Do airport scanners see cash?

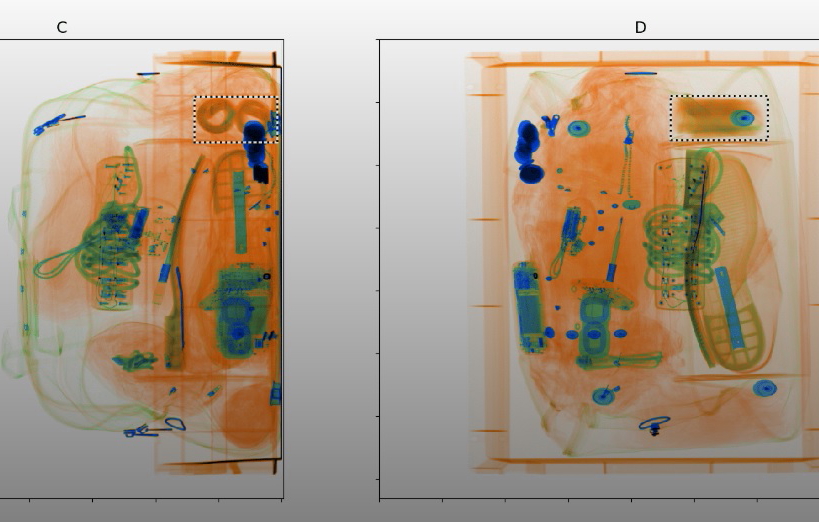

Scanners at airports are operated in a way that they can detect thick wads of cash. This money is counted to determine how much it is, and the person carrying it might be questioned.

How do I hide money from my airport scanner?

For a little extra cash, roll up your cash. Put it exactly back into the wrapper very carefully. And easily put it in place. And put some other gum around it to make it nice and camouflage.

Does cash set off metal detectors?

They can only count the number of bills they find. That’s because a dollar bill carries the same amount of responsive magnetic ink as a $100 bill — meaning somebody carrying $10 in ones would trigger the metal detector just as much as somebody carrying $1,000 in hundreds.

Can I keep cash in my pocket through airport security?

You can fly with any amount of cash. No law prohibits you from bringing any amount of money on a flight. Likewise, TSA has no rules that limit how much money you can bring through security.

Can TSA question you about cash?

However, if you are found flying with large amounts of cash or money, TSA officers may question you as to why you have it and details of your trip. These questions are designed to prevent crime such as drug trafficking or money laundering, so you should be prepared to answer truthfully and honestly to these questions.

Can cash be detected?

No, metal detectors are not able to detect paper money. This is because paper money is not magnetic and it has no trace of metal in it. Metal detectors use an electromagnetic field to detect metal objects, and since paper money contains no metal, it cannot be detected.

How can I travel safely with cash?

Keep cash in places that only you can reach easily, such as front pant pockets or inside jacket pockets. You can also attach your wallet to your belt with a small chain for extra security. Storing cash and other valuables in handbags and backpacks can also put you at risk of being robbed.

How do you keep cash safe when traveling?

6 Tips for Keeping Your Money Safe While Traveling Abroad: Use Credit, Limit Cash. Using a credit card saves you from unauthorized charges should someone get ahold of it. Avoid Secluded ATMs. The more visible you are, the better. Use A Money Belt. Use A Dummy Wallet. Carry An Anti-Theft Bag. Use Small Bills.

Will a metal detector find paper money?

“Large bundles of banknotes contain enough magnetic material to be detected at a distance” They found an ordinary handheld metal detector was able to pick up a dollar bill from 3 centimeters.

Is there a way to detect cash?

Hold the bill up to a light to check for a watermark. A watermark bearing the image of the person whose portrait is on the bill can be found on all $10, $20, $50, and $100 bills series 1996 and later, and on $5 bills series 1999 and later.

What is the safest way to fly with cash?

Always keep your money in a carry-on bag. Your airline will not compensate you if your money is in a checked bag and that bag is lost, stolen, or destroyed. Keep your money and other valuables out of public view. Keep your baggage and belongings in sight when passing through a security checkpoint.

Do airport scanners see cash

Does Money Get Flagged During Scanning Scanners at airports are operated in a way that they can detect thick wads of cash. This money is counted to determine how much it is, and the person carrying it might be questioned.

Cached

How do I hide money from my airport scanner

For. A little extra cash roll up your cash. Put it exactly back into the wrapper very carefully. And easily put it in place. And put some other gum around it to make it nice and camouflage.

Does cash set off metal detectors

They can only count the number of bills they find. That's because a dollar bill carries the same amount of responsive magnetic ink as a $100 bill — meaning somebody carrying $10 in ones would trigger the metal detector just as much as somebody carrying $1,000 in hundreds.

Can I keep cash in my pocket through airport security

You can fly with any amount of cash. No law prohibits you from bringing any amount of money on a flight. Likewise, TSA has no rules that limit how much money you can bring through security.

Can TSA question you about cash

However, if you are found flying with large amounts of cash or money, TSA officers may question you as to why you have it and details of your trip. These questions are designed to prevent crime such as drug trafficking or money laundering, so you should be prepared to answer truthfully and honestly to these questions.

Can cash be detected

No, metal detectors are not able to detect paper money. This is because paper money is not magnetic and it has no trace of metal in it. Metal detectors use an electromagnetic field to detect metal objects, and since paper money contains no metal, it cannot be detected.

How can I travel safely with cash

Keep cash in places that only you can reach easily, such as front pant pockets or inside jacket pockets. You can also attach your wallet to your belt with a small chain for extra security. Storing cash and other valuables in handbags and backpacks can also put you at risk of being robbed.

How do you keep cash safe when traveling

6 Tips for Keeping Your Money Safe While Traveling AbroadUse Credit, Limit Cash. Using a credit card saves you from unauthorized charges should someone get ahold of it.Avoid Secluded ATMs. The more visible you are, the better.Use A Money Belt.Use A Dummy Wallet.Carry An Anti-Theft Bag.Use Small Bills.

Will a metal detector find paper money

"Large bundles of banknotes contain enough magnetic material to be detected at a distance" They found an ordinary handheld metal detector was able to pick up a dollar bill from 3 centimetres…

Is there a way to detect cash

Hold the bill up to a light to check for a watermark. A watermark bearing the image of the person whose portrait is on the bill can be found on all $10, $20, $50, and $100 bills series 1996 and later, and on $5 bills series 1999 and later.

What is the safest way to fly with cash

Always keep your money in a carry-on bag. Your airline will not compensate you if your money is in a checked bag and that bag is lost, stolen, or destroyed. Keep your money and other valuables out of public view. Keep your baggage and belongings in sight when passing through a security checkpoint.

Do I need to declare cash at airport

You may bring into or take out of the country, including by mail, as much money as you wish. However, if it is more than $10,000, you will need to report it to CBP. Use the online Fincen 105 currency reporting site or ask a CBP officer for the paper copy of the Currency Reporting Form (FinCen 105).

What happens when you declare cash at the airport

U.S. Customs and Border Protection notes that consequences can include: Forfeiture of the money you're carrying—meaning they take the money at customs and you don't get it back. Civil penalties such as fines. Criminal penalties—including prison time—if you're convicted of a crime related to illegally transporting money.

How much cash looks suspicious

$10,000

Financial institutions are required to report cash deposits of $10,000 or more to the Financial Crimes Enforcement Network (FinCEN) in the United States, and also structuring to avoid the $10,000 threshold is also considered suspicious and reportable.

Is cash untraceable

Physical money has been with us for thousands of years for a reason. Cash is essentially untraceable, it's easy to carry, it's widely accepted and it's reliable.

Can you travel with $10,000 cash

It's legal to travel with more than $10,000 in the United States and abroad. You have the right to travel with as much money as you want. However, during international travel, you need to report currency and monetary instruments in excess of $10,000.

Is it safe to put cash in checked luggage

Always keep cash and other valuables with you in a carry-on bag. Never leave such items in checked baggage. Don't forget to declare the cash to customs if you're traveling internationally.

Is it smart to travel with cash

While credit cards are easy to carry and more secure than cash, you should always have some local cash on you when traveling. It's just good sense. Besides the fact that some local shops and vendors won't accept credit cards, having some cash provides a safety net in case your bank shuts off your card for any reason.

Is paper money untraceable

Paper money also isn't subject to cybersecurity risks or potential privacy violations, he added. “When I hand you a $20 bill, there is no data captured by anybody from that transaction…it's a relatively anonymous private thing, whereas all digital forms of payment generate data trails,” Maurer said.

Will a metal detector pick up paper money

Today to the money can't quite pick the whole thing up yet. But it's close. So let's give it a try on the detector.

Can I fly with $2000 cash

There is no limit on the amount of cash you can carry with you when flying domestically within the United States. However, if you are traveling internationally, you are required to declare any amounts over $10,000 USD to customs. Failure to do so can result in a penalty.

What happens if you don’t declare money at the airport

Not reporting cash or cash equivalents over the amount of $10,000 can come with serious consequences. U.S. Customs and Border Protection notes that consequences can include: Forfeiture of the money you're carrying—meaning they take the money at customs and you don't get it back. Civil penalties such as fines.

Can I travel with $10,000 dollars

It's legal to travel with more than $10,000 in the United States and abroad. You have the right to travel with as much money as you want. However, during international travel, you need to report currency and monetary instruments in excess of $10,000.

What amount of cash gets flagged

Although many cash transactions are legitimate, the government can often trace illegal activities through payments reported on complete, accurate Forms 8300, Report of Cash Payments Over $10,000 Received in a Trade or BusinessPDF. Here are facts on who must file the form, what they must report and how to report it.

Is depositing 500 cash suspicious

Depending on the situation, deposits smaller than $10,000 can also get the attention of the IRS. For example, if you usually have less than $1,000 in a checking account or savings account, and all of a sudden, you make bank deposits worth $5,000, the bank will likely file a suspicious activity report on your deposit.