expensive at 18? Car Insurance Rates for 18-Year-Old Males and Females

Insurance companies charge higher rates for 18-year-olds because they are considered high-risk drivers. This age group has less driving experience and is more likely to engage in risky behaviors on the road. Additionally, younger individuals tend to have higher accident rates, leading to more claims for insurance companies.

What factors affect car insurance rates? Car Insurance Premium Factors

Several factors can influence your car insurance rates, including:

– Age

– Gender

– Driving record

– Location

– Vehicle type

– Coverage level

– Credit score

– Deductible amount

It’s important to note that these factors can vary depending on the insurance company. Factors like age and driving record have a significant impact on rates, as younger and less experienced drivers are considered higher-risk.

Can you negotiate car insurance rates? Negotiating Car Insurance RatesWhile you may not be able to negotiate the base rate for car insurance, there are steps you can take to potentially lower your premiums:

– Shop around for different insurance companies and compare quotes.

– Take advantage of discounts offered by insurance companies.

– Bundle your car insurance with other policies, such as home or renters insurance.

– Maintain a good driving record and avoid accidents or traffic violations.

– Consider increasing your deductible to reduce your premiums.

In general, married individuals may enjoy lower car insurance rates compared to single individuals. Insurance companies consider married couples to be more stable and less likely to engage in risky driving behaviors. However, the exact impact on car insurance rates can vary depending on the insurance company and other factors like age and driving record.

How can you lower car insurance rates for a teenager? Ways to Lower Car Insurance Rates for TeenagersWhile car insurance rates for teenagers are generally higher, there are steps you can take to potentially lower the cost:

– Encourage your teenager to maintain good grades, as some insurance companies offer discounts for students with a B average or higher.

– Have your teenager take a defensive driving course, as this can also lead to discounts.

– Consider adding your teenager to your existing car insurance policy rather than purchasing a separate policy.

– Choose a safe and reliable vehicle for your teenager to drive, as insurance rates can vary based on the type of vehicle.

Typically, car insurance rates can decrease over time as you gain more driving experience and maintain a good driving record. Insurance companies may also offer loyalty discounts to customers who have been with them for a certain period. However, individual circumstances can vary, and factors like accidents or traffic violations can impact your rates.

At what age does your insurance go down

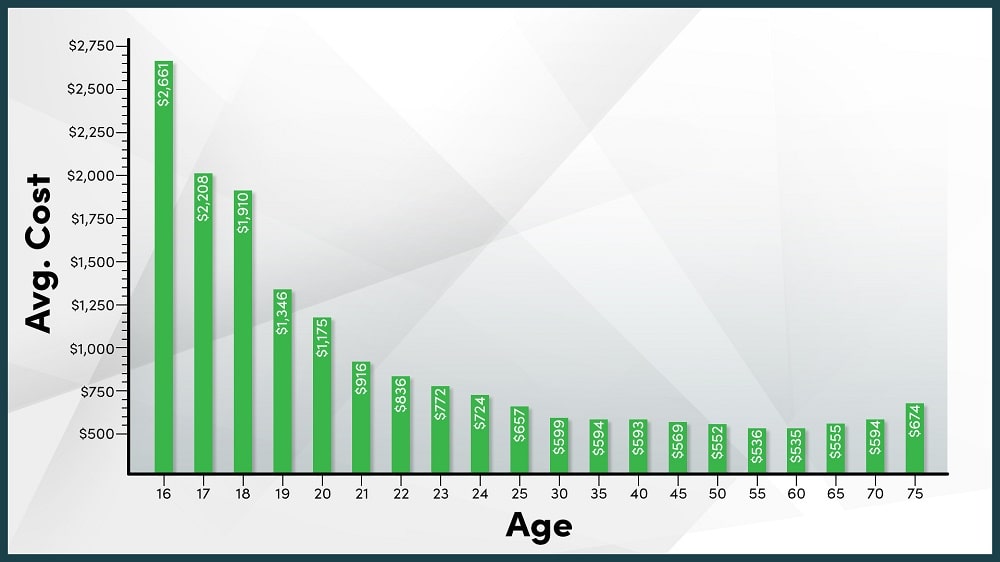

While your auto insurance rates may drop at age 25, they will go down the most when you turn 19 (a 16% savings) and when you turn 21 (a 17% drop). The reason car insurance is expensive for drivers under age 25 is because younger drivers are statistically more likely to get into an accident than older drivers.

Should my insurance go down when I turn 25

Usually, yes. At Progressive, rates drop by 9% on average at age 25. But there are other cost factors impacting your car insurance, such as your claims history. So if you're in an accident right before you turn 25, your rate may not drop.

Cached

What age group is the most expensive to insure

Teen

Teen and senior drivers typically pay the highest car insurance prices, while drivers in their 30s and 40s often pay the lowest rates. We built the table below using data supplied to us from Quadrant Information Services. Each profile combines data for both male and female drivers of each age group.

Cached

What is the best age to buy car insurance

Car insurance rates by age chart

For example, a 19-year-old driver pays 32% less for full coverage insurance than an 18-year-old driver. Rates decrease by 20% between ages 20 and 21. Overall, young drivers can expect their car insurance rates to be much more affordable at around age 25.

Does insurance go down at 30

Although most people believe that 25 is the age when car insurance rates go down, the most significant decreases occur when drivers turn 19 and 21. Rates continue to lower until you turn 30. After that, they tend to remain roughly the same.

Does car insurance go down at 40

Car Insurance Can Go Down As You Age

Car insurance is most expensive for teen drivers and then decreases as they get older. Rates level off between the age groups of 35 and 55, then rise slightly as senior drivers are seen as a bit riskier to insure.

How to lower car insurance when you turn 25

You may also be able to lower your premiums after age 25 by:Continuing to pay your car insurance premiums on time.Maintaining an accident-free driving record.Avoiding violations for speeding or drinking while driving.Signing up for a telematics or usage-based insurance program.Improving your credit score.

Why is my insurance so high at 20

The main reason for these high rates is that young drivers are statistically more likely to get into car accidents that result in costly claims for insurers. Young men are particularly likely to pay a lot for car insurance. A 20-year-old man pays about 16% more than a woman of the same age.

What is the cheapest car insurance for senior citizens

Cheapest Car Insurance for SeniorsGeico – $267 per year.USAA – $286 per year.Liberty Mutual – $327 per year.Travelers – $579 per year.Nationwide – $622 per year.State Farm – $655 per year.Direct Auto – $858 per year.Mercury – $909 per year.

Are older cars cheaper to insure

Are older cars cheaper to insure Yes, most older cars are cheaper to insure, especially in terms of comprehensive and collision insurance. Cars lose value as they age, so the potential insurance payouts after an accident drop as well. This is not the case with many classic or collector cars.

Which gender pays more for car insurance male or female

In many states, it's a general fact that men pay more for auto insurance than women overall. Statistics show that men are generally higher risk drivers, resulting in insurance companies charging more to insure them.

What is insurance fronting

Fronting refers to the use of a licensed, admitted insurer to issue an insurance policy on behalf of a self-insured organization or captive insurer without the intention of transferring any of the risk.

Is 30 a good age to get life insurance

Generally, the younger and healthier you are when buying life insurance, the more money you'll save. As we age, we're at increased risk of developing health conditions, which can result in higher mortality rates and higher life insurance rates. You'll typically pay less for life insurance at age 25 than at age 40.

At what age is it too late to get life insurance

At What Age Can You No Longer Buy Life Insurance 90 years old is the highest issue age we've seen from any life insurance company. But many companies won't issue policies to people older than 85.

Will my insurance go down when I turn 30

Although most people believe that 25 is the age when car insurance rates go down, the most significant decreases occur when drivers turn 19 and 21. Rates continue to lower until you turn 30. After that, they tend to remain roughly the same.

Will my car insurance go down when I turn 50

Auto insurance generally gets more affordable as drivers get older and gain more driving experience. The average 50-year-old pays $2,698 per year, or $225 per month, for car insurance. That's $509 less than the average cost for a 25-year-old, and $4,481 less than the average for an 18-year-old.

Does credit score affect insurance rate

A higher credit score decreases your car insurance rate, often significantly, with almost every insurance company and in most states. Getting a quote, however, does not affect your credit.

Why is my car insurance 2000 a year

Common reasons for high car insurance costs include your driving record, age, coverage options, where you live, the car you drive, your credit history or not taking advantage of discounts. The average car insurance premium has also become more expensive as it increased by more than 50% in the past 10 years.

Why is my insurance so high at 21

If you are 21-years-old, you have less driving experience than an older, more experienced driver. To compensate for the increased risk of causing an accident, car insurance companies typically charge a higher rate if you are recently licensed. Generally, your premiums should begin to decrease when you turn 25.

Which insurance is best for 65 and older

Medicare

Medicare is the best health insurance option for seniors and retirees. For those age 65 and older or who have a qualifying disability, the Medicare program will be the cheapest health insurance with the best benefits.

Who has the best insurance for seniors

Geico has the best car insurance rates for senior drivers of all ages, which makes it worth a look if you want cheap auto insurance. Geico's low level of auto insurance complaints is another reason to consider Geico.

Is a 20 year old car too old

Reliability does depend on the vehicle and how many miles it's covered. We wouldn't go too far beyond the mid- to late-1990s for any car, as parts can be harder to find once a car crests 20 years of age.

Why is insurance cheaper for females

The reason for the difference between male and female rates is that insurance companies have found women are generally less likely to be in accidents. This rate discrepancy is most pronounced in teen car insurance rates.

Why is it legal for insurance to charge men more

The practice of charging men more is not considered to be discrimination because insurance companies have proven over time that male drivers present a different risk than female drivers. The most significant thing that you can do to help reduce your insurance premium is to maintain a safe driving record.

What is twisting in insurance

Twisting describes the act of inducing or attempting to induce a policy owner to drop an existing life insurance policy and to take another policy that is substantially the same kind by using misrepresentations or incomplete comparisons of the advantages and disadvantages of the two policies.