Summary of the Article

1. Is it a good idea to buy a brand new car?

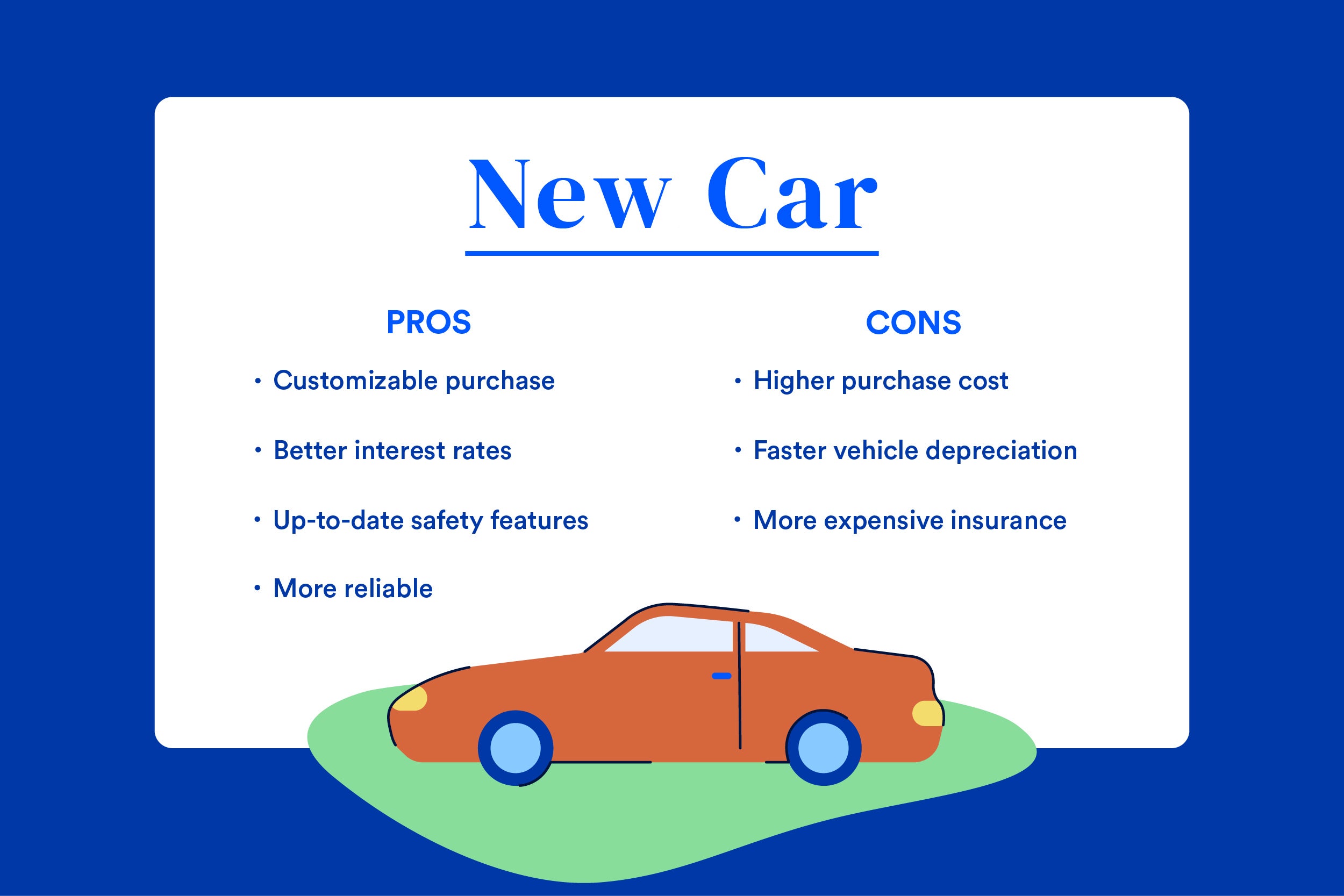

New cars come with the latest safety features and are very likely to be reliable, though they can come with a higher price tag and higher insurance costs. Used cars are generally cheaper because the high depreciation of their early years is already behind them and you may not need as much insurance coverage.

2. Should I buy a car now or wait until 2023?

Americans planning to shop for a new car in 2023 might find slightly better prices than during the past two years, though auto industry analysts say it is likely better to wait until the fall. Since mid-2021, car buyers have been frustrated by rising prices, skimpy selection, and long waits for deliveries.

3. Is there ever a good reason to buy a new car?

One of the best reasons to buy a new car is, everything’s new, including the parts. Even if something goes wrong, most manufacturers have a warranty for the first year or two. Insurance is cheaper. This is because there is less risk of mechanical failure.

4. How much should I spend on a car if I make $100000?

How much car can I afford based on salary

Annual salary (pre-tax) Estimated monthly car payment should not exceed

$75,000 $625 per month

$100,000 $833 per month

$125,000 $1,042 per month

$150,000 $1,250 per month

5. Will car prices drop in 2023?

There is good news on the horizon in 2023, however. J.P. Morgan estimates that prices for both new and used vehicles are set to decrease as supply chain issues abate and inflation is poised to keep easing. Per the financial firm, new vehicle prices are slated to go down 2.5-5% while used cars may go down by 10-20%.

6. What is a disadvantage of buying a new car?

The newer the car, the higher the insurance premiums. There’s just no getting around that. And, in case you’re ever in an accident, you’ll need what is known as gap insurance. Gap insurance covers the difference between the purchase price and the vehicle’s current value.

7. Are car prices expected to drop in 2023?

There is good news on the horizon in 2023, however. J.P. Morgan estimates that prices for both new and used vehicles are set to decrease as supply chain issues abate and inflation is poised to keep easing. Per the financial firm, new vehicle prices are slated to go down 2.5-5% while used cars may go down by 10-20%.

Questions and Answers

1. Is it a good idea to buy a brand new car?

Answer: New cars come with the latest safety features and are likely to be reliable, but they can be more expensive and have higher insurance costs compared to used cars.

2. Should I wait until 2023 to buy a car?

Answer: It is recommended to wait until the fall of 2023 for potential better prices and improved availability, as the current market has experienced rising prices and limited options.

3. What are the advantages of buying a new car?

Answer: New cars have all new parts and often come with warranties, making them less likely to have mechanical failures. Insurance costs may also be lower compared to used cars.

4. How much should I spend on a car with a $100,000 salary?

Answer: Based on a $100,000 salary, the estimated monthly car payment should not exceed $833.

5. Will car prices decrease in 2023?

Answer: According to J.P. Morgan, both new and used car prices are expected to decrease in 2023, with new vehicles potentially going down by 2.5-5% and used cars by 10-20%.

6. What is a disadvantage of buying a new car?

Answer: The insurance premiums for new cars are typically higher, and additional gap insurance may be required to cover the difference between the purchase price and the current value of the vehicle.

7. Are car prices expected to drop in 2023?

Answer: Yes, J.P. Morgan predicts that car prices will decrease in 2023 due to the resolution of supply chain issues and easing inflation, with new vehicles potentially experiencing a 2.5-5% decline and used cars a 10-20% decline.

Is it a good idea to buy a brand new car

New cars come with the latest safety features and are very likely to be reliable, though they can come with a higher price tag and higher insurance costs. Used cars are generally cheaper because the high depreciation of their early years is already behind them and you may not need as much insurance coverage.

Cached

Should I buy a car now or wait until 2023

Americans planning to shop for a new car in 2023 might find slightly better prices than during the past two years, though auto industry analysts say it is likely better to wait until the fall. Since mid-2021, car buyers have been frustrated by rising prices, skimpy selection and long waits for deliveries.

Cached

Is there ever a good reason to buy a new car

One of the best reasons to buy a new car is, everything's new, including the parts. Even if something goes wrong, most manufacturers have a warranty for the first year or two. Insurance is cheaper. This is because there is less risk of mechanical failure.

Cached

How much should I spend on a car if I make $100000

How much car can I afford based on salary

| Annual salary (pre-tax) | Estimated monthly car payment should not exceed |

|---|---|

| $75,000 | $625 per month |

| $100,000 | $833 per month |

| $125,000 | $1,042 per month |

| $150,000 | $1,250 per month |

Will car prices drop in 2023

There is good news on the horizon in 2023, however. J.P. Morgan estimates that prices for both new and used vehicles are set to decrease as supply chain issues abate and inflation is poised to keep easing. Per the financial firm, new vehicle prices are slated to go down 2.5-5% while used cars may go down by 10-20%.

What is a disadvantage of buying a new car

The newer the car, the higher the insurance premiums. There's just no getting around that. And, in case you're ever in an accident, you'll need what is known as gap insurance. Gap insurance covers the difference between the purchase price and the vehicle's current value.

Are car prices expected to drop in 2023

There is good news on the horizon in 2023, however. J.P. Morgan estimates that prices for both new and used vehicles are set to decrease as supply chain issues abate and inflation is poised to keep easing. Per the financial firm, new vehicle prices are slated to go down 2.5-5% while used cars may go down by 10-20%.

Will car prices drop in 2023 recession

According to J.P. Morgan Research's weighted index of the commodities used to produce an automobile, costs may average 24% lower in 2023 compared with 2022.

What are disadvantages of buying a new car

Drawbacks of Buying a CarBuying Can Be More Expensive – in the Short Term.Pay Interest on the Total Cost of Your Car.You May Pay More Sales Tax.Larger Down Payments.Future Value of Your Car is Unknown.Manufacturer Warranties Will End.

Can you afford a $30,000 car making $60,000 salary

Follow the 35% rule. Whether you're paying cash, leasing, or financing a car, your upper spending limit really shouldn't be a penny more than 35% of your gross annual income. That means if you make $36,000 a year, the car price shouldn't exceed $12,600. Make $60,000, and the car price should fall below $21,000.

How much should you spend on a car with a 70k salary

Using the 20/4/10 rule and a $70k salary

This means that you can spend up to $580/month on all car expenses. This includes not only your car payment, but your insurance, car maintenance, gas, and taxes and registration.

Will cars ever be affordable again

But they warn that prices won't be nearly as low as they were pre-pandemic. Prices skyrocketed during the pandemic, and remained high, due to supply-chain disruptions and a shortage of semiconductor chips, which power cars and more. But now, experts predict that changing conditions in the market will drive prices down.

Is there still a car shortage 2023

Here in 2023, the supply of new vehicles is climbing back up, so then incentives have returned. More vehicles on lots means more competition, and dealers can't demand the same higher prices as before. Still, the new vehicle average could top $50,000 sometime this year.

What is the 20 4 10 rule

To apply this rule of thumb, budget for the following: A 20% down payment. Repayment terms of four years or less. Spending less than 10% of your monthly income on transportation costs.

Do millionaires buy new cars

Millionaires spending and budgeting isn't just limited to clothing and groceries but also to automobiles. While it's easy to think that millionaires all drive sports cars and live in huge mansions it's just not true. 81% of millionaires purchase their vehicle and only 23.5 percent actually buy new cars.

What will happen to car sales in 2023

Inventory levels at some automakers are moving back up above pre-pandemic normal, suggesting that overall demand has slowed in some corners of the market.” Fleet sales for the full year of 2023 are forecast at 2.2 million, up 23% from 2022, when 1.8 million units were sold to commercial buyers.

What are the projections for new car sales in 2023

Overall, 2023 projections indicate that registrations are expected to increase roughly 6.9 percent more than last year (just shy of 2021 sales numbers), despite increasing economic uncertainty in the state and nationwide. CNCDA's quarterly Auto Outlook data is sourced from Experian Automotive.

Will 2023 be a bad year for the economy

There is broad consensus that the U.S. is likely to see an economic slowdown in Q1 2023 as the impacts of the Federal rate rises from late 2022 start to feed into the economy; however, there is a significant divergence with regards to the quarters that follow.

Will car prices stabilize in 2023

Fortunately, 2023 is going to be the year that prices finally drop. Based on recent industry data, April 2023 was the second month in a row that the average transactions on new cars fell below MSRP in nearly two years, and manufacturer incentives increased.

How often does the average person get a new car

With the average length of car ownership at about 8 years, car owners should be mindful of ways to improve their car's longevity. Using the above tips, you can extend your car's lifespan and enjoy it for more miles on the road.

How much of a car can I afford if I make $75000 a year

The 36% Rule: With this rule, your total loan payments shouldn't take up more than 36% of your salary. This includes your mortgage, car loan, personal loans, student loans, and minimum credit card payments. If you make $75,000 per year, your total loan payments shouldn't exceed $2,250 per month.

Can I afford a 40k car if I make 60K a year

Follow the 35% rule

Whether you're paying cash, leasing, or financing a car, your upper spending limit really shouldn't be a penny more than 35% of your gross annual income. That means if you make $36,000 a year, the car price shouldn't exceed $12,600. Make $60,000, and the car price should fall below $21,000.

What car can I afford with a 75k salary

Finding the right car payment

If you take your annual income of $75,000 and divide it by 12 to get your monthly income, you'll come to $6,250. Now multiply that by 10% to get $625, as per the rule stated above. From this math, you shouldn't spend more than $625 on your monthly car note.

What car can I afford with 60k salary

In the context of $60k a year, the limit would be $21,000. Popular cars that range in cost from $17,000 to $19,000 includes the 2020 Honda Fit, 2021 Kia Soul, 2022 Hyundai Accent, 2021 Hyundai Venue, 2022 Kia Rio, and 2020 Chevrolet Sonic.

How much longer will cars be overpriced

For this reason, it may be best to hold out for as long as possible before shopping for a new used car. As inventory slowly continues to level back out, so will prices. In the past, Clark has predicted that the market would gradually improve throughout 2023, and now we're finally starting to see some lower prices.