HTML format without tags:

Summary of the Article:

1. Gap insurance does not cover missed or late payment fees, repossessions, extended warranty costs, or car repairs. It only covers loan balances.

2. Some gap insurance policies have a limit on the total amount you can receive. For example, Progressive’s gap insurance policy covers up to 25% of the vehicle’s ACV.

3. If you already paid for gap insurance, you can cancel it and request a refund from your car insurance company for any unused portion of the coverage.

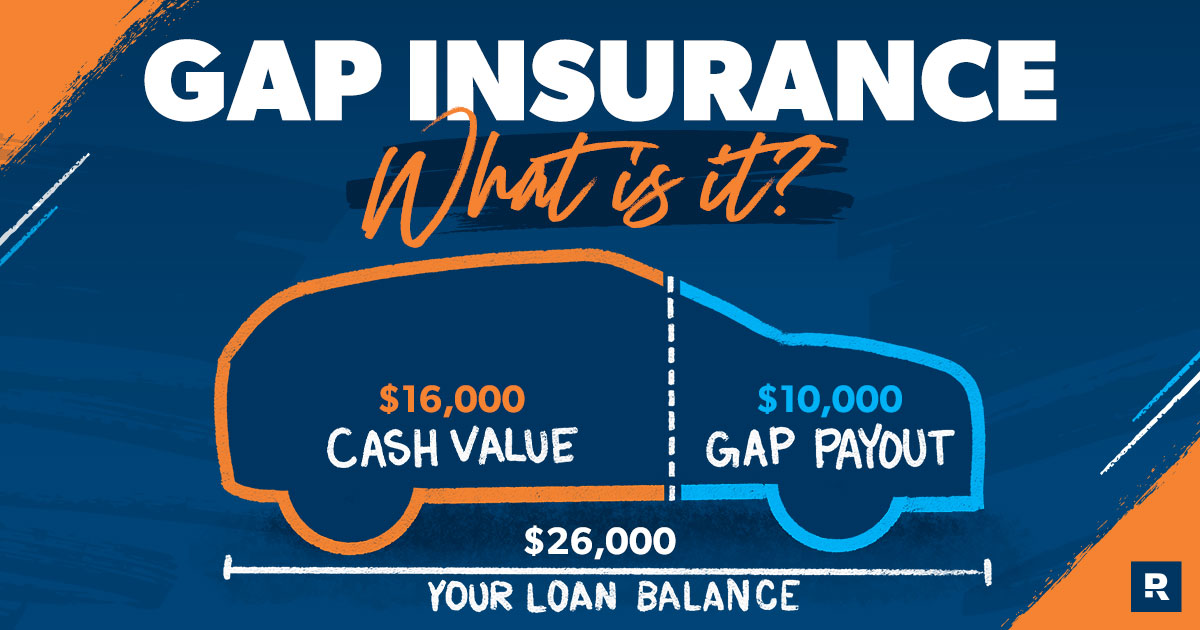

4. Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car’s depreciated value.

5. Gap insurance can deny a claim if the claim is for something that is not covered by your gap insurance policy or if you’ve missed recent insurance payments.

6. When you cancel your GAP policy early, you’ll receive a GAP insurance refund reimbursing you with a portion of your unused premiums.

7. The credit score requirement for Gap store card is usually in the lower 600s, while a higher credit score near the 700s is required for the Gap Visa.

8. A GAP insurance refund is received when you cancel your GAP policy early and you get reimbursed with a portion of your unused premiums.

Unique Questions:

1. Does gap insurance cover missed payments?

No, gap insurance doesn’t cover missed or late payment fees.

2. What is the limit of gap insurance?

Some gap insurance policies have a limit on the total amount you can receive.

3. How much can a gap insurance refund be?

If you cancel your gap insurance policy, you can request a refund for the unused portion of the coverage.

4. Will gap insurance pay off my loan?

Gap insurance helps pay off your auto loan if your car is totaled or stolen and you owe more than its depreciated value.

5. Why would my gap claim be denied?

Gap insurance can deny a claim if it is for something not covered by the policy or if you have missed recent insurance payments.

6. Is there a refund for gap insurance after payoff?

If you cancel your GAP policy early, you can receive a refund for the unused premiums.

7. What credit score do you need for Gap?

A credit score in the lower 600s may qualify for the Gap store card, while a score near the 700s is required for the Gap Visa.

8. How do gap insurance refunds work?

When you cancel your GAP policy early, you receive a refund for the unused premiums.

Does gap insurance cover a missed payment

Gap insurance doesn't cover missed or late payment fees, repossessions, extended warranty costs or car repairs…just loan balances.

Does Gap have a limit

Some gap insurance policies limit the total amount you can receive. For example, Progressive's gap insurance policy covers up to 25% of the vehicle's ACV. It's possible this gap payout wouldn't cover the whole loan if your car had depreciated significantly.

How much can a gap refund be

If you already paid for gap insurance, you can cancel it and request a refund from your car insurance company for any unused portion of the coverage. For example, if you have six months of coverage left on a 12-month gap insurance policy and you cancel, you can be reimbursed for the unused six months minus any fees.

Will Gap Insurance pay off my loan

Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car's depreciated value. Gap insurance may also be called "loan/lease gap coverage."

Why would my gap claim be denied

Yes, gap insurance can deny a claim if the claim is for something that is not covered by your gap insurance policy or you've missed recent insurance payments. Gap insurance pays for the “gap” between a car's actual cash value (ACV) and the remaining balance on a loan or lease if the car is stolen or totaled.

Is GAP insurance refund after payoff

When you cancel your GAP policy early, you'll receive a GAP insurance refund reimbursing you with a portion of your unused premiums. This usually occurs after you repay your loan, or if you sell or trade in your vehicle before you pay off your loan.

What credit score do you need for Gap

Although you might qualify for the Gap store card with a credit score in the lower 600s, a higher credit score near the 700s will be required to get approved for the Gap Visa. In comparison, most other rewards credit cards require higher credit scores around the 700s as well.

How do gap insurance refunds work

What Is a GAP Insurance Refund When you cancel your GAP policy early, you'll receive a GAP insurance refund reimbursing you with a portion of your unused premiums. This usually occurs after you repay your loan, or if you sell or trade in your vehicle before you pay off your loan.

How long does gap take to refund money

As soon as we process your returned item, we refund the purchase amount to the original method of payment, such as the credit card used. If the refund is applied to your credit card, your credit card company may take up to 10 additional business days to post the refund to your account.

Is gap insurance refund after payoff

When you cancel your GAP policy early, you'll receive a GAP insurance refund reimbursing you with a portion of your unused premiums. This usually occurs after you repay your loan, or if you sell or trade in your vehicle before you pay off your loan.

Why didn t Gap pay off my car

The most common reasons are a loss that isn't covered by the policy or that the policy has lapsed. Gap insurance only pays in one situation: After an accident, your car is a total loss and you owe more than it's worth.

Which insurance company denies the most claims

WHICH INSURANCE COMPANIES ARE CONSIDERED THE WORSTALLSTATE. Allstate CEO Thomas Wilson admits that his priority is the shareholders—not the insured parties who have claims.PROGRESSIVE.UNITEDHEALTH.STATE FARM.ANTHEM.UNUM.FEDERAL EMPLOYEE BENEFITS.FARMERS.

How does gap reimbursement work

What Is a GAP Insurance Refund When you cancel your GAP policy early, you'll receive a GAP insurance refund reimbursing you with a portion of your unused premiums. This usually occurs after you repay your loan, or if you sell or trade in your vehicle before you pay off your loan.

How do you get your gap money back

Typically, if you cancel your insurance within 30 days after the policy's start date, you can get a full refund (including GAP insurance costs). If you cancel your insurance after 30 days, your refund will be prorated. Check with your insurance provider for your policy details.

How does Gap funding work

Gap funding is a private loan that covers the “gap” between the hard money loan and the total cost of the project — which can include everything from the actual rehabbing and renovating, marketing the finished property, carrying costs, and selling the rehabbed home.

Which credit score is used for couples

Lenders determine what's called the "lower middle score" and usually look at each applicant's middle score. For example, say your credit scores from the three credit bureaus are 723, 716 and 699, and your partners are 688, 657 and 649. Lenders will then use the lower of the two middle scores, which is 657.

How long does a gap insurance refund take

between four and six weeks

Once you cancel your policy and request a refund, it typically takes between four and six weeks to receive the money. You have to ask for a GAP insurance refund.

How long does gap take to process refund

How Long Does It Take to Get a Gap Insurance Refund Gap insurance refunds usually take 4-6 weeks. Staying in contact with your gap insurance provider and promptly returning signed paperwork can expedite the process, though.

How does Gap refund work

Insurance companies may have a specific cutoff deadline for GAP insurance refunds, but usually you can qualify for a refund at any point before the policy period expires. For example, if you purchase a GAP policy that should last 36 months but cancel after 24 months, then you may be able to request a refund.

How is Gap refund calculated

How do you calculate a gap insurance refund You can do a simple calculation to determine how much money you're owed. Take the total cost of your gap insurance, and divide it by the number of months you had coverage. Then, multiply the monthly premium by the number of months you have left on your policy.

What are three reasons why an insurance claim may be denied

5 Reasons a Claim May Be DeniedThe claim has errors. Minor data errors are the most common culprit for claim denials.You used a provider who isn't in your health plan's network.Your care needed approval ahead of time.You get care that isn't covered.The claim went to the wrong insurance company.

What causes insurance to reject a claim

Insurance claims are often denied if there is a dispute as to fault or liability. Companies will only agree to pay you if there's clear evidence to show that their policyholder is to blame for your injuries. If there is any indication that their policyholder isn't responsible the insurer will deny your claim.

How long does gap insurance refund take

between four and six weeks

Once you cancel your policy and request a refund, it typically takes between four and six weeks to receive the money. You have to ask for a GAP insurance refund.

How is gap claims calculated

When your loan amount is more than your vehicle is worth, gap insurance coverage pays the difference. For example, if you owe $25,000 on your loan and your car is only worth $20,000, your gap coverage covers the $5,000 gap, minus your deductible.

What type of deals can you use gap funding

Gap funding is a private loan that covers the “gap” between the hard money loan and the total cost of the project — which can include everything from the actual rehabbing and renovating, marketing the finished property, carrying costs, and selling the rehabbed home.