Is a 700 Experian score good

Your score falls within the range of scores, from 670 to 739, which are considered Good. The average U.S. FICO® Score, 714, falls within the Good range.

Is Experian more reliable than Credit Karma

Experian vs. Credit Karma: Which is more accurate for your credit scores You may be surprised to know that the simple answer is that both are accurate. Read on to find out what's different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.